Introduction 1 Scoop: Commodity trader Trafigura Warned Credit suisse Last year, the bank’s supply chain finance fund appeared to contain suspicious invoices from businessmen. Sanjeve GuptaBusiness empire.obtain Full story..

And one reminder: Don’t miss the Greensill event next Tuesday.Sign up for a free online event Here..

Metal Industry Simon Dawson / Bloomberg © Simon Dawson / Bloomberg

Welcome to due diligence. Briefings on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter.sign up Here Send your newsletter to your inbox every Tuesday to Friday. Please contact us anytime: [email protected]

The movement of virtual currencies is becoming mainstream

Veteran bank clerk Packing suitcases In the west pioneer era, the crypto boom is inviting previously unreachable executives to join the sector.

Some North Korean defectors Goldman Sachs lobbyist Faya Shield Zard, Who will start Coinbase Next month, and Citadel Securities veteran Brett Harrison Those who participated in the crypto exchange FTX..

John Dalby,CFO Bridge waterAlso, from the world’s largest hedge fund, we are jumping over ships to join the crypto financial services group. Nidig..

But the influx of talented people on Wall Street isn’t the only power to turn Silicon Valley into a more serious competitor to traditional finance. DD Miles Kruppa Report..

Goldman Sachs lobbyist Fariya Shieldzard is one of Wall Street’s prominent executives who has played a new role in cryptocurrency companies © EPA / Armando Babani

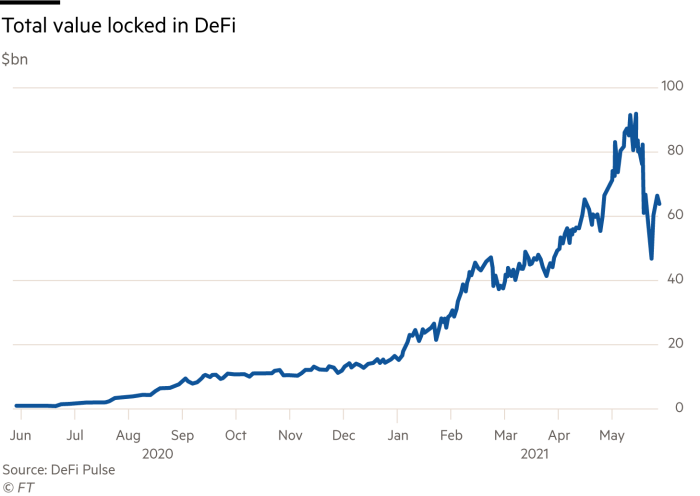

Cryptocurrency movements and a flood of venture capital financing are driving the growth of decentralized finance (“DeFi”) projects. These companies aim to eliminate traditional intermediaries by replicating basic financial services such as lending and transactions using software programs called blockchains.

What started as Niche corner The number of cryptocurrencies has grown to the multi-billion dollar sector as venture capitalists recognize the huge dividends from investor incentives offered by up-and-coming platforms.

take Uniswap, For example. Last year, the trading platform began the process of issuing 1 billion free digital tokens to users over a four-year period as a reward for joining the network.

This initiative aims to extend governance rights to a wider group and weaken their founders over time.

Approximately one-fifth of these tokens were given to VC investors as a reward for the first $ 1280 million invested in seed funding. At Uniswap’s $ 28 transaction price, investors will own approximately $ 5 billion worth of shares in all issued tokens. Even if it takes four years for an investor to receive the full amount, it’s not too poor.

Defeating Wall Street in your own game may be beneficial to early investors, but Obstacle..

Some lawyers and venture capitalists who spoke to Miles compared DeFi with the initial coin offering boom four years ago, which collapsed due to regulatory intervention.

Mint Condition: Etsy is hooked on Depop’s vast vintage collection

Scroll through specific corners of fashion Ticktaku Feel like you’re browsing a time capsule with a 70’s paisley dress, an early spaghetti strap, and a Gen-Z with 90’s grunge.

But the year is 2021. The social media platform of choice for the younger generation has barely escaped the ban by the previous US administration (Not perfect),and it is Style renaissance So Young entrepreneur Collectors show off what recycled designers find Depop And other used fashion apps.

Last year, with an active network of 4 million buyers and 2 million sellers trading about $ 650 million worth of merchandise, Depop became a popular prize, not a way to win it. ..

Etsy I’m buying London-based startups cost $ 1.6 billion, and the two companies announced Wednesday in a majority cash transaction scheduled to close in the third quarter of this year.

Etsy CEO Josh Silberman © Bloomberg

The tie-up makes sense. The two companies have created a business model centered around helping home entrepreneurs rather than the following large-scale technology rivals: Amazon..

Depop, 90% of active users are under the age of 26 EtsyIs typically targeted at millennials and above and will give them access to each other’s demographics.

The app has raised about $ 100 million from early backers since its inception 10 years ago. HV Capital, And Clana Founder and CEO Sebastian Simiatokowski..

Raised $ 40 million in the latest round of 2019, General Atlantic, The aim was to expand Depop’s presence in the United States. Today, it makes as much money from the United States as its home country, the United Kingdom, but dealing with California-based rivals makes Depop much more likely to grow further. Poshmark And Thread up..

Game of Thrones actor Maisie Williams (left) and Depop founder Simon Beckerman (right), one of many celebrities selling used clothing and accessories in the app © Getty Images

Rex colleagues I think Etsy might have paid too muchThe price tag is 23 times the revenue in 2020, and Depop is now a cool young man with a block of used clothing, but young people can be capricious when it comes to shopping habits.

Etsy, whose stocks have risen more than 450% since the pandemic struck the global economy last March, clearly seizes the opportunity before the fall of the other luxury world.

A heated international court struggle goes to the sky

If you are based in Edinburgh Cairn Energy There is a way, but Air indiaThe New York-based fleet doesn’t fly anywhere right away.Latest Dramatic twist In a saga that has been going on for 7 years.

Allows DD to speed you up.

In 2006, Cairn reorganized its business in India Cairn India As a separate subsidiary that floated on Bombay Stock Exchange following year.

Scottish energy company took most of Cairn India’s stake in 2011 Vedanta Limited Natural Resources Company Managed by $ 6.7 Billion Anil Agarwal — One of the wealthiest men in India.

Billionaire and owner of Vedanta Resources, Anil Agarwal © Bloomberg

Cairn’s plan seemed to be on track. But a year later, New Delhi introduced a new law allowing Indian authorities to retroactively impose taxes on cross-border transactions if the underlying asset is in India.

In 2014, just as Cairn wanted to sell the remaining 10% stake in Cairn India, New Delhi authorities blocked the deal and launched a tax audit. A year later, Cairn $ 1.6 billion tax invoice, And since then, the two have said it.

Cairn has filed a dispute resolution under the Bilateral Investment Treaty between the United Kingdom and India to revoke the tax bill and recover its losses. International court The Netherlands seemed to agree to that position in December, and India ordered a Scottish company to pay $ 1.2 billion and interest. It’s worth $ 1.7 billion today.

The only problem is the Prime Minister of India. Narendra ModiThe government has shown no signs of planning payments.

Cairn does not forgive either.The company employs a highly regarded international arbitration lawyer Dennis Flanitsky If Air India can act as the Indian government’s “alter ego” and convince the judge to bear the same debt, it will seek $ 1.7 billion in compensation.

Robert Cohen (left) and Dennis Flanitsky (right) © Annie Tritt

Flanitsky to lead Quinn EmmanuelSovereignty proceedings, best known for seizing Argentine naval vessels in Ghana as part of a lengthy court battle with US hedge funds. Elliott Capital Management And Buenos Aires, cutting work for him.

Job change

Tyson Foods Chief executive officer Dean Banks Eight months after joining the company, he left the company due to personal reasons.Operation manager Donnie King Will be the fifth CEO in five years.

Citigroup Poached Goldman Sachs veteran Chuck Adams Launch a new M & A advisory franchise in New York. Reuters Other Articles..

Tullow oil Chair Dorothy Thompson She said she would leave A few weeks after refinancing $ 1.8 billion to secure the future, he is an African-focused oil and gas explorer.

Smart lead

Canadian bacon Harvard, Yale, and other US donation fund portfolios are squeezed by traditional investment allocations. Dive into a high-risk asset class and increase internal talent, such as your northern neighbors, could be the answer. (FT)

Manufactured megastar K-POP Phenomenon Hybe, the vast entertainment empire behind BTS, has turned a fandom into a profit by perfecting a pandemic-resistant model. The next big action needs to stimulate the same level of global hysteria. (Nikkei Asia)

Housework The glorious Bond is named more than just a fictional spy. The franchise has been carefully pastured for generations of its historic owner, the Broccoli / Wilson family. In the hands of Amazon, 007 faces new challenges. (New York Times)

News summary

Proceedings allege former Apollo CEO Leon Black sexually assaulted Russian model (FT)

Dropbox is attracting activist attention from Elliott amid sluggish market share (FT)

Activists likely to win third place on Exxon’s board (Wall Street Journal)

Germany tells U.S. bankers that they must return to their offices by September 6th (FT)

UK regulators have approved a deal with Adevinta on eBay’s $ 9.2 billion ad. (FT)

Altria and Jules contract brought to trial (WSJ)

SEC avoiding enforcement of power of attorney advisory rules in the Trump era (FT)

AMC / Jason Mudrick: A quick flip of $ 230 million relied on a return to the meme (Rex)

Recommended newsletter for you

score board — Important news and analysis behind business decisions in sports.sign up Here

Best of Rex — A review of the best commentary of the week and a mid-week letter.sign up Here

Silicon Valley paves the way for a new kind of Wall Street Source link Silicon Valley paves the way for a new kind of Wall Street