Something I have been thinking about since the summertime is how December will play out for the largest market gainers, going into the now probable 2021 political move to higher federal income tax rates. President-elect Joe Biden has promised higher tax rates for both high earners and corporations, including increased capital gains rates. Wouldn’t holders with massive gains the last four years under President Trump want to sell before the end of 2020, to guarantee their long-term business ownership profits are taxed at today’s 24% or lower level? If so, sellers only have a matter of weeks to liquidate shares.

I am not alone in pondering the possibility of major tax-related selling in the U.S. stock market. Biden has proposed a sizable increase in the top capital gains tax rate from 24% to nearly 40% next year. Mainstream financial media outlets have been asking the question about potential tax selling for months, and we may have an answer quite soon. Economists and statisticians have phrased the tax jump, if enacted, as the largest capital gains hike in U.S. history.

Image Source: CNBC Article

According to the Robert Frank CNBC piece in September,

A research paper by Tim Dowd, a senior economist at the U.S. Congress Joint Committee on Taxation, and Robert McClelland, a senior fellow at the Urban-Brookings Tax Policy Center, found that the two previous hikes in capital gains taxes lead to a wave of selling.

In 1986, as part of the Reagan tax plan, the top rate for capital gains jumped from 20% in 1986 to 28% in 1987. In the months before the increase, capital gains realizations – or sales of stocks and other assets – surged by 60%. In 2012, as part of the fiscal cliff negotiations, the top rate went from 15% to 23.8%. Again, in the months leading before the change, capital gains realizations and sales jumped, by 40%.

Then contemplate 1986 and 2012 were preceded by years of smaller market advance than 2016-20, plus the economic outlook was far more certain and predictable. My argument is the next 2-3 weeks could see an avalanche of selling in companies that have generated the largest capital gains of 2016-20.

Profit Taking List

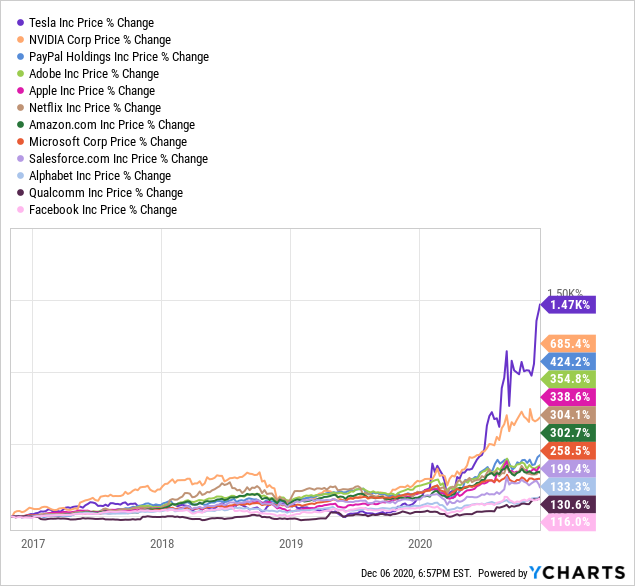

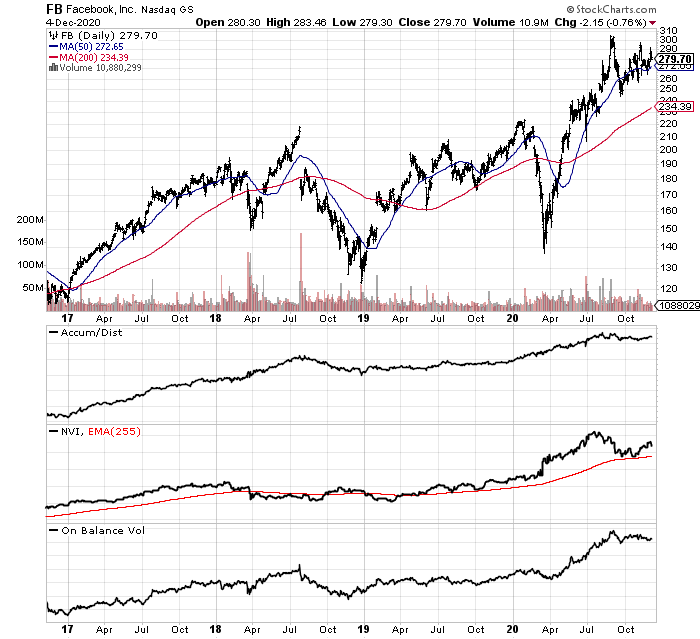

If you are an insider or early investor in the Big Technology names, keeping 16% more in your pocket, sheltered from the tax man, is a serious factor to weigh in a hold or sell decision. What if you were sitting on the fence about pushing your luck into 2021’s uncertain economic outlook? Locking in gains now, of +116% in Facebook (FB) to +1,470% in Tesla (TSLA) measured from Trump’s election win four years ago, may prove a smart choice for those looking to exit.

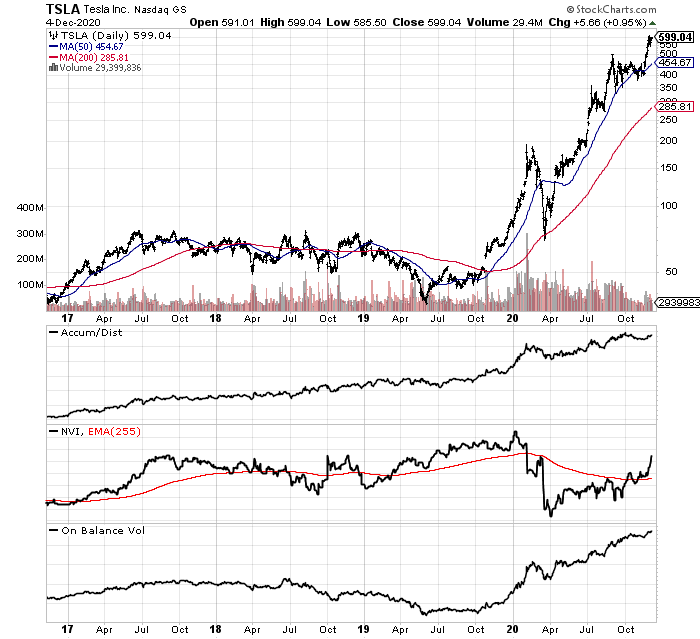

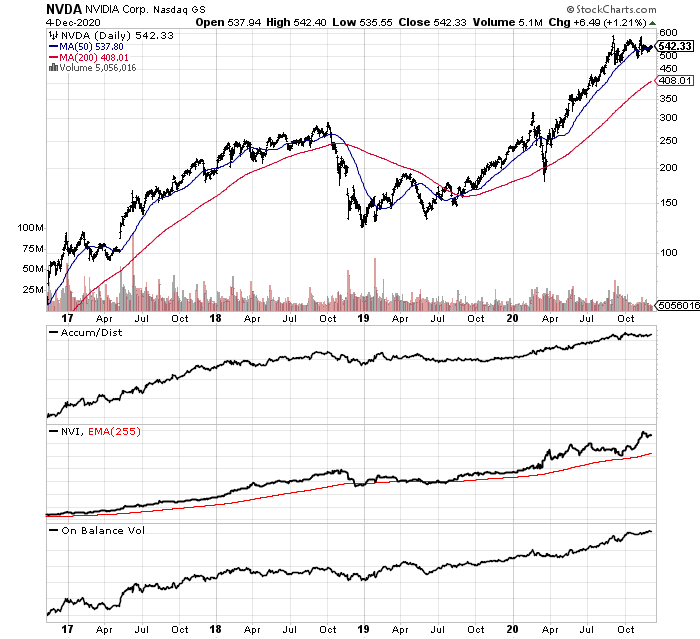

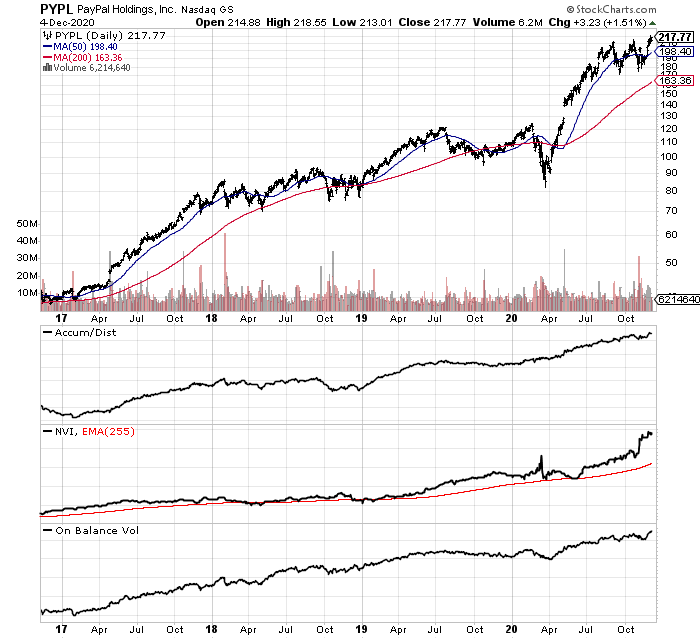

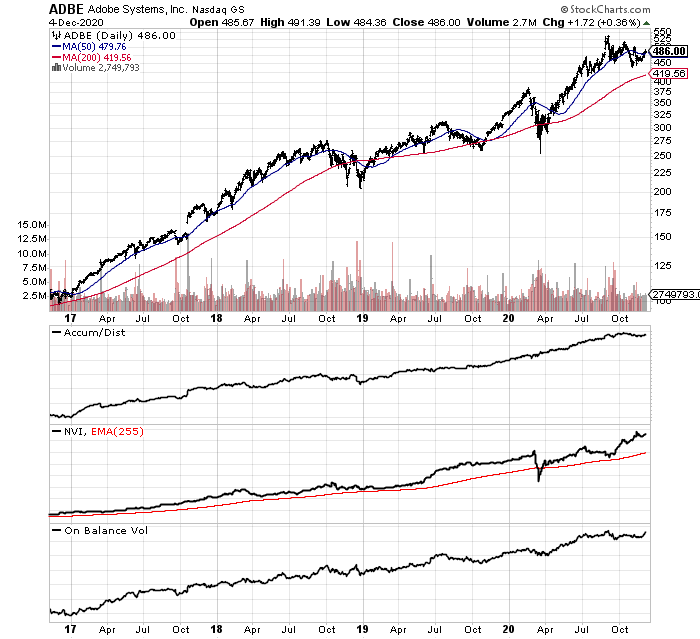

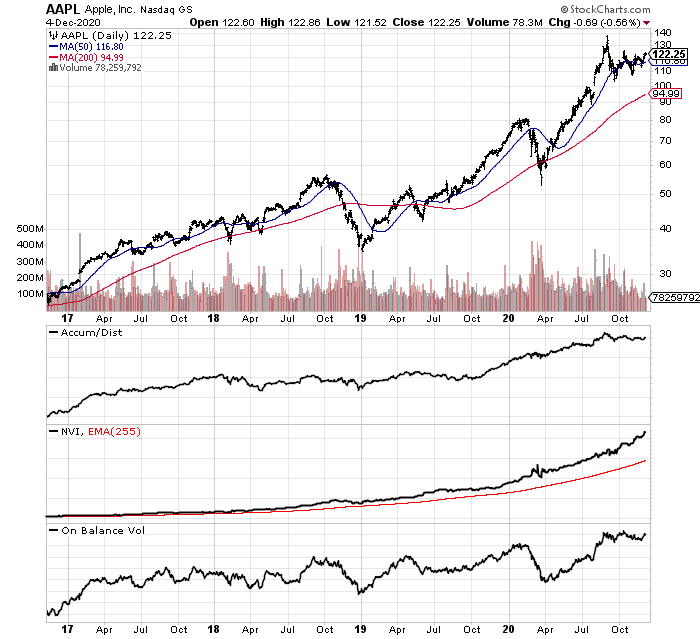

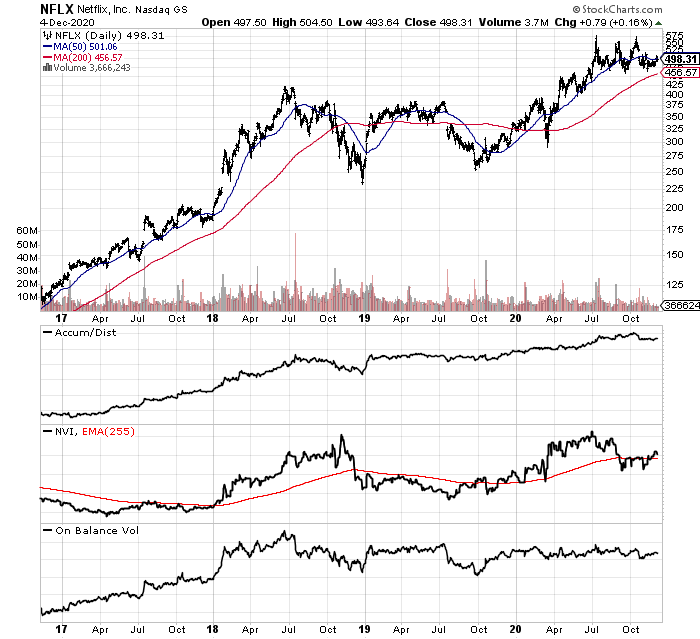

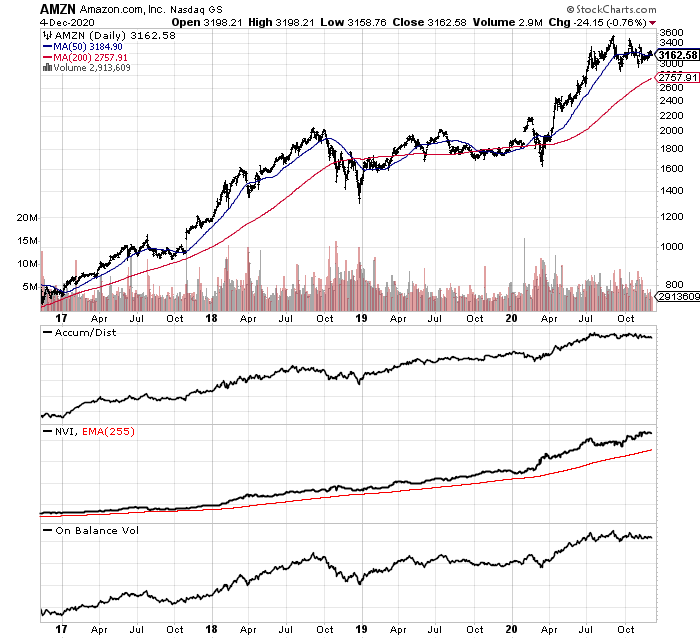

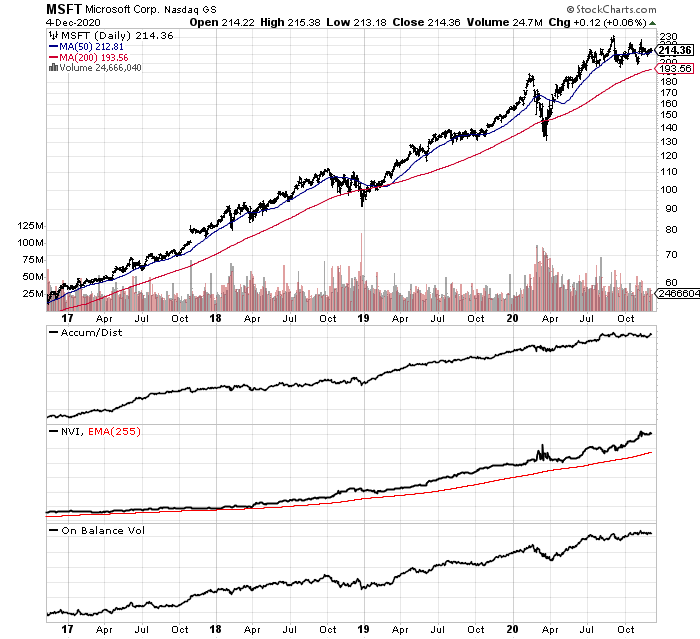

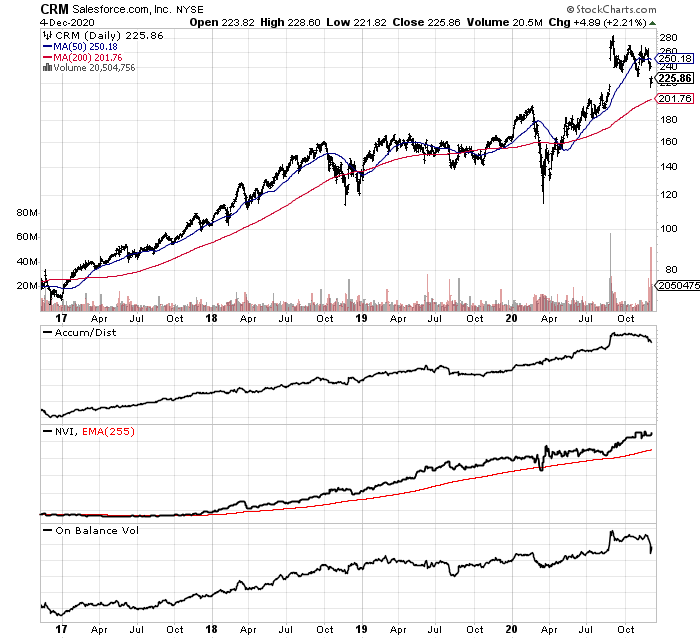

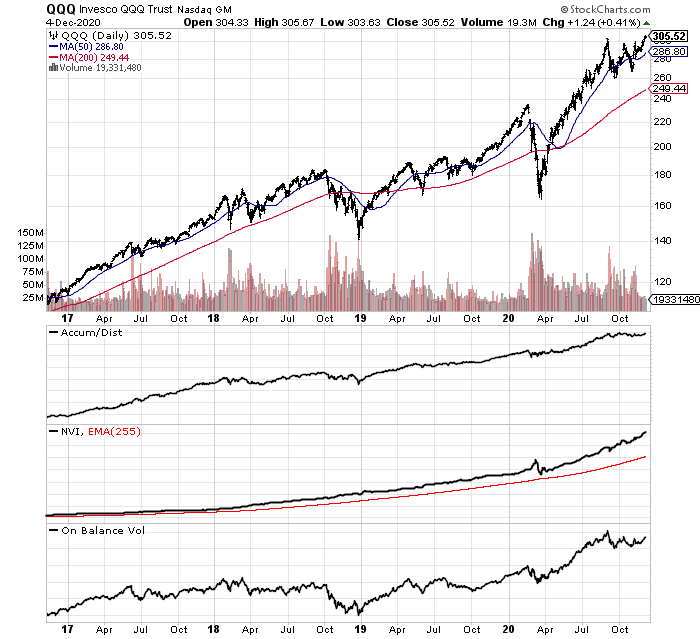

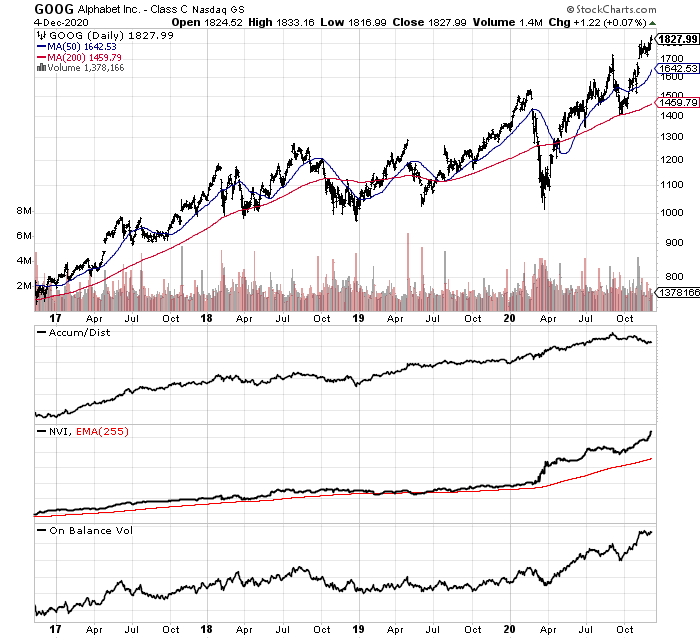

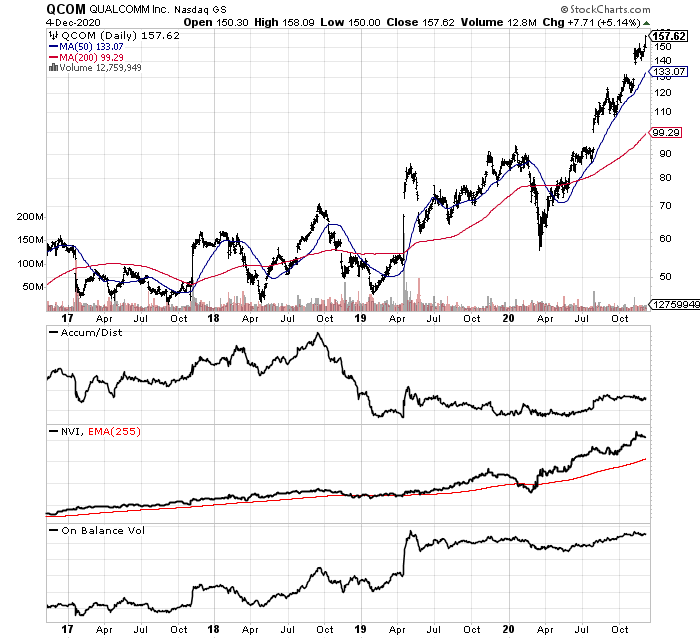

Below are charts of some of the huge gains (ripe for the taking) since election day, November 8th, 2016. Most are part of the Top 10 holdings of the Invesco Nasdaq 100 ETF (QQQ) up +180%, also pictured. Only the four years leading up to the infamous year 2000 Tech Bubble peak produced stronger industry gains. I have ranked them in order of winning percentage, where the animal spirits to sell could be the greatest. Tesla, Nvidia (NVDA), PayPal (PYPL), Adobe (ADBE), Apple (AAPL), Netflix (NFLX), Amazon (AMZN), Microsoft (MSFT), Salesforce (CRM), Alphabet-Google, Qualcomm (QCOM) and Facebook (FB) seem to have a middle to older-aged (in tech years) list of shareholders that may be considering the advantageous tax-related sell window, closing in a matter of days.

On the charts, I have included several of my favorite momentum indicators, the Accumulation/Distribution Line, Negative Volume Index and On Balance Volume measurements. Most have seen lagging ADL and OBV conditions since the September 1st momentum/price peak for the vast majority of NASDAQ tech leaders. Intraday selling trends and heightened volume on down vs. up days for price change have been a consistent theme for months.

Higher Corporate Tax Rates Will Hurt

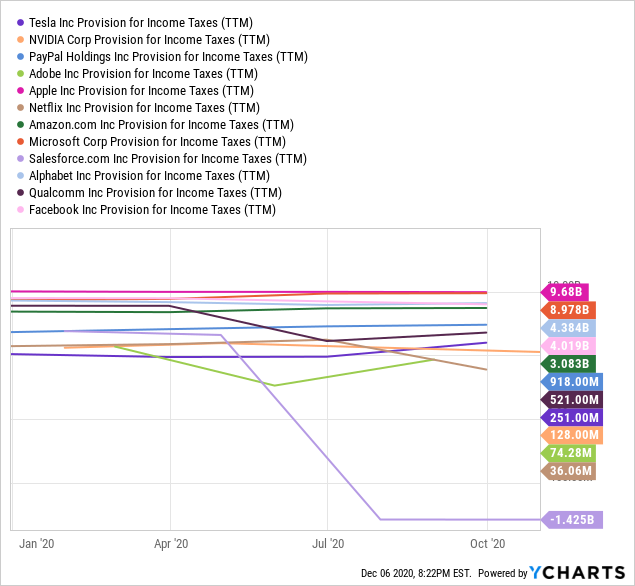

A secondary concern for Big Tech names is Biden’s platform promise to raise corporate tax rates. Many of America’s blue-chip technology companies paid little or no taxes in 2019-20. Biden wants to significantly increase top rates from 21% now to 28%, and more importantly, require a minimum 15% tax be paid if profits are reported. Big Tech uses creative accounting to avoid paying the existing 21% rate to the IRS. So, new tax law requiring a minimum payment will drag down future cash flow and income numbers.

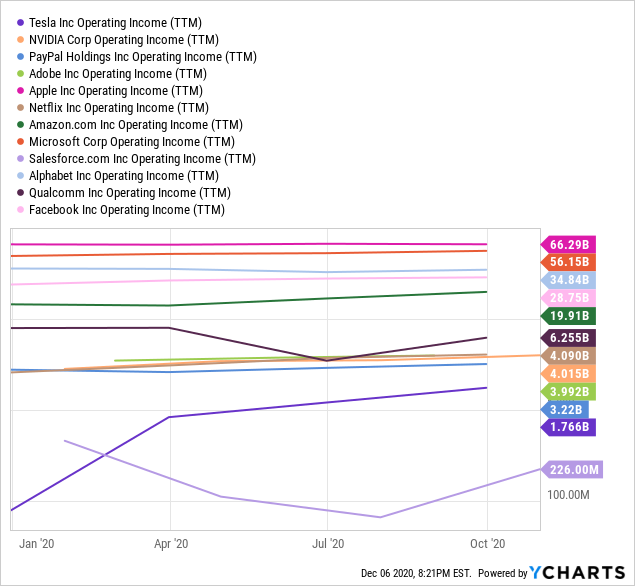

The Tax Foundation estimates Biden’s whole tax proposal, if enacted, would subtract 1.6% from GDP into 2023. However, the macroeconomic effect of higher taxes would pale in comparison to the exaggerated, negative outcome on Big Tech equities. Below is a chart of the 12 tech names listed as ripe for tax selling. I have graphed operating income and income tax provisions for each, over the trailing four quarters.

As a group, $229 billion in operating profits have been reported since late 2019, against just $30.6 billion in taxes paid, a 13.4% rate. I am estimating a 15% minimum, with a 7% hike in the base rate could increase taxes paid by $15-30 billion annually for these 12 corporations. The net effect would be a REDUCTION in after-tax earnings of 6-12%, all other variables remaining the same.

How many analysts and advisors are telling you a flat economy with higher tax rates could drastically slash reported income growth at the major tech leaders in 2021-22? If you are a major shareholder thinking ahead to how tax hikes might play out for your company, why not jump ship in December, avoiding higher taxes next year on the business and your capital gains?

Final Thoughts

Of course, any equity name experiencing excessive gains the last few years is susceptible to tax-related liquidations, not just the leading technology enterprises. What if Wall Street gets slammed with selling, after the Electoral College votes for Biden on December 14th, marking the official end of the Trump regime according to the Constitution?

The debate yet to be settled is whether abnormal selling amounts would derail the bullish market upmove since early November’s election. My worry is the latest euphoria from investors, regarding the rollout of vaccines for the coronavirus, has set up the market for a steep 10-20% price fall. I talked about the precarious sentiment and valuation issues for the overall market in an article this past weekend here. The trigger for a bear move could very well be tax-related selling in the largest American-based technology corporations, overdue for a price drop.

All-time equity overvaluations (U.S. stocks are selling for record price to sales and GDP output); solid investment gains that are just paper profits until liquidated; an uncertain economic outlook for 2021 including the potential for rising corporate tax rates; in addition to a reasonable opportunity to slash your tax bill, in combination could be the catalyst for dramatic sell volumes into January 1st.

Thanks for reading. This article should be a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Want to read more? Click the “Follow” button at the top of this article to receive future author posts.

Disclosure: I am/we are short QQQ, TSLA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.