News and research before you hear about it on CNBC and others. Claim your 1-week free trial to StreetInsider Premium here.

|

WCM Focused Emerging Markets Fund Investor Class: WFEMX Institutional Class: WCMEX |

|

| Summary Prospectus | September 1, 2021 |

Before you invest, you may want to review

the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Statutory Prospectus

and Statement of Additional Information and other information about the Fund online at https://www.wcminvestfunds.com/focused-emerging-markets-fund.

You may also obtain this information at no cost by calling 1-888-988-9801 or by sending an e-mail request to [email protected].

The Fund’s Statutory Prospectus and Statement of Additional Information, both dated September 1, 2021, as each may be amended or

supplemented, are incorporated by reference into this Summary Prospectus.

Investment Objective

The investment objective of the WCM Focused Emerging

Markets Fund (the “Fund”) is long-term capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you

may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial

intermediaries, which are not reflected in the table and example below.

|

Investor Class Shares |

Institutional Class Shares | |||||||

|

Shareholder Fees (fees paid directly from your investment) |

||||||||

| Maximum sales charge (load) imposed on purchases | None | None | ||||||

| Maximum deferred sales charge (load) | None | None | ||||||

| Wire fee | $20 | $20 | ||||||

| Overnight check delivery fee | $25 | $25 | ||||||

| Retirement account fees (annual maintenance fee) | $15 | $15 | ||||||

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your |

||||||||

| Management fees | 1.00% | 1.00% | ||||||

| Distribution (Rule 12b-1) fee | 0.25% | None | ||||||

| Other expenses | 0.28% | 0.28% | ||||||

| Shareholder service fee | 0.09% | 0.09% | ||||||

| All other expenses | 0.19% | 0.19% | ||||||

| Total annual fund operating expenses | 1.53% | 1.28% | ||||||

| Fees waived and/or expenses reimbursed1 | (0.03%) | (0.03%) | ||||||

| Total annual fund operating expenses after waiving fees and/or reimbursing expenses1 | 1.50% | 1.25% | ||||||

| 1 | The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses (as determined in accordance with Form N-1A), expenses incurred in connection with any merger or reorganization, and extraordinary expenses such as litigation expenses) do not exceed 1.50% and 1.25% of the average daily net assets of the Fund’s Investor Class and Institutional Class shares of the Fund, respectively. This agreement is in effect until August 31, 2022, and it may be terminated before that date only by the Trust’s Board of Trustees. The Fund’s advisor is permitted to seek reimbursement from the Fund, subject to certain limitations, of fees waived or payments made to the Fund for a period ending three full fiscal years after the date of the waiver or payment. This reimbursement may be requested from the Fund if the reimbursement will not cause the Fund’s annual expense ratio to exceed the lesser of (a) the expense limitation in effect at the time such fees were waived or payments made, or (b) the expense limitation in effect at the time of the reimbursement. |

Example

This example is intended to help you compare the cost

of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for

the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment

has a 5% return each year and that the Fund’s operating expenses remain the same. The example reflects the Fund’s contractual

fee waiver and/or expense reimbursement only for the term of the contractual fee waiver and/or expense reimbursement.

Although your actual costs may be higher or lower, based on these assumptions

your costs would be:

| One Year | Three Years | Five Years | Ten Years | |

| Investor Class | $153 | $480 | $831 | $1,821 |

| Institutional Class | $127 | $403 | $699 | $1,543 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund

operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio

turnover rate was 35% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Fund invests at

least 80% of its net assets (including amounts borrowed for investment purposes) in equity securities of companies in emerging or frontier

countries or markets. Emerging and frontier countries or markets are those countries or markets with low- to middle-income economies as

classified by the World Bank or included in any of the Morgan Stanley Capital International (MSCI) emerging markets or frontier markets

indices. The Fund’s advisor considers a company to be in an emerging or frontier country or market if the company has been organized

under the laws of, has its principal offices in, or has its securities principally traded in, the emerging or frontier country or market,

or if the company derives at least 50% of its revenues, net profits or incremental revenue growth (typically over the past five years)

from, or has at least 50% of assets or production capacities in, the emerging or frontier country or market.

The Fund’s advisor expects the Fund to primarily

invest in equity securities under normal circumstances. The Fund’s equity investments include common stock and depository receipts.

The Fund’s investments in depository receipts may include American, European, Canadian and Global Depository Receipts (“ADRs”,

“EDRs”, “CDRs” and “GDRs”, respectively).

The Fund’s advisor uses a bottom-up approach

that seeks to identify companies with attractive fundamentals, such as long-term historical growth in revenue and earnings, and/or a strong

probability for superior future growth. The advisor’s investment process seeks companies that are industry leaders with strengthening

competitive advantages; corporate cultures emphasizing strong, quality and experienced management; low or no debt; and attractive relative

valuations. The Fund’s advisor also considers other factors including political risk, monetary policy risk, and regulatory risk

in selecting securities.

The Fund may invest in securities of any size companies.

The Fund generally invests in the securities of companies domiciled in at least three different countries. However, from time to time,

the Fund may have a significant portion of its assets invested in the securities of companies domiciled in one or a few countries or regions.

The Fund may make significant investments in certain sectors or group of sectors within a particular industry or industries from time

to time.

Principal Risks of Investing

Risk is inherent in all investing and you could lose

money by investing in the Fund. A summary description of certain principal risks of investing in the Fund is set forth below. Before you

decide whether to invest in the Fund, carefully consider these risk factors associated with investing in the Fund, which may cause investors

to lose money. There can be no assurance that the Fund will achieve its investment objective.

Market Risk. The market price of

a security or instrument may decline, sometimes rapidly or unpredictably, due to general market conditions that are not specifically related

to a particular company, such as real or perceived adverse economic or political conditions throughout the world, changes in the general

outlook for corporate earnings, changes in interest or currency rates, or adverse investor sentiment generally. In addition, local, regional

or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, or other events could

have significant impact on a security or instrument. The market value of a security or instrument also may decline because of factors

that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within

an industry.

Equity Risk. The value of the equity

securities held by the Fund may fall due to general market and economic conditions, perceptions regarding the industries in which the

issuers of securities held by the Fund participate, or factors relating to specific companies in which the Fund invests.

Foreign Investment Risk. The prices

of foreign securities may be more volatile than the prices of securities of U.S. issuers because of economic and social conditions abroad,

political developments, and changes in the regulatory environments of foreign countries. Changes in exchange rates and interest rates,

and the imposition of sanctions, confiscations, trade restrictions (including tariffs) and other government restrictions by the United

States and/or other governments may adversely affect the values of the Fund’s foreign investments. Foreign companies are generally

subject to different legal and accounting standards than U.S. companies, and foreign financial intermediaries may be subject to less supervision

and regulation than U.S. financial firms. Foreign securities include ADRs, EDRs, CDRs and GDRs. Unsponsored ADRs and GDRs are organized

independently and without the cooperation of the foreign issuer of the underlying securities, and involve additional risks because U.S.

reporting requirements do not apply. In addition, the issuing bank may deduct shareholder distribution, custody, foreign currency exchange,

and other fees from the payment of dividends.

Emerging Markets Risk. Many of the

risks with respect to foreign investments are more pronounced for investments in issuers in developing or emerging market countries. Emerging

market countries tend to have more government exchange controls, more volatile interest and currency exchange rates, less market regulation,

and less developed and less stable economic, political and legal systems than those of more developed countries. There may be less publicly

available and reliable information about issuers in emerging markets than is available about issuers in more developed markets. In addition,

emerging market countries may experience high levels of inflation and may have less liquid securities markets and less efficient trading

and settlement systems.

Frontier Markets Risk. Frontier market

countries generally have smaller economies and even less developed capital markets than traditional emerging markets, and as a result,

the risks of investing in emerging market countries are magnified in frontier market countries.

IPO Risk. The market value of IPO

shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of

shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs.

IPO shares are subject to market risk and liquidity risk.

Risks Associated with China. The

Fund may invest a significant portion of its assets in the securities of Chinese companies. For example, as of April 30, 2021, 33.2% of

the Fund’s assets were invested in such securities. The Chinese economy is generally considered an emerging market and can be significantly

affected by economic and political conditions and policy in China and surrounding Asian countries. A relatively small number of Chinese

companies represent a large portion of China’s total market and thus may be more sensitive to adverse political or economic circumstances

and market movements. The economy of China differs, often unfavorably, from the U.S. economy in such respects as structure, general development,

government involvement, wealth distribution, rate of inflation, growth rate, allocation of resources and capital reinvestment, among others.

The Public Company Accounting Oversight Board (“PCAOB”), which regulates auditors of U.S. public companies, has warned that

it lacks the ability to inspect audit work and practices of PCAOB-registered accounting firms in China and Hong Kong. The PCAOB’s

limited ability to oversee the operations of accounting firms in China and Hong Kong means that inaccurate or incomplete financial records

of an issuer’s operations may not be detected, which could negatively impact the Fund’s investments in such companies. Under

China’s political and economic system, the central government has historically exercised substantial control over virtually every

sector of the Chinese economy through administrative regulation and/or state ownership. In addition, expropriation, including nationalization,

confiscatory taxation, political, economic or social instability or other developments could adversely affect and significantly diminish

the values of the Chinese companies in which the Fund invests. International trade tensions may arise from time to time which can result

in trade tariffs, embargoes, trade limitations, trade wars and other negative consequences. These consequences may trigger a reduction

in international trade, the oversupply of certain manufactured goods, substantial price reductions of goods and possible failure of individual

companies and/or large segments of China’s export industry with a potentially severe negative impact to the Fund. From time to time

and as recently as January 2020, China has experienced outbreaks of infectious illnesses, and the country may be subject to other public

health threats or similar issues in the future. Any spread of an infectious illness, public health threat or similar issue could reduce

consumer demand or economic output, result in market closures, travel restrictions or quarantines, and generally have a significant impact

on the Chinese economy.

Risks of Investing in A-Shares. The

A-Share market is volatile with a risk of suspension of trading in a particular security or multiple securities or government intervention.

Securities in the A-Share market may be suspended from trading without an indication of how long the suspension will last, which may impair

the liquidity of such securities and may impact the ability of the Fund to pursue its investment strategy. The Chinese securities markets

are emerging markets characterized by relatively low trading volume, resulting in substantially less liquidity and greater price volatility.

Liquidity risks may be more pronounced for the A-Share market than for Chinese securities markets generally because the A-Share market

is subject to greater government restrictions and control, including trading suspensions. China A-Shares are only available to non-mainland

China investors (i) through the QFII Programs or (ii) through Stock Connect.

A-Shares Tax Risk. The Fund’s

investments in A-Shares will be subject to a number of taxes and tax regulations in China. The application of many of these tax regulations

is at present uncertain. Moreover, the People’s Republic of China (“PRC”) has implemented a number of tax reforms in

recent years, including the value added tax reform, and may continue to amend or revise existing PRC tax laws in the future. Changes in

applicable PRC tax law, particularly taxation on a retrospective basis, could reduce the after-tax profits of the Fund directly or indirectly

by reducing the after-tax profits of the Chinese companies in which the Fund invests. Uncertainties in the Chinese tax rules governing

taxation of income and gains from investments in A-Shares could result in unexpected tax liabilities for the Fund. The Fund’s investments

in securities issued by Chinese companies, including A-Shares, may cause the Fund to become subject to withholding income tax and other

taxes imposed by the PRC. The PRC taxation rules are evolving, may change, and new rules may be applied retroactively. Any such changes

could have an adverse impact on Fund performance.

Risks of Investing through Stock Connect.

Investing in A-Shares through Stock Connect is subject to trading, clearance, settlement and other procedures, which could pose risks

to the Fund. Trading through Stock Connect is also subject to a daily quota (the “Daily Quota”), which limits the maximum

net purchases under Stock Connect each day, and as such, buy orders for A-Shares would be rejected once the Daily Quota is exceeded (although

the Fund will be permitted to sell A-Shares regardless of the Daily Quota balance). Thus, the Daily Quota may restrict the Fund’s

ability to invest in A-Shares through Stock Connect on a timely basis and could affect the Fund’s ability to effectively pursue

its investment strategy. Stock Connect will only operate on days when both the Chinese and Hong Kong markets are open for trading and

when banking services are available in both markets on the corresponding settlement days. Therefore, an investment in A-Shares through

Stock Connect may subject the Fund to the risk of price fluctuations on days when the Chinese markets are open, but Stock Connect is not

trading.

Currency Risk. The value of investments

in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S.

Dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency

exchange rates can be volatile and are affected by factors such as general economic conditions, the actions of the United States and foreign

governments or central banks, the imposition of currency controls, and speculation.

Liquidity Risk. The Fund may

not be able to sell some or all of the investments that it holds due to a lack of demand in the marketplace or other factors such as market

turmoil, or if the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs it may only be able to sell

those investments at a loss. Illiquid assets may also be difficult to value.

Management and Strategy Risk. The

value of your investment depends on the judgment of the Fund’s advisor about the quality, relative yield, value or market trends

affecting a particular security, industry, sector or region, which may prove to be incorrect.

Market Capitalization Risk. Larger,

more established companies may be unable to attain the high growth rates of successful, smaller companies during periods of economic expansion.

The securities of small-capitalization or mid-capitalization companies may be subject to more abrupt or erratic market movements and may

have lower trading volumes or more erratic trading than securities of larger, more established companies or market averages in general.

In addition, such companies typically are more likely to be adversely affected than large capitalization companies by changes in earning

results, business prospects, investor expectations or poor economic or market conditions.

Recent Market Events. An outbreak

of a respiratory disease caused by a novel coronavirus (known as COVID-19) has resulted in a global pandemic and has caused major disruptions

to economies and markets around the world, including the United States. Financial markets experienced and may continue to experience extreme

volatility and severe losses, and trading in many instruments was and may continue to be disrupted as a result. Liquidity for many instruments

was and may continue to be greatly reduced for extended periods of time. Some interest rates are very low and in some cases yields are

negative. Governments and central banks, including the Federal Reserve in the United States, have taken extraordinary and unprecedented

actions to support local and global economies and the financial markets. The impact of these measures, and whether they will be effective

to mitigate the economic and market disruption, will not be known for some time. In addition, the outbreak of COVID-19, and measures taken

to mitigate its effects, could result in disruptions to the services provided to the Fund by its service providers. Other market events

like the COVID-19 outbreak may cause similar disruptions and effects.

Sector Focus Risk. The Fund may invest

a larger portion of its assets in one or more sectors than many other mutual funds, and thus will be more susceptible to negative events

affecting those sectors.

Cybersecurity Risk. Cybersecurity

incidents may allow an unauthorized party to gain access to Fund assets, customer data (including private shareholder information), or

proprietary information, or cause the Fund, the Fund’s advisor, and/or other service providers (including custodians, sub-custodians,

transfer agents and financial intermediaries) to suffer data breaches, data corruption or loss of operational functionality. In an extreme

case, a shareholder’s ability to exchange or redeem Fund shares may be affected. Issuers of securities in which the Fund invests

are also subject to cybersecurity risks, and the value of those securities could decline if the issuers experience cybersecurity incidents.

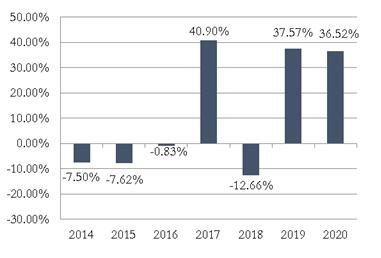

Performance

The bar chart and table below provide some indication

of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year for Institutional Class Shares

and by showing how the average annual total returns of each class of the Fund compare with the average annual total returns of a broad-based

market index. Performance for classes other than those shown may vary from the performance shown to the extent the expenses for those

classes differ. Updated performance information is available at the Fund’s website www.wcminvestfunds.com, or by calling the Fund

at 1-888-988-9801. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform

in the future.

Annual Total Return (before taxes) for Institutional

Class Shares

For each calendar year at NAV

The year-to-date return as of June 30, 2021, was 6.76%.

| Institutional Shares | ||

| Highest Calendar Quarter Return at NAV | 27.34% | Quarter Ended 06/30/2020 |

| Lowest Calendar Quarter Return at NAV | (21.09)% | Quarter Ended 03/31/2020 |

| Average Annual Total Returns (for the periods ended December 31, 2020) |

1 Year | 5 Years | Since Inception | Inception Date |

| Institutional Class Shares — Return Before Taxes | 36.52% | 18.05% | 10.12% | June 28, 2013 |

| Institutional Class Shares — Return After Taxes on Distributions* | 36.23% | 17.87% | 9.99% | June 28, 2013 |

| Institutional Class Shares — Return After Taxes on Distributions and Sale of Fund Shares* | 21.81% | 14.65% | 8.19% | June 28, 2013 |

| Investor Class Shares — Return Before Taxes | 36.15% | 17.95% | 9.99% | June 28, 2013 |

| MSCI Emerging Markets Index (reflects no deduction for fees, expenses or taxes) | 18.31% | 12.81% | 6.79% | June 28, 2013 |

| * | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After–tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Institutional Class Shares only and after-tax returns for classes other than Institutional Class will vary from returns shown for Institutional Class. |

Investment Advisor

WCM Investment Management, LLC (the “Advisor”

or “WCM”)

Portfolio Managers

The portfolio management team is comprised of Sanjay

Ayer, CFA, Portfolio Manager, Peter J. Hunkel, Portfolio Manager, Michael B. Trigg, Portfolio

Manager, Gregory S. Ise, CFA, Portfolio Manager, and Mike Tian, Portfolio

Manager. Messrs. Ayer, Hunkel, and Trigg have served as portfolio managers of the Fund since its inception on June 28, 2013. Messrs.

Ise and Tian have served as portfolio managers of the Fund since June 30, 2018. The members of the portfolio management team are jointly

and primarily responsible for the day-to-day management of the Fund’s portfolio.

Purchase and Sale of Fund Shares

To purchase shares of the Fund, you must invest at

least the minimum amount.

| Investor Class | Institutional Class | |||

| Minimum Investments | To Open Your Account | To Add to Your Account | To Open Your Account | To Add to Your Account |

| Direct Regular Accounts | $1,000 | $100 | $100,000 | $5,000 |

| Direct Retirement Accounts | $1,000 | $100 | $100,000 | $5,000 |

| Automatic Investment Plan | $100 | $50 | $5,000 | $2,500 |

| Gift Account For Minors | $1,000 | $500 | $100,000 | $5,000 |

Fund shares are redeemable on any business day the

New York Stock Exchange (“NYSE”) is open for business, by written request or by telephone.

Tax Information

The Fund’s distributions are generally taxable,

and will ordinarily be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged

arrangement, such as a 401(k) plan or an individual retirement account. Shareholders investing through such tax-advantaged arrangements

accounts may be taxed later upon withdrawal of monies from those arrangements.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through a broker-dealer

or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares

and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your

salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for

more information.