Get instant alerts when news breaks on your stocks. Claim your 1-week free trial to StreetInsider Premium here.

0001552947

false

trst

Two Roads Shared Trust

497

2022-06-13

2022-06-13

N-1A

2021-10-31

~ http://trst/role/ShareholderFeesData column period compact * column dei_LegalEntityAxis compact trst_S000059371Member column rr_ProspectusShareClassAxis compact * row primary compact * ~

~ http://trst/role/OperatingExpensesData column period compact * column dei_LegalEntityAxis compact trst_S000059371Member column rr_ProspectusShareClassAxis compact * row primary compact * ~

~ http://trst/role/ExpenseExample column period compact * column dei_LegalEntityAxis compact trst_S000059371Member column rr_ProspectusShareClassAxis compact * row primary compact * ~

~ http://trst/role/BarChartData column period compact * column dei_LegalEntityAxis compact trst_S000059371Member column rr_ProspectusShareClassAxis compact * row primary compact * ~

2020-06-30

2020-03-31

~ http://trst/role/PerformanceTableData column period compact * column dei_LegalEntityAxis compact trst_S000059371Member column rr_ProspectusShareClassAxis compact * row primary compact * ~

0001552947

2022-06-13

2022-06-13

0001552947

trst:S000059371Member

trst:C000194765Member

2022-06-13

2022-06-13

0001552947

trst:S000059371Member

2022-06-13

2022-06-13

0001552947

trst:S000059371Member

trst:C000194765Member

rr:AfterTaxesOnDistributionsMember

2022-06-13

2022-06-13

0001552947

trst:S000059371Member

trst:C000194765Member

rr:AfterTaxesOnDistributionsAndSalesMember

2022-06-13

2022-06-13

0001552947

trst:S000059371Member

trst:AlerianMLPIndexReflectsNoDeductionForFeesExpensesOrTaxesMember

2022-06-13

2022-06-13

iso4217:USD

xbrli:pure

PROSPECTUS

March 1, 2022

as amended June 13, 2022

Recurrent MLP &

Infrastructure Fund

Class I – Ticker:

www.recurrentadvisors.com

Tel. 1-833-RECURRENT (1-833-732-8773)

This Prospectus provides important information about

the Recurrent MLP & Infrastructure Fund (the “Fund”) that you should know before investing. Please read it carefully and

keep it for future reference.

These securities have not been approved or disapproved

by the Securities and Exchange Commission (“SEC”) nor has the SEC passed upon the accuracy or adequacy of this Prospectus.

Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

| FUND SUMMARY: | 1 | |||

| ADDITIONAL INFORMATION ABOUT PRINCIPAL INVESTMENT STRATEGIES AND RELATED RISKS | 7 | |||

| More About MLPs | 7 | |||

| Principal and Other Investment Risks | 8 | |||

| Portfolio Holdings Disclosure | 15 | |||

| MANAGEMENT | 16 | |||

| Investment Advisor | 16 | |||

| Portfolio Managers | 16 | |||

| HOW SHARES ARE PRICED | 17 | |||

| HOW TO PURCHASE SHARES | 18 | |||

| Class I Shares | 18 | |||

| Purchasing Shares | 18 | |||

| Minimum and Additional Investment Amounts | 19 | |||

| When Order is Processed | 19 | |||

| Good Order | 19 | |||

| Retirement Plans | 19 | |||

| HOW TO REDEEM SHARES | 20 | |||

| Redeeming Shares | 20 | |||

| Good Order | 21 | |||

| When You Need Medallion Signature Guarantees | 21 | |||

| Retirement Plans | 21 | |||

| Low Balances | 21 | |||

| FREQUENT PURCHASES AND REDEMPTIONS OF FUND SHARES | 21 | |||

| TAX STATUS, DIVIDENDS AND DISTRIBUTIONS | 22 | |||

| DISTRIBUTION OF SHARES | 24 | |||

| Distributor | 24 | |||

| Additional Compensation to Financial Intermediaries | 24 | |||

| Householding | 24 | |||

| FINANCIAL HIGHLIGHTS | 25 | |||

| PRIVACY NOTICE | 26 | |||

FUND SUMMARY

Investment Objective:

The Fund seeks total

return including substantial current income from a portfolio of MLP and energy infrastructure investments.

Fees and Expenses of the Fund:

This table describes

the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions

and other fees to financial intermediaries, which are not reflected in the table and Example below. More information about how to purchase

shares of the Fund is available in the section entitled HOW TO PURCHASE SHARES beginning on page 18 of this Prospectus and in the

Statement of Additional Information (“SAI”).

| Shareholder Fees (fees paid directly from your investment) | Class I |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

| Management Fees | 0.90% |

| Distribution (12b-1) and Service Fees | None |

| Other Expenses | 0.35% |

| Total Annual Fund Operating Expenses | 1.25% |

Example:

This Example is intended to

help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the

Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your

investment has a 5% return each year and that the Fund’s operating expenses remain the same (except that the Example incorporates

any applicable fee waiver and/or expense limitation arrangements for only the first year). Although your actual costs may be higher or

lower, based upon these assumptions your costs would be:

| Class | 1 Year | 3 Years | 5 Years | 10 Years |

| I | $127 | $397 | $686 | $1,511 |

Portfolio Turnover:

The Fund pays transaction

costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover

may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which

are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. For the fiscal year ended

October 31, 2021, the Fund’s Portfolio Turnover rate was 22% of the average value of its portfolio.

Principal Investment Strategies:

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets (plus

any borrowings for investment purposes) in energy infrastructure and master limited partnership (“MLP”) investments. The Fund’s

investments may include, but are not limited to:

| · | MLPs structured as limited partnerships or limited liability companies; |

| · | MLPs that are taxed as “C” corporations; |

| · | institutional units (“I-Units”) issued by MLP affiliates; |

| · | taxable “C” corporations that hold significant interests in MLPs; |

| · | companies providing infrastructure to the energy industry; |

| · | other equity securities, including pooled investment vehicles, exchange-traded notes, and exchange-traded funds, that provide exposure to MLPs. |

Recurrent Investment Advisors,

LLC, the Fund’s investment advisor (“Recurrent” or the “Advisor”) focuses its investments on energy infrastructure,

which own and operate assets that are used in the energy sector, including assets used in exploring, developing, producing, generating,

transporting (including marine), transmitting, terminal operation, storing, gathering, processing, refining, distributing, mining or marketing

of natural gas, natural gas liquids, crude oil, refined products, coal or electricity, or that provide energy related equipment or services.

The Advisor’s investment process is strongly focused on company-level valuation analysis for determining security selection in the

Fund. The Fund’s investments may be of any capitalization size including a company’s first offering of stock to the public

in an initial public offering (IPO).

The Fund may invest 20% of

its net assets in sectors outside of energy infrastructure investments, including, without limitation, securities of corporations that

operate in the energy sector or that hold energy assets. The Fund may, when market signals warrant, take a defensive position, investing

all or a substantial portion of Fund assets in cash and/or cash equivalents.

The Fund is non-diversified

and may invest a larger percentage of its assets in fewer issuers than diversified mutual funds.

Principal Investment Risks:

As with all mutual

funds, there is the risk that you could lose money through your investment in the Fund. The Fund is not intended to be a complete investment

program but rather one component of a diversified investment portfolio. An investment in the Fund is not guaranteed to achieve its investment

objective; is not a deposit with a bank; is not insured, endorsed or guaranteed by the Federal Deposit Insurance Corporation or any other

government agency; and is subject to investment risks. The value of your investment in the Fund, as well as the amount of return you receive

on your investment, may fluctuate significantly. You may lose part or all of your investment in the Fund or your investment may not perform

as well as other similar investments. Many factors affect the Fund’s net asset value and performance. Each risk summarized below

is a principal risk of investing in the Fund and different risks may be more significant at different times depending upon market conditions

or other factors.

The Fund

may be subject to the risks described below through its own direct investments and indirectly through investments in underlying funds.

| · | Energy Sector Focus Risk. The Fund focuses its investments in the energy sector which is comprised of energy, industrial, consumer, infrastructure and logistics companies, and will therefore be susceptible to adverse economic, environmental, business, regulatory or other occurrences affecting that sector. The energy markets have experienced significant volatility in recent periods, including a historic drop in crude oil and natural gas prices in April 2020 attributable to the significant decrease in demand for oil and other energy commodities as a result of the slowdown in economic activity due to the COVID-19 pandemic as well as price competition among key oil-producing countries. The low price environment caused financial hardship for energy companies and has led to, and may continue to lead to, energy companies defaulting on debt and filing for bankruptcy. The energy markets may continue to experience stress and relatively high volatility for a prolonged period. The energy sector has historically experienced substantial price volatility. At times, the performance of these investments may lag the performance of other sectors or the market as a whole. Companies operating in the energy sector are subject to specific risks, including, among others, fluctuations in commodity prices; reduced consumer demand for commodities such as oil, natural gas or petroleum products; reduced availability of natural gas or other commodities for transporting, processing, storing or delivering; slowdowns in new construction; extreme weather or other natural disasters; and threats of attack by terrorists on energy assets. Additionally, energy sector companies are subject to substantial government regulation and changes in the regulatory environment for energy companies may adversely impact their profitability. Over time, depletion of natural gas reserves and other energy reserves may also affect the profitability of energy companies. |

| · | Master Limited Partnership Risk. An investment in MLP units involves certain risks which differ from an investment in the securities of a corporation. Holders of MLP units have limited control and voting rights on matters affecting the partnership. In addition, there are certain tax risks associated with an investment in MLP units and conflicts of interest exist between common unit holders of MLPs and the general partner, including those arising from incentive distribution payments. The MLP market may be adversely impacted by negative investor perceptions, such as reaction to reduced distributions. Risks of MLPs include the following: a decrease in the production of natural gas, natural gas liquids, crude oil, coal or other energy commodities or a decrease in the volume of such commodities available for transportation, mining, processing, storage or distribution may adversely impact the financial performance of MLPs or MLP-related securities. In addition, investing in MLPs involves certain risks related to investing in the underlying assets of the MLPs. The amount of cash that any MLP has available to pay its unit holders in the form of distributions/dividends depends on the amount of cash flow generated from such company’s operations. Cash flow from operations will vary from quarter to quarter and is largely dependent on factors affecting the MLP’s operations and factors affecting the energy, natural resources or real estate sectors in general. MLPs were adversely impacted by the reduced demand for oil and other energy commodities as a result of the slowdown in economic activity resulting from the spread of the COVID-19 pandemic, which triggered an unprecedented sell-off of energy pipeline and midstream companies in 2020. Recently, global oil prices have experienced significant volatility, including a period where an oil-price futures contract fell into negative territory for the first time in history. Reduced production and continued oil price volatility may adversely impact the value of the Fund’s investments in MLPs and energy infrastructure companies. |

| · | Energy Infrastructure Industry Focus Risks. A substantial percentage of the Fund invests primarily in the energy infrastructure industry. As a result, the Fund will therefore be susceptible to adverse economic, environmental or regulatory occurrences affecting the energy infrastructure industry. Risks associated with investments in MLPs and other companies operating in the energy infrastructure industry include but are not limited to the following: |

| o | Acquisition Risk. Energy infrastructure companies owned by the Fund may depend on their ability to make acquisitions that increase adjusted operating surplus per unit in order to increase distributions to unit holders. The substantial market disruption and slowdown in economic activity resulting from the COVID-19 pandemic may limit the ability of energy companies to make acquisitions. |

| o | Catastrophic Event Risk. MLPs and other companies operating in the energy infrastructure industry are subject to many dangers inherent in the production, exploration, management, transportation, processing and distribution of natural gas, natural gas liquids, crude oil, refined petroleum and petroleum products and other hydrocarbons. Any occurrence of a catastrophic event, such as a terrorist attack, could bring about a limitation, suspension or discontinuation of the operations of MLPs and other companies operating in the energy infrastructure industry. |

| o | Commodity Price Risk. MLPs and other companies operating in the energy infrastructure industry may be affected by fluctuations in the prices of energy commodities. Fluctuations in energy infrastructure commodity prices would directly impact companies that own such energy infrastructure commodities and could indirectly impact companies that engage in transportation, storage, processing, distribution or marketing of such energy infrastructure commodities. |

| o | Depletion Risk. Energy infrastructure companies engaged in the exploration, development, management, gathering or production of energy commodities face the risk that commodity reserves are depleted over time. Such companies seek to increase their reserves through expansion of their current businesses, acquisitions, further development of their existing sources of energy infrastructure commodities or exploration of new sources of energy infrastructure commodities or by entering into long-term contracts for additional reserves; however, there are risks associated with each of these potential strategies. |

| o | Environmental and Regulatory Risk. Companies operating in the energy infrastructure industry are subject to significant regulation of their operations by federal, state and local governmental agencies. Additionally, voluntary initiatives and mandatory controls have been adopted or are being studied and evaluated, both in the United States and worldwide, to address current potentially hazardous environmental issues, including hydraulic fracturing and related waste disposal and geological concerns, as well as those that may develop in the future. The U.S. regulatory landscape has been impacted by the change in administration. The Fund cannot predict whether regulatory agencies will take any action to adopt new regulations or provide guidance that will adversely impact the energy infrastructure industry. In addition, the Biden administration has recently announced several initiatives aimed at addressing climate change. It is unclear how these initiatives could impact the Fund’s investments. |

| o | Interest Rate Risk. Rising interest rates could increase the cost of capital thereby increasing operating costs and reducing the ability of MLPs and other companies operating in the energy industry to carry out acquisitions or expansions in a cost-effective manner. Rising interest rates may also impact the price of energy infrastructure securities as the yields on alternative investments increase. |

| o | Natural Resources Risk. The Fund’s investments in natural resources issuers (including MLPs) is susceptible to adverse economic, environmental, business, regulatory or other occurrences affecting that sector. The natural resources sector has historically experienced substantial price volatility. At times, the performance of these investments may lag the performance of other sectors or the market as a whole. Companies operating in the natural resources sector are subject to specific risks, including, among others, fluctuations in commodity prices; reduced consumer demand for commodities such as oil, natural gas or petroleum products; reduced availability of natural gas or other commodities for transporting, processing, storing or delivering; slowdowns in new construction; domestic and global competition, extreme weather or other natural disasters; and threats of attack by terrorists on energy assets. Additionally, natural resource sector companies are subject to substantial government regulation, including environmental regulation and liability for environmental damage, and changes in the regulatory environment for energy companies may adversely impact their profitability. Over time, depletion of natural gas reserves and other natural resources reserves may also affect the profitability of natural resources companies. |

| o | Supply and Demand Risk. Companies in the energy infrastructure industry may be impacted by the levels of supply and demand for energy infrastructure commodities. The demand for oil and other energy commodities was adversely impacted by the market disruption and slowdown in economic activity resulting from the COVID-19 pandemic. Future pandemics could lead to reduced production and price volatility. |

| o | Weather Risk. Weather plays a role in the seasonality of some energy infrastructure companies’ cash flows, and extreme weather conditions could adversely affect performance and cash flows of those companies. |

| · | Cash Flow Risk. The Fund expects that a substantial portion of the investment income it receives may be derived from its investments in MLPs. The amount and tax characterization of cash available for distribution by an MLP depends upon the amount of cash generated by such entity’s operations. Cash available for distribution by MLPs may vary widely from quarter to quarter and will be affected by various factors affecting the entity’s operations. In addition to the risks described herein, operating costs, capital expenditures, acquisition costs, construction costs, exploration costs and borrowing costs may reduce the amount of cash that an MLP has available for distribution in a given period. A reduction in an MLP’s cash flow may cause investor turnover and negatively impact the overall MLP market. |

| · | Market Risk. Overall market risk may affect the value of individual instruments in which the Fund invests. The Fund is subject to the risk that the securities markets will move down, sometimes rapidly and unpredictably, based on overall economic conditions and other factors, which may negatively affect the Fund’s performance. Factors such as domestic and foreign (non-U.S.) economic growth and market conditions, real or perceived adverse economic or political conditions, inflation, changes in interest rate levels, lack of liquidity in the bond or other markets, volatility in the equities market or adverse investor sentiment affect the securities markets and political events affect the securities markets. U.S. and foreign stock markets have experienced periods of substantial price volatility in the past and may do so again in the future. Securities markets also may experience long periods of decline in value. When the value of the Fund’s investments goes down, your investment in the Fund decreases in value and you could lose money. |

Local, state, regional,

national or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions,

or other events could have a significant impact on the Fund and its investments and could result in decreases to the Fund’s net

asset value. Political, geopolitical, natural and other events, including war, terrorism, trade disputes, government shutdowns, market

closures, natural and environmental disasters, epidemics, pandemics and other public health crises and related events and governments’

reactions to such events have led, and in the future may lead, to economic uncertainty, decreased economic activity, increased market

volatility and other disruptive effects on U.S. and global economies and markets. Such events may have significant adverse direct or indirect

effects on the Fund and its investments. For example, a widespread health crisis such as a global pandemic could cause substantial market

volatility, exchange trading suspensions and closures, impact the ability to complete redemptions, and affect Fund performance. A health

crisis may exacerbate other pre-existing political, social and economic risks. In addition, the increasing interconnectedness of markets

around the world may result in many markets being affected by events or conditions in a single country or region or events affecting a

single or small number of issuers.

| · | Management Risk. The risk that investment strategies employed by the Advisor in selecting investments for the Fund may not result in an increase in the value of your investment or in overall performance equal to other similar investment vehicles having similar investment strategies. The Adviser’s judgments about the attractiveness, value and potential appreciation of particular securities in which the Fund invests may prove to be incorrect and may not produce the desired results. |

| · | Active Trading Risk. A higher portfolio turnover due to active and frequent trading may result in higher transactional and brokerage costs that may result in lower investment returns. |

| · | Concentration Risk. Because the Fund may focus on one or more industries or sectors of the economy, its performance depends in large part on the performance of those sectors or industries. As a result, the value of an investment may fluctuate more widely than it would in a fund that is diversified across industries and sectors. |

| · | Cybersecurity Risk. There is risk to the Fund of an unauthorized breach and access to fund assets, customer data (including private shareholder information), or proprietary information, or the risk of an incident occurring that causes the Fund, the investment advisor, custodian, transfer agent, distributor and other service providers and financial intermediaries (“Service Providers”) to suffer data breaches, data corruption or lose operational functionality. Successful cyber-attacks or other cyber-failures or events affecting the Fund or its Service Providers may adversely impact the Fund or its shareholders. |

| · | Equity Risk. Common stocks are susceptible to general stock market fluctuations; volatile increases and decreases in value as market confidence in and perceptions of their issuers change and unexpected trading activity among retail investors. Factors that may influence the price of equity securities include developments affecting a specific company or industry, or changing economic, political or market conditions. Preferred stocks are subject to the risk that the dividend on the stock may be changed or omitted by the issuer, and that participation in the growth of an issuer may be limited. |

| · | Gap Risk. The Fund is subject to the risk that a stock price or derivative value will change dramatically from one level to another with no trading in between and/or before the Fund can exit from the investment. Usually such movements occur when there are adverse new announcements, which can cause a stock price or derivative value to drop substantially from the previous day’s closing price. Trading halts may lead to gap risk. |

| · | Geographic and Sector Risk. The risk that if the Fund invests a significant portion of its total assets in certain issuers within the same geographic region or economic sector, an adverse economic, business or political development or natural or other event, including war, terrorism, natural and environmental disasters, epidemics, pandemics and other public health crises, affecting that region or sector may affect the value of the Fund’s investments more than if the Fund’s investments were not so concentrated. |

| · | IPO Risk. The market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk. |

| · | Liquidity Risk. Liquidity risk is the risk that the Fund will not be able to pay redemption proceeds in a timely manner because of unusual market conditions, an unusually high volume of redemption requests, legal restrictions impairing its ability to sell particular securities at an advantageous market price or other reasons. Certain portfolio securities may be less liquid than others, which may make them difficult or impossible to sell at the time and the price that the Fund would like, and the Fund may have to lower the price, sell other securities instead or forego an investment opportunity. In addition, less liquid securities may be more difficult to value, and markets may become less liquid when there are fewer interested buyers or sellers or when dealers are unwilling or unable to make a market for certain securities. Recently, dealers have generally been less willing to make markets for fixed income securities. All of these risks may increase during periods of market turmoil, such as that experienced in 2020 with COVID-19, and could have a negative effect on the Fund’s performance. |

| · | Market Capitalization Risk. Investing in larger-sized companies subjects the Fund to the risk that larger companies may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods, and that they may be less capable of responding quickly to competitive challenges and industry changes. Because the Fund may invest in companies of any size, its share price could be more volatile than the Fund that invests only in large companies. |

Small and medium–sized companies

typically have less experienced management, narrower product lines, more limited financial resources, and less publicly available information

than larger companies. The earnings and prospects of small and medium sized companies are more volatile than larger companies and may

experience higher failure rates than larger companies. Medium sized companies normally have a lower trading volume than larger companies,

which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures.

| · | Market Events Risk. There has been increased volatility, depressed valuations, decreased liquidity and heightened uncertainty in the financial markets during the past several years, including what was experienced in 2020. These conditions may continue, recur, worsen or spread. The U.S. government and the Federal Reserve, as well as certain foreign governments and central banks, have taken steps to support financial markets, including by keeping interest rates at historically low levels. This and other government intervention may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. The U.S. government and the Federal Reserve may reduce market support activities. Such reduction, including interest rate increases, could negatively affect financial markets generally, increase market volatility and reduce the value and liquidity of securities in which the Fund invests. Policy and legislative changes in the United States and in other countries may also contribute to decreased liquidity and increased volatility in the financial markets. The impact of these influences on the markets, and the practical implications for market participants, may not be fully known for some time. |

| · | MLP Tax Risk. Historically, MLPs have been able to offset a significant portion of their taxable income with tax deductions, including depreciation and amortization expense deductions. A change in current tax law, or a change in the business of a given MLP, could result in an MLP being treated as a corporation or other form of taxable entity for U.S. federal income tax purposes, which would result in such MLP being required to pay U.S. federal income tax, excise tax or other form of tax on its taxable income. The classification of an MLP as a corporation or other form of taxable entity for U.S. federal income tax purposes could have the effect of reducing the amount of cash available for distribution by the MLP and could cause any such distributions received by the Fund to be taxed as dividend income, return of capital, or capital gain. Thus, if any of the MLPs owned by the Fund were treated as corporations or other form of taxable entity for U.S. federal income tax purposes, the after-tax return to the Fund with respect to its investment in such MLPs could be materially reduced which could cause a material decrease in the net asset value per share of the Fund’s shares. |

| · | Non-Diversification Risk. The Fund is non-diversified, and thus may invest its assets in a smaller number of companies or instruments than many other funds. As a result, an investment in the Fund has the risk that changes in the value of a single security may have a significant effect on the Fund’s value. The Fund may be more susceptible than a diversified fund to being adversely affected by any single corporate, economic, political or regulatory occurrence. |

| · | Portfolio Turnover Risk. The Fund may experience high portfolio turnover, including investments made on a shorter-term basis, which may lead to increased Fund expenses that may result in lower investment returns. High portfolio turnover may also result in higher short-term capital gains taxable to shareholders. |

| · | RIC Qualification Risk. The Fund intends to qualify for treatment as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”), which means that the Fund must meet certain income source, asset diversification and annual distribution requirements. The Fund’s MLP investments may make it more difficult for the Fund to meet these requirements. The asset diversification requirements include a requirement that, at the end of each quarter of each taxable year, not more than 25% of the value of our total assets is invested in the securities (including debt securities) of one or more qualified publicly traded partnerships. The Fund anticipates that the MLPs in which it invests will be qualified publicly traded partnerships, which include MLPs that satisfy a qualifying income test described below and in the Fund’s SAI. If the Fund’s MLP investments exceed this 25% limitation, which could occur, for example, if the Fund’s investment in an MLP affiliate were re-characterized as an investment in an MLP, then the Fund would not satisfy the diversification requirements and could fail to qualify as a RIC. If, in any year, the Fund fails to qualify as a RIC for any reason, the Fund would be taxed as an ordinary corporation and would become (or remain) subject to corporate income tax. The resulting corporate taxes could substantially reduce the Fund’s net assets, the amount of income available for distribution and the amount of our distributions. Such a failure would have a material adverse effect on the Fund and its shareholders. In such case, distributions to shareholders generally would be eligible (i) for treatment as qualified dividend income in the case of individual shareholders, and (ii) for the dividends-received deduction in the case of corporate shareholders, provided certain holding period requirements are satisfied. In such circumstances, the Fund could be required to recognize unrealized gains, pay substantial taxes and interest and make substantial distributions before re-qualifying as a RIC that is accorded special treatment. |

| · | Volatility Risk. The Fund’s investments may appreciate or decrease significantly in value over short periods of time. The value of an investment in the Fund’s portfolio may fluctuate due to factors that affect markets generally or that affect a particular industry or sector. The value of an investment in the Fund’s portfolio may also be more volatile than the market as a whole. This volatility may affect the Fund’s net asset value per share, including by causing it to experience significant increases or declines in value over short periods of time. Events or financial circumstances affecting individual investments, industries or sectors may increase the volatility of the Fund. |

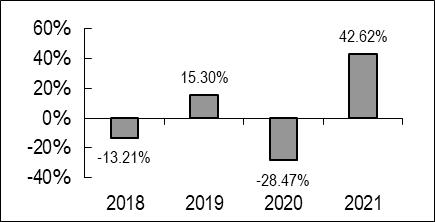

Performance:

The

bar chart and performance table below show the variability of the Fund’s returns, which is some indication of the risks of investing

in the Fund. The bar chart shows performance of the Fund’s Class I shares for each calendar year since the Fund’s inception.

The performance table compares the performance of the Fund’s shares to the performance of a broad-based market index. You should

be aware that the Fund’s past performance (before and after taxes) may not be an indication of how the Fund will perform in the

future. Updated performance information is available at no cost by visiting www.recurrentadvisors.com or by calling 1-833-RECURRENT

(1-833-732-8773).

Performance

Bar Chart for the Calendar Year Ended December 31st:

| Highest Quarter: | 06/30/2020 | 39.80% |

| Lowest Quarter: | 03/31/2020 | -54.01% |

Performance Table

Average Annual Total Returns

(For the year ended December 31, 2021)

| Class I Shares | One Year | Since Inception(1) |

| 42.62% | 1.12% | |

| Return after taxes on Distributions | 41.84% | 0.65% |

| Return after taxes on Distributions and Sale of Fund Shares | 25.73% | 0.80% |

Alerian MLP Index(2) (reflects no deduction for fees, expenses or taxes) | 40.17% | -0.79% |

After-tax returns were calculated using the historical

highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns

depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors

who hold shares of the Fund through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Investment Advisor: Recurrent Investment Advisors,

LLC serves as investment advisor to the Fund.

Portfolio Managers: The Fund is jointly managed

by Mark Laskin and Brad Olsen, each a Portfolio Manager and Principal of Recurrent. Messrs. Laskin and Olsen have managed the Fund since

its inception in November 2017.

Purchase and Sale of Fund Shares: You may purchase

and redeem shares of the Fund on any day that the New York Stock Exchange is open for trading by written request, by telephone at 1-833-RECURRENT

(1-833-732-8773), or through your broker. Redemptions will be paid by automated clearing house funds (“ACH”), check or wire

transfer. The Fund or its Advisor may waive any of the minimum initial and subsequent investment amounts.

| Class | Minimum Investment | |

| Initial | Subsequent | |

| I | $2,500 | $500 |

Tax Information: Dividends and capital gain

distributions you receive from the Fund, whether you reinvest your distributions in additional Fund shares or receive them in cash, are

generally taxable to you at either ordinary income or capital gains tax rates unless you are investing through a tax-deferred plan such

as an IRA or 401(k) plan.

Payments to Broker-Dealers and Other Financial

Intermediaries: If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund

and its related companies, including the Advisor, may pay the intermediary for the sale of Fund shares and related services. These payments

may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over

another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

ADDITIONAL

INFORMATION ABOUT PRINCIPAL INVESTMENT STRATEGIES AND RELATED RISKS

This section provides more detailed information about

the investment objectives, principal investment strategies and certain risks of investing in the Recurrent MLP & Infrastructure Fund.

This section also provides information regarding the Fund’s disclosure of portfolio holdings. The investment objective and the investment

strategies of the Fund are non-fundamental, which means that they may be changed without shareholder approval upon 60 days’ written

notice to shareholders. There is no assurance that the Fund will achieve its investment objective.

More About MLPs

An MLP is an entity that,

if it satisfies a qualifying income test described below and in the Fund’s SAI, is classified as a partnership under the Code; the

partnership interests or “units” of which are traded on securities exchanges like shares of corporate stock. To be treated

as a partnership for U.S. federal income tax purposes, an MLP must receive at least 90% of its income from qualifying sources such as

interest, dividends, income and gain from mineral or natural resources activities, income and gain from the transportation or storage

of certain fuels, and, in certain circumstances, income and gain from commodities or futures, forwards and options with respect to commodities.

For this purpose, mineral or natural resources activities include exploration, development, production, mining, refining, marketing and

transportation (including pipelines) of oil and gas, minerals, geothermal energy, fertilizer, timber or industrial source carbon dioxide.

A typical MLP consists of

a general partner and limited partners; however, some entities receiving partnership taxation treatment under the Code are established

as limited liability companies (LLCs). The general partner of an MLP manages the partnership, has an ownership stake in the partnership

and in some cases the general partners are eligible to receive an incentive distribution. The limited partners provide capital to the

partnership, receive common units of the partnership, have a limited role in the operation and management of the partnership and are entitled

to receive cash distributions with respect to their units. Currently, most MLPs operate in the energy, natural resources and real estate

sectors. Due to their partnership structure, MLPs generally do not pay income taxes. Thus, unlike investors in corporate securities, direct

MLP investors are generally not subject to double taxation (i.e., corporate level tax and tax on corporate dividends).

The Advisor believes that

MLPs may be attractive investments for several reasons, including: higher yields relative to most common equity and investment grade debt,

generally low correlation to other asset classes, cash flows that remain relatively stable regardless of broader market conditions, and

the potential for deferred taxation for taxable investors.

MLPs are generally publicly traded, are regulated

by the SEC and must make public filings like any publicly traded corporation.

The Fund may also invest in privately placed securities of publicly traded MLPs.

Investment Objective: The Fund seeks total

return including substantial current income from a portfolio of MLP and energy infrastructure investments.

Principal Investment Strategies:

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets (plus

any borrowings for investment purposes) in energy infrastructure and MLP investments. The Fund’s investments may include, but are

not limited to:

| · | MLPs structured as limited partnerships or limited liability companies; |

| · | MLPs that are taxed as “C” corporations; |

| · | institutional units (“I-Units”) issued by MLP affiliates; |

| · | taxable “C” corporations that hold significant interests in MLPs; and |

| · | companies providing infrastructure to the energy industry. |

The Advisor focuses its investments

on energy infrastructure and MLPs, which own and operate assets that are used in the energy sector, including assets used in exploring,

developing, producing, generating, transporting (including marine), transmitting, terminal operation, storing, gathering, processing,

refining, distributing, mining or marketing of natural gas, natural gas liquids, crude oil, refined products, coal or electricity, or

that provide energy related equipment or services. The Fund’s investments may be of any capitalization size including a company’s

first offering of stock to the public in an IPO.

Many of the companies in

which the Fund invests operate oil, gas or petroleum facilities, or other facilities within the energy sector. The Fund intends to concentrate

its investments in the energy sector, with a focus on “midstream” energy infrastructure. Midstream companies are generally

engaged in the treatment, gathering, compression, processing, transportation, transmission, fractionation, storage and terminalling of

natural gas, natural gas liquids, crude oil, refined products or coal. Midstream companies may also operate ancillary businesses including

marketing of energy products and logistical services. The Fund may also invest in “upstream” and “downstream”

MLPs. Upstream MLPs are primarily engaged in the exploration, recovery, development and production of crude oil, natural gas and natural

gas liquids. Downstream MLPs are primarily engaged in the processing, treatment, and refining of natural gas liquids and crude oil. The

MLPs in which the Fund invests may also engage in owning, managing and transporting alternative energy assets, including alternative fuels

such as ethanol, hydrogen and biodiesel.

The Fund may invest 20% of its net assets in sectors outside of energy

infrastructure investments, including, without limitation, securities of corporations that operate in the energy sector or that hold energy

assets.

The Fund may invest in other equity securities, including pooled investment

vehicles, exchange-traded notes, and exchange-traded funds that provide exposure to MLPs.

Although the Fund will generally

invest substantially all of its assets in accordance with its investment objective and principal investment strategies, the Fund may hold

cash or short-term cash equivalents, such as money market instruments, money market funds or treasury funds, for cash management purposes.

The percentage of the Fund’s assets invested in cash and short-term cash equivalents may vary and will depend on various factors, including

market conditions and purchases and redemptions of Fund shares.

The Fund is non-diversified

and may invest a larger percentage of its assets in fewer issuers than diversified mutual funds.

The Advisor’s investment

process is strongly focused on company-level valuation analysis for determining security selection in the Fund. The Advisor uses detailed

financial models of the midstream MLPs and energy infrastructure companies in the North American midstream universe to evaluate several

factors: 1) a midstream company’s historical return profile (as measured by returns on invested capital or ROIC); 2) a midstream

company’s prospective returns based on the publicly available information regarding future capital expenditure and financing plans.

With a view of a company’s past and expected future return performance, we form a view of a company’s “justified”

multiple of invested capital.

Generally, we believe a company’s

return profile should be reflected in its multiple of “enterprise value to invested capital” or EV/IC. By this methodology,

companies with returns higher than their costs of capital should trade at higher EV/IC multiples, while companies with lower returns should

trade at lower multiples.

While we will consider the

commodity price environment when making investment decisions, we emphasize that we do not use commodity views to drive investment decision

making, and believe that commodity-driven “bets” generally lead to inferior long-term performance. We believe that commodity

exposure will generally be reflected in more volatile and often lower returns on capital, which will in turn be reflected in market valuation.

Both more and less stable companies can present attractive opportunities for investment, depending on how their valuations compare to

what is “justified” by their historical return profile.

In addition to our core EV/IC

methodology, we will use our financial analysis tools to consider other company valuation metrics, such as EV/EBITDA, cash flow yields,

as well as financial attributes such as balance sheet strength, business mix, commodity price exposure.

Temporary Defensive Position

In response to adverse market, economic, political

or other conditions, the Fund may temporarily invest up to 100% of its total assets, without limitation, in high-quality short-term debt

securities, money market instruments and cash. These short-term debt securities and money market instruments include: shares of money

market mutual funds, commercial paper, certificates of deposit, bankers’ acceptances, U.S. Government securities and repurchase

agreements. While the Fund is in a temporary defensive position, the opportunity to achieve upside return may be limited.

Principal and Other Investment Risks:

As

with all funds, there is the risk that you could lose money through your investment in the Fund. An investment in the Fund is not guaranteed

to achieve its investment objective; is not a deposit with a bank; is not insured, endorsed or guaranteed by the Federal Deposit Insurance

Corporation or any other government agency; and is subject to investment risks. The Adviser can not guarantee that the Fund will achieve

its objectives. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate

significantly. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments.

The Fund is not intended to be a complete investment program but rather one component of a diversified investment portfolio. Many factors

affect the Fund’s net asset value and performance. It is important that investors closely review and understand these risks before

making an investment in the Fund. Additional information regarding the principal and certain other risks of investing in the Fund is provided

below. The Fund’s SAI, which is incorporated by reference into this Prospectus, includes more information about the Fund and its

investments and risks. The risks described in this Prospectus (and in the SAI) are not intended to include every potential risk of investing

in the Fund. The Fund could be subject to additional risks because the types of investments it makes may change over time.

The following section provides

additional information regarding certain of the principal risks identified under “Principal Risk Factors” in the Fund’s

summary along with additional risk information. The Fund may be subject to the risks described below through its own direct investments

and indirectly through investments in underlying funds.

| · | Active Trading Risk. A higher portfolio turnover may result in higher transaction and brokerage costs associated with the turnover which may reduce the Fund’s return, unless the securities traded can be bought and sold without corresponding commission costs. Active trading of securities may also increase the Fund’s realized capital gains and losses, which may affect the taxes you pay as the Fund shareholder. |

| · | Cash Flow Risk. The Fund expects that a substantial portion of the investment income it receives may be derived from its investments in MLPs. The amount and tax characterization of cash available for distribution by an MLP depends upon the amount of cash generated by such entity’s operations. Cash available for distribution by MLPs may vary widely from quarter to quarter and will be affected by various factors affecting the entity’s operations. In addition to the risks described herein, operating costs, capital expenditures, acquisition costs, construction costs, exploration costs and borrowing costs may reduce the amount of cash that an MLP has available for distribution in a given period. |

| · | Concentration Risk. If the Fund invests a significant portion of its total assets in certain issuers within the same economic sector, an adverse economic, business or political development affecting that sector may affect the value of the Fund’s investments more than if the Fund’s investments were not so concentrated. |

| · | Cybersecurity Risk. There is risk to the Fund of an unauthorized breach and access to fund assets, customer data (including private shareholder information), or proprietary information, or the risk of an incident occurring that causes the Fund or its Service Providers to suffer data breaches, data corruption or lose operational functionality. Successful cyber-attacks or other cyber-failures or events affecting the Fund, or its Service Providers may adversely impact the Fund or its shareholders. Because information technology (“IT”) systems and digital data underlie most of the Fund’s operations, Service Providers are exposed to the risk that their operations and data may be compromised as a result of internal and external cyber-failures, breaches or attacks (“Cyber Risk”). This could occur as a result of malicious or criminal cyber-attacks. Cyber-attacks include actions taken to: (i) steal or corrupt data maintained online or digitally, (ii) gain unauthorized access to or release confidential information, (iii) shut down the Fund or Service Provider website through denial-of-service attacks, or (iv) otherwise disrupt normal business operations. Events arising from human error, faulty or inadequately implemented policies and procedures or other systems failures unrelated to any external cyber-threat may have effects similar to those caused by deliberate cyber-attacks. |

| o | The computer systems, networks and devices used by the Fund and its Service Providers to carry out routine business operations employ a variety of protections designed to prevent damage or interruption from computer viruses, network failures, computer and telecommunication failures, infiltration by unauthorized persons and security breaches. Despite the various protections utilized by the Fund and its Service Providers, systems, networks, or devices potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach. The Fund and the Advisor have limited ability to prevent or mitigate cybersecurity incidents affecting third-party Service Providers. |

| o | Cybersecurity breaches can include unauthorized access to systems, networks, or devices; infection from computer viruses or other malicious software code; and attacks that shut down, disable, slow, or otherwise disrupt operations, business processes, or website access or functionality. Cybersecurity breaches may cause disruptions and impact the Fund’s business operations, potentially resulting in financial losses; interference with the Fund’s ability to calculate its net asset value; impediments to trading; the inability of the Fund and its Service Providers to transact business; prevention of Fund investors from purchasing, redeeming or exchanging shares or receiving distributions; violations of applicable privacy and other laws; regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, or additional compliance costs; as well as the inadvertent release of confidential information. |

| o | Similar adverse consequences could result from cybersecurity breaches affecting issuers of securities in which the Fund invests; counterparties with which the Fund engages in transactions; governmental and other regulatory authorities; exchange and other financial market operators, banks, brokers, dealers, insurance companies, and other financial institutions (including financial intermediaries and service providers for the Fund’s shareholders); and other parties. In addition, substantial costs may be incurred by these entities in order to prevent any cybersecurity breaches in the future. |

| · | Energy Infrastructure Industry Focus Risks. The Fund primarily invests in companies engaged in the energy infrastructure industry. As a result, a downturn in the energy infrastructure industry could have a larger impact on the Fund than on an investment strategy that is broadly diversified across many sectors and industries. At times, the performance of securities of companies in the energy infrastructure industry may lag behind the performance of other industries or sectors or the broader market as a whole. There are several risks associated with investments in the energy infrastructure industry, including the following: |

| o | Acquisition Risk. MLPs owned by the Fund may depend on their ability to make acquisitions that increase adjusted operating surplus per unit in order to increase distributions to unit holders. The ability of such MLPs to make future acquisitions is dependent on their ability to identify suitable targets, negotiate favorable purchase contracts, obtain acceptable financing and outbid competing potential acquirers. To the extent that MLPs are unable to make future acquisitions, or such future acquisitions fail to increase the adjusted operating surplus per unit, their growth and ability to make distributions to unit holders will be limited. The substantial market disruption and slowdown in economic activity resulting from the COVID-19 pandemic may limit the ability of energy companies to make acquisitions. |

| o | Catastrophic Event Risk. The energy infrastructure industry is subject to many dangers inherent in the production, exploration, management, transportation, processing and distribution of natural gas, natural gas liquids, crude oil, refined petroleum and petroleum products and other hydrocarbons. These dangers include leaks, fires, explosions, damage to facilities and equipment resulting from natural disasters, inadvertent damage to facilities and equipment and terrorist acts. Since the September 11 terrorist attacks, the U.S. government has issued warnings that energy assets, specifically U.S. pipeline infrastructure, may be targeted in future terrorist attacks. These dangers give rise to |

risks of substantial losses as a result

of loss or destruction of commodity reserves; damage to or destruction of property, facilities and equipment; pollution and environmental

damage; and personal injury or loss of life. Any occurrence of such catastrophic events could bring about a limitation, suspension or

discontinuation of the operations of companies operating in the energy infrastructure industry. Companies operating in the energy infrastructure

industry may not be fully insured against all risks inherent in their business operations and therefore accidents and catastrophic events

could adversely affect such companies’ financial conditions and ability to pay distributions to shareholders.

| o | Commodity Price Risk. The energy infrastructure industry may be affected by fluctuations in the prices of energy commodities, including, for example, natural gas, natural gas liquids, crude oil and coal, in the short- and long-term. Fluctuations in energy commodity prices would directly impact companies that own such energy commodities and could indirectly impact energy infrastructure companies that engage in transportation, storage, processing, distribution or marketing of such energy infrastructure commodities. Fluctuations in energy commodity prices can result from changes in general economic conditions or political circumstances (especially of key energy-consuming countries); market conditions; weather patterns; domestic production levels; volume of imports; energy conservation; domestic and foreign governmental regulation; international politics; policies of the Organization of Petroleum Exporting Countries (“OPEC”); taxation; tariffs; and the availability and costs of local, intrastate and interstate transportation methods. OPEC and other oil-producing countries may agree to reduce production as they did in 2020 in response to the COVID-19 pandemic. An extended period of reduced production and continued price volatility may significantly lengthen the time the energy sector would need to recover after a stabilization of prices. Energy infrastructure companies, as part of the energy industry, may also be impacted by the perception that the performance of energy industry companies is directly linked to commodity prices. High commodity prices may drive further energy conservation efforts and a slowing economy may adversely impact energy consumption which may adversely affect the performance of energy infrastructure and other companies operating in the energy industry. Low commodity prices may have the effect of reducing investment, exploration and production activities associated with such commodities and may adversely affect the performance of MLPs and other companies operating in the energy infrastructure industry. |

| o | Depletion Risk. Energy infrastructure companies engaged in the exploration, development, management, gathering or production of energy commodities face the risk that commodity reserves are depleted over time. Such companies seek to increase their reserves through expansion of their current businesses, acquisitions, further development of their existing sources of energy commodities or exploration of new sources of energy infrastructure commodities or by entering into long-term contracts for additional reserves; however, there are risks associated with each of these potential strategies. If such companies fail to acquire additional reserves in a cost-effective manner and at a rate at least equal to the rate at which their existing reserves decline, their financial performance may suffer. Additionally, failure to replenish reserves could reduce the amount and affect the tax characterization of the distributions paid by such companies. |

| o | Environmental and Regulatory Risk. Companies operating in the energy infrastructure industry are subject to significant regulation of nearly every aspect of their operations by federal, state and local governmental agencies, including (i) the way in which certain MLP assets are constructed, maintained and operated and the prices MLPs may charge for their services (ii) how and where wells are drilled, (iii) how services are provided, and (iv) environmental and safety controls. Various governmental authorities have the power to enforce compliance with these regulations and the permits issued under them, and violators are subject to administrative, civil and criminal penalties, including civil fines, injunctions or both. Stricter laws, regulations or enforcement policies could be enacted in the future which would likely increase compliance costs and may adversely affect the financial performance of energy companies. Additionally, voluntary initiatives and mandatory controls have been adopted or are being discussed both in the United States and worldwide to address current potentially hazardous environmental issues as well as those that may develop in the future. Regulations can change over time in scope and intensity. Changes in existing, or new, environmental restrictions may force energy infrastructure industry companies to incur significant expenses, or otherwise curtail or alter their underlying business operations, which could materially and adversely affect the value of these companies’ securities in the Fund’s portfolio. Moreover, many state and federal environmental laws provide for civil as well as regulatory remediation, thus adding to the potential exposure energy infrastructure companies may face. The U.S. regulatory landscape has been impacted by the change in administration. The Fund cannot predict whether regulatory agencies will take any action to adopt new regulations or provide guidance that will adversely impact the energy infrastructure industry. In addition, the Biden administration has recently announced several initiatives aimed at addressing climate change. It is unclear how these initiatives could impact the Fund’s investments. |

| o | Regulations currently exist that generally involve emissions into the air, effluents into the water, use of water, wetlands preservation, waste disposal, endangered species and noise regulation, among others. Additionally, federal and state regulatory agencies are continually monitoring and taking actions with respect to the environmental effects of the energy industry’s exploration and developmental processes, which could spur further regulations and/or restrictions on the current operations of certain companies in which the Fund may invest. Voluntary initiatives and mandatory controls have also been adopted or are being discussed both in the United States and worldwide to reduce emissions of “greenhouse gases” such as carbon dioxide, a by-product of burning fossil fuels, and methane, the major constituent of natural gas, which many scientists and policymakers believe contribute to global climate change. These measures and future measures could result in increased costs to certain companies in which the Fund may invest to operate and maintain facilities and administer and manage a greenhouse gas emissions program and may reduce demand for fuels that generate greenhouse gases and that are managed or produced by companies in which the Fund may invest. |

| o | Interest Rate Risk. Rising interest rates could increase the costs of capital thereby increasing operating costs and reducing the ability of companies operating in the energy infrastructure industry to carry out acquisitions or expansions in a cost-effective manner. As a result, rising interest rates could negatively affect the financial performance of companies operating in the energy infrastructure industry in which the Fund invests. Rising interest rates may also impact the price of the securities of companies operating in the energy infrastructure industry as the yields on alternative investments increase. |

| o | Natural Resources Risk. The Fund’s investments in natural resources issuers (including MLPs) is susceptible to adverse economic, environmental, business, regulatory or other occurrences affecting that sector. The natural resources sector has historically experienced substantial price volatility. At times, the performance of these investments may lag the performance of other sectors or the market as a whole. Companies operating in the natural resources sector are subject to specific risks, including, among others, fluctuations in commodity prices; reduced consumer demand for commodities such as oil, natural gas or petroleum products; reduced availability of natural gas or other commodities for transporting, processing, storing or delivering; slowdowns in new construction; domestic and global competition, extreme weather or other natural disasters; and threats of attack by terrorists on energy assets. Additionally, natural resource sector companies are subject to substantial government regulation, including environmental regulation and liability for environmental damage, and changes in the regulatory environment for energy companies may adversely impact their profitability. Over time, depletion of natural gas reserves and other natural resources reserves may also affect the profitability of natural resources companies. |

| o | Supply and Demand Risk. Companies operating in the energy infrastructure industry may be impacted by the levels of supply and demand for energy commodities. Companies operating in the energy infrastructure industry could be adversely affected by reductions in the supply of or demand for energy infrastructure commodities. The volume of production of energy infrastructure commodities and the volume of energy infrastructure commodities available for transportation, storage, processing or distribution could be affected by a variety of factors, including depletion of resources; depressed commodity prices; catastrophic events; labor relations; increased environmental or other governmental regulation; equipment malfunctions and maintenance difficulties; import volumes; international politics, policies of OPEC; and increased competition from alternative energy sources. Alternatively, a decline in demand for energy infrastructure commodities could result from factors such as adverse economic conditions (especially in key energy-consuming countries); increased taxation; increased environmental or other governmental regulation; increased fuel economy; increased energy conservation or use of alternative energy sources; legislation intended to promote the use of alternative energy sources; or increased commodity prices. The demand for oil and other energy commodities was adversely impacted by the market disruption and slowdown in economic activity resulting from the COVID-19 pandemic. Future pandemics could lead to reduced production and price volatility. |

| o | Weather Risk. Weather plays a role in the seasonality of some energy infrastructure companies’ cash flows. Companies in the propane sector, for example, rely on the winter season to generate almost all of their earnings. In an unusually warm winter season, propane infrastructure companies experience decreased demand for their product. Although most companies can reasonably predict seasonal weather demand based on normal weather patterns, extreme weather conditions, such as hurricanes, can adversely affect performance and cash flows. |

| · | Energy Sector Focus Risk. The Fund concentrates its investments in the energy sector which is comprised of energy, energy industrial, energy infrastructure and energy logistics companies, and will therefore be susceptible to adverse economic, environmental, business, regulatory or other occurrences affecting that sector. The energy markets have experienced significant volatility in recent periods, including a historic drop in crude oil and natural gas prices in April 2020 attributable to the significant decrease in demand for oil and other energy commodities as a result of the slowdown in economic activity due to the COVID-19 pandemic as well as price competition among key oil-producing countries. The low-price environment caused financial hardship for energy companies and has led to, and may continue to lead to, energy companies defaulting on debt and filing for bankruptcy. The energy markets may continue to experience stress and relatively high volatility for a prolonged period. The energy sector has historically experienced substantial price volatility. At times, the performance of these investments may lag the performance of other sectors. The energy sectors are subject to specific risks, including, among others, fluctuations in commodity prices; reduced consumer demand for commodities such as oil, natural gas or petroleum products; reduced availability of natural gas or other commodities for transporting, processing, storing or delivering; slowdowns in new construction; extreme weather or other natural disasters; and threats of attack by terrorists on energy assets. Additionally, energy sector companies are subject to substantial government regulation and changes in the regulatory environment for energy companies may adversely impact their profitability. Infrastructure companies may incur environmental costs and liabilities due to the nature of their businesses and the substances they handle. Changes in existing laws, regulations or enforcement policies governing the energy sector could significantly increase compliance costs. Certain companies could, from time to time, be held responsible for implementing remediation measures, the cost of which may not be recoverable from insurance. Over time, depletion of natural gas reserves and other energy reserves may also affect the profitability of energy companies. |

| · | Equity Risk. Common stocks are susceptible to general stock market fluctuations, volatile increases and decreases in value as market confidence in and perceptions of their issuers change, and unexpected trading activity among retail investors. Factors that may influence the price of equity securities include developments affecting a specific company or industry, or changing economic, political or market conditions. Preferred stocks are subject to the risk that the dividend on the stock may be changed or omitted by the issuer, and that participation in the growth of an issuer may be limited. |

| · | Gap Risk. The Fund is subject to the risk that a stock price or derivative value will change dramatically from one level to another with no trading in between and/or before the Fund can exit the investment. Usually such movements occur when there are adverse news announcements, which can cause a stock price or derivative value to drop substantially from the previous day’s closing price. For example, the price of a stock can drop from its closing price one night to its opening price the next morning. The difference between the two prices is the gap. Trading halts may lead to gap risk. |

| · | Geographic and Sector Risk. If the Fund invests a significant portion of its total assets in securities of issuers within the same state, geographic region or economic sector, an adverse economic, business or political development or natural or other event, including war, terrorism, natural and environmental disasters, epidemics, pandemics and other public health crises, affecting that state, region or sector may affect the value of the Fund’s investments more than if its investments were not so concentrated in such geographic region or economic sector. |

| · | IPO Risk. The market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk. |

| · | Leveraging Risk. The use of certain derivatives may increase leveraging risk and adverse changes in the value or level of the underlying asset, rate, or index may result in a loss substantially greater than the amount paid for the derivative. The use of leverage may exaggerate any increase or decrease in the net asset value, causing the Fund to be more volatile. The use of leverage may increase expenses and increase the impact of the Fund’s other risks. Certain derivatives require the Fund to make margin payments, a form of security deposit intended to protect against nonperformance of the derivative contract. The Fund may have to post additional margin if the value of the derivative position changes in a manner adverse to the Fund. The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations, to meet additional margin requirements, or to meet regulatory requirements resulting in increased volatility of returns. Leverage, including borrowing, may cause the Fund to be more volatile than if the Fund had not been leveraged. |

| · | Liquidity Risk. There is risk that the Fund may not be able to pay redemption proceeds within the time periods described in this Prospectus because of unusual market conditions, an unusually high volume of redemption requests, legal restrictions impairing its ability to sell particular securities or close derivative positions at an advantageous market price or other reasons. Certain portfolio securities may be less liquid than others, which may make them difficult or impossible to sell at the time and the price that the Fund would like or difficult to value. The Fund may have to lower the price, sell other securities instead or forgo an investment opportunity. Any of these events could have a negative effect on fund management or performance. Funds with principal investment strategies that involve investments in securities of companies with smaller market capitalizations, foreign securities, Rule 144A securities, derivatives or securities with substantial market and/or credit risk tend to have the greatest exposure to liquidity risk. All of these risks may increase during periods of market turmoil, such as that experienced in 2020 with COVID-19, and could have a negative effect on the Fund’s performance. |

| · | Management Risk. The risk that investment strategies employed by the Advisor in selecting investments for the Fund may not result in an increase in the value of your investment or in overall performance equal to other similar investment vehicles having similar investment strategies. The net asset value of the Fund changes daily based on the performance of the securities in which it invests. The Advisor’s judgments about the attractiveness, value and potential appreciation of particular securities in which the Fund invests may prove to be incorrect and may not produce the desired results. |

| · | Market Capitalization Risk. Investing in larger-sized companies subjects the Fund to the risk that larger companies may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods, and that they may be less capable of responding quickly to competitive challenges and industry changes. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large companies. Small and medium–sized companies typically have less experienced management, narrower product lines, more limited financial resources, and less publicly available information than larger companies. The earnings and prospects of small and medium sized companies are more volatile than larger companies and may experience higher failure rates than larger companies. Medium sized companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures. |

| · | Market Events Risk. There has been increased volatility, depressed valuations, decreased liquidity and heightened uncertainty in the financial markets during the past several years, including what was experienced in 2020. These conditions are an inevitable part of investing in capital markets and may continue, recur, worsen or spread. The U.S. government and the Federal Reserve, as well as certain foreign governments and central banks, may take steps to support financial markets, including by keeping interest rates at historically low levels. This and other government intervention may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. The U.S. government and the Federal Reserve may also reduce market support activities. Such reduction, including interest rate increases, could negatively affect financial markets generally, increase market volatility and reduce the value and liquidity of securities in which the Fund invests. Policy and legislative changes in the United States and in other countries may also contribute to decreased liquidity and increased volatility in the financial markets. The impact of these influences on the markets, and the practical implications for market participants, may not be fully known for some time. |

COVID-19 has resulted

in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays

in healthcare service preparation and delivery, prolonged quarantines, cancellations, business and school closings, supply chain disruptions,