The Explainer is where we explain an aspect of Chinese life. Simple. So now you know.

What is Daigou?

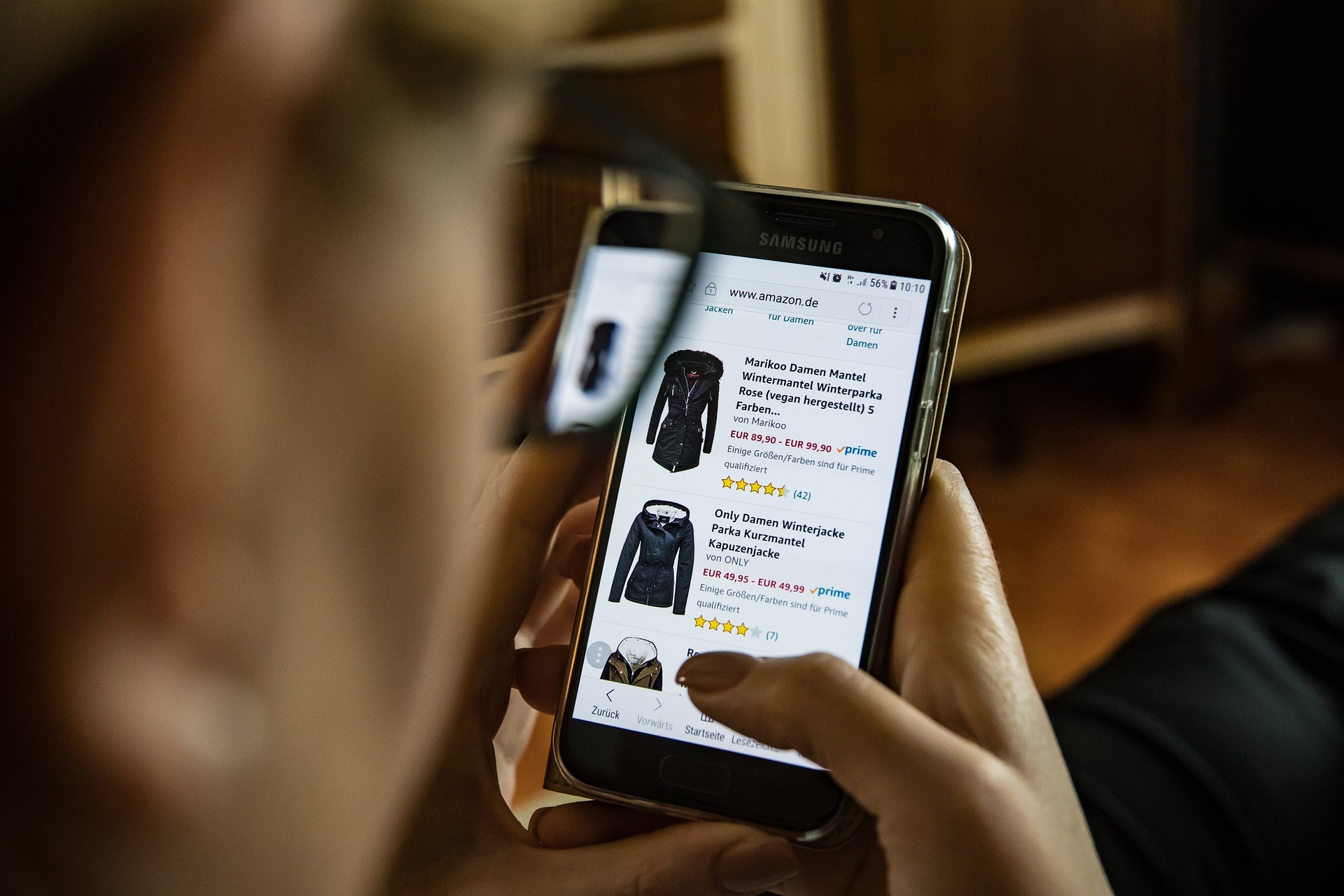

Daigou (代购) is roughly translated as ‘buying (on behalf of),’ but the definition has grown much broader – into a true cultural phenomenon – in the last decade. It has become a trust-based consumer-to-consumer network based on exporting luxury and household goods from abroad into China.

Originally a gray channel navigated mainly by international Chinese students sending friends and family members luxury items back home, it has since progressed into a global community and industry consisting of anything from German knives to Australian baby food. The community includes over one million international daigou (professional and part-time) and grossed more than RMB7.2 trillion in total sales last year, according to Guangzhou-based iiMedia Research group. Sales are expected to top those numbers in 2020.

Success in the Daigou World

The originally unregulated market saw rapid growth in recent years for a multitude of reasons. First and foremost, China’s rising middle-class leads to higher demand for luxury products. Next, due to recently increasing taxes on many kinds of imported goods, products purchased via daigou still come out cheaper, even with an additional fee charged by the daigou for time and effort, than buying that same imported product in China.

Furthermore, there is a lack of trust in the Chinese market for imported products following a 2008 baby food scandal involving milk and infant formula. Finally, many international brands have turned a blind eye to the daigou market because it allows their brand to be introduced to China without having to pay for advertising or a product launch in China.

Advantages of Daigou

Items being purchased via daigou can lead to financial freedom for Chinese students studying overseas and it’s convenient for small brands. Many consumers also develop a relationship with specific daigou they trust, allowing for a more customized shopping experience. Many Chinese shoppers ask for suggestions from daigou and take their recommendations into strong consideration – even products they’ve never tried before. The network traditionally offers cheaper items too, benefitting both parties.

Items being purchased via daigou can lead to financial freedom for Chinese students studying overseas and it’s convenient for small brands. Many consumers also develop a relationship with specific daigou they trust, allowing for a more customized shopping experience. Many Chinese shoppers ask for suggestions from daigou and take their recommendations into strong consideration – even products they’ve never tried before. The network traditionally offers cheaper items too, benefitting both parties.

Disadvantages of Daigou

The daigou network has led to unnecessary stockpiling and hoarding, causing brands and even entire industries to place purchasing caps on specific items, such as baby formula, vitamins and certain luxury goods, affecting all purchasers globally. From a marketing perspective, the daigou community distorts a brand’s perception of its demand, possibly weakening its understanding of how their sales translate into customer loyalty.

The network also, unfortunately, fuels the fake market, as not everyone can be trusted, and some sellers have discovered they can double or triple their profits by delivering false goods for the same price. With no way to authenticate sales, trust is integral to the community.

Recent Regulations

In January 2019, the Chinese government implemented cross-border e-commerce policies to begin a more rigorous regulation of the daigou community and encourage sellers to register and pay the relevant taxes on their profits. In an attempt to prevent sellers from sending items in as ‘personal items’ – thus missing duty fees – the new regulations offer up to 150% increased tax breaks and an increased list of items that fall under the duty-free category.

Daigou who continue to sell without meeting the regulations can be found guilty of tax evasion, smuggling and willfully violating the law, with potential fines of up to RMB2 million in the future.

Pandemic Implications

Since the pandemic started, daigou sales have been uncertain. An initial rush of transnational panic led to increased buying. However, more recently, it’s since been halted. With brands such as Alexander Wang, Prada, Cartier, Miu Miu and Bulgari planning to launch on Tmall and cut out the daigou ‘middlemen’ in a bid to create brand loyalty and their own customer base. There are clear attempts by luxury brands to bypass the current source of their popularity in China.

BBC predicts, however, that such a large network is unlikely to die out, and instead it will reinvent itself, continuing to adapt while delayed shipping and limited international travel remain.

For example, Australia currently recognizes the benefits of its large Chinese daigou community, and while the country is still maintaining restrictions on key products to avoid over-purchasing, it has established the Australia China Daigou Association. They’ve even created a daigou platform for small-time sellers to register themselves and continue sales above board, potentially paving the way for other countries to follow suit.

Daigou have been recognized as ‘influencers of the East,’ building a new layer between standard retail services and end customers, personally introducing and advising customers in a way that brands haven’t yet mastered.

As more Western brands enter the Chinese market, only time will tell how they will fare in an already saturated online market without the support of their daigou influence.

In what form this selling network will exist in the future is uncertain for now, but one thing that is safe to say is that daigou aren’t going anywhere anytime soon.

READ MORE: Can Brands Find Success Without Livestreaming in China?

(All images via Pixabay)