News and research before you hear about it on CNBC and others. Request your 1-week free trial at StreetInsider Premium here.

Thor reports strong sales growth, gross

Profit margin and earnings per share for the first quarter of fiscal 2021

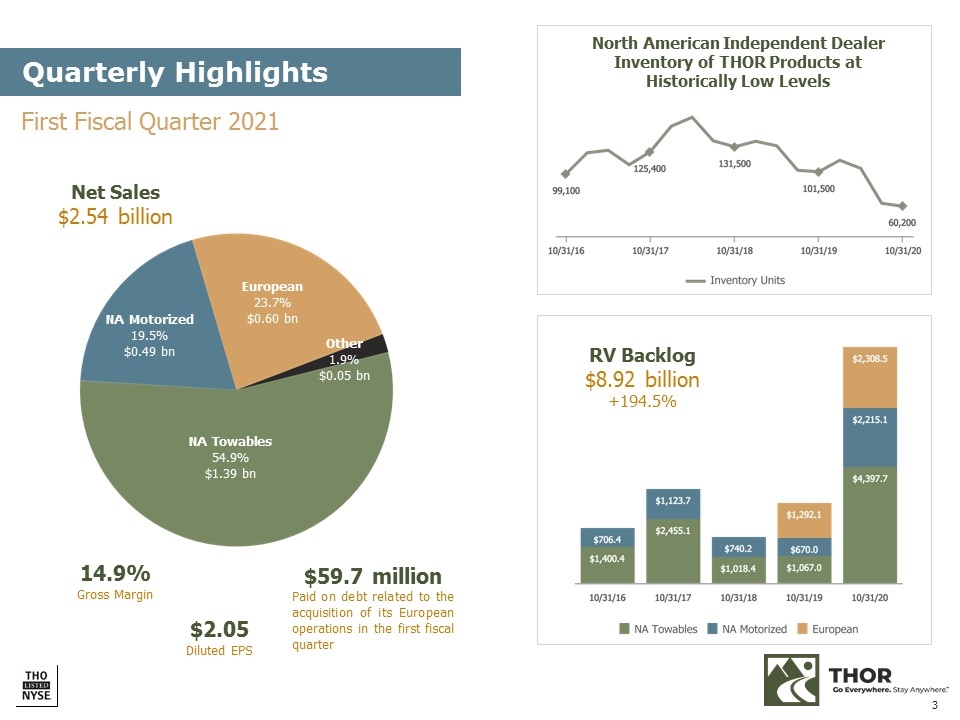

– Net sales for the first quarter were $ 2.54 billion, an increase of 17.5%.

First quarter results include net sales of $ 1.89 billion for RVs in North America and

US $ 602.5 million net RV sales in Europe.

– The consolidated gross profit margin for the first quarter was 14.9%, on a basis of 60

Point improvement compared to the same period last year.

– The annual surplus attributable to THOR rose by 122.8% in the first quarter

$ 113.8 million, or $ 2.05 per diluted share.

– Consolidated RV backlog as of October 31, 2020 was $ 8.92 billion, an increase

of 194.5% compared to October 31, 2019.

ELKHART, Ind., Dec. 8, 2020 / PRNewswire / – THOR Industries, Inc. (NYSE: THO) today announced strong growth for the first quarter of fiscal 2021 that ended October 31, 2020.

"We are excited to have a solid start to our fiscal year with strong year-over-year growth in all key metrics, including sales, gross margin and THOR's net income. Our order backlog continued to grow in the first quarter This is a record, while dealer inventories continued to decline as many of our product deliveries are direct to existing end customer orders. To meet the surge in demand, we have increased production levels, even with our higher one

Output and delivery, demand and backlog for our RV products continue to grow, "said Bob Martin, President and CEO of THOR Industries.

"We are working hard to resolve temporary supply chain problems that are currently common across the RV industry. We are confident that our shipments will continue to increase once these temporary supply chain constraints are eased. We believe so too will take some time. " months of production to fulfill pre-sold dealer orders first before we begin a replenishment cycle to help our dealers bring their inventory back to historically normal levels, ”added Martin.

First Quarter Financial Results

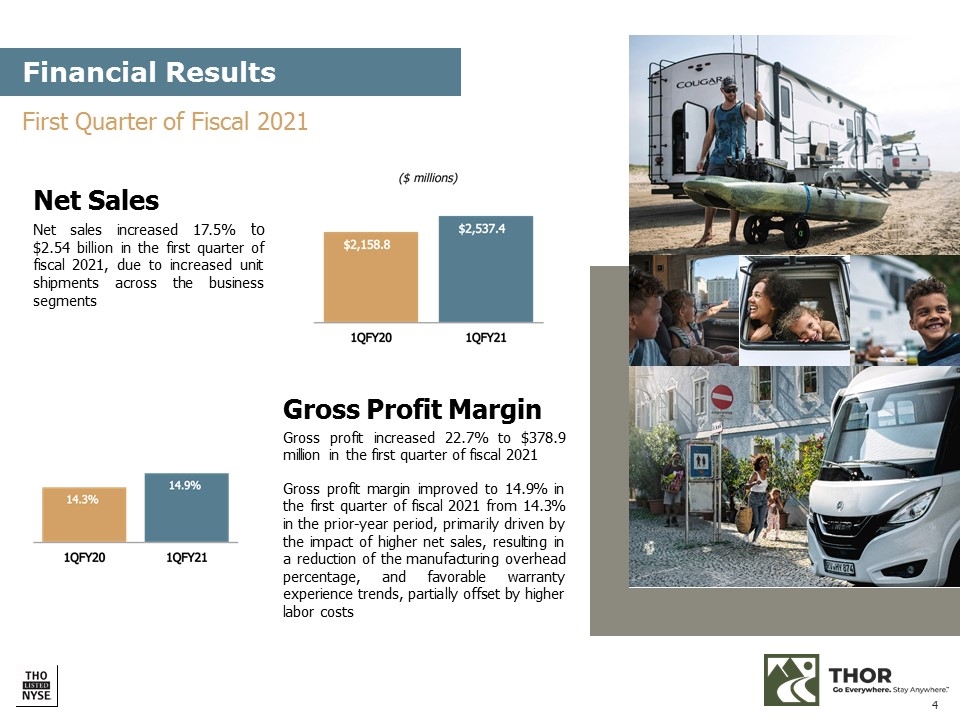

Net sales for the first quarter were $ 2.54 billion compared to $ 2.16 billion for the first quarter of fiscal 2020. Net sales for the first quarter of this year are $ 1.39 billion for North America

Towable RV segment, $ 493.9 million for the North American Motorized RV segment and $ 602.5 million for the European RV segment.

The consolidated gross profit margin was 14.9% in the first quarter of fiscal year 2021 compared to 14.3% in the same period last year. The improved gross profit margin is primarily due to the increase in net sales, which results in a decrease in manufacturing overhead percentage and favorable trends in warranty experience, partially offset by higher labor costs due to the current competitive RV labor market in Northern Indiana.

THOR's net income and diluted earnings per share were $ 113.8 million and $ 2.05, respectively, for the first quarter of fiscal 2021, compared to THOR's net income and diluted earnings per share of 51.1 USD million or USD 0.92 in the previous year period.

The companys

The effective income tax rate for the first quarter of fiscal year 2021 was 21.0% compared to 24.5% for the first quarter of fiscal year 2020. The main reason for the decrease in the effective tax rate between comparable periods was the additional income tax expense in the three months ended December 31 October 2019 from the transfer of share-based compensation commitments. The company estimates that the effective income tax rate for the 2021 financial year will be between 19% and 22% before taking discrete tax items into account. The actual effective income tax rate depends on the mix of foreign and domestic input tax income and is subject to the effects of exchange rates.

Cash flow from operating activities was $ 81.3 million for the first quarter of fiscal 2021 compared to $ 52.0 million for the first quarter of fiscal 2020. The company's cash flow is seasonal and the cash flow for the fiscal year of

Operating activity in the first quarter of the 2021 financial year increased compared to the same period in the previous year. This is due to an increase in inventories and accounts receivable in the current period, which was partially offset by an increase in liabilities. In the first quarter of fiscal 2021, the company made payments of $ 59.7 million for its debt related to the acquisition of its European operations.

Segment results

North American RVs

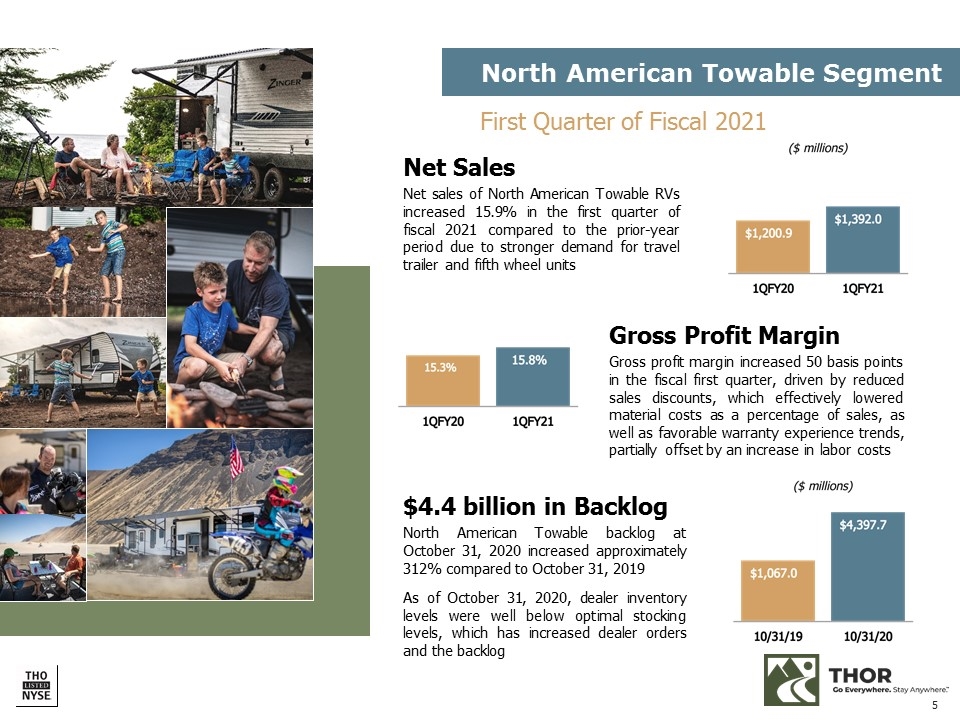

- North American Towable RV net sales were $ 1.39 billion for the first quarter of fiscal 2021, compared to net sales of $ 1.20 billion for the same period last year. The increase was mainly due to an increase in unit numbers, which was partially offset by a change in the product mix.

- North American Towable RV's gross profit margin was 15.8% for the first quarter of fiscal 2021, compared to 15.3% in

the same period last year. The improvement in gross profit margin in the first quarter mainly resulted from a decrease in sales discounts, which effectively reduced the cost of materials as a percentage of net sales, and favorable trends in warranty experience, partly offset by higher labor costs due to current competitive labor market conditions for RVs in North -Indiana. - Income before taxes for RVs in North America was $ 141.2 million for the first quarter of fiscal 2021, compared to $ 104.3 million in the first quarter of last year, driven by the increase in net sales of North American tow trucks.

- North American RV backlog as of October 31, 2020 was $ 4.40 billion, an increase of $ 3.33 billion, or 312.1%, compared to $ 1.07 billion as of October 31, 2019.

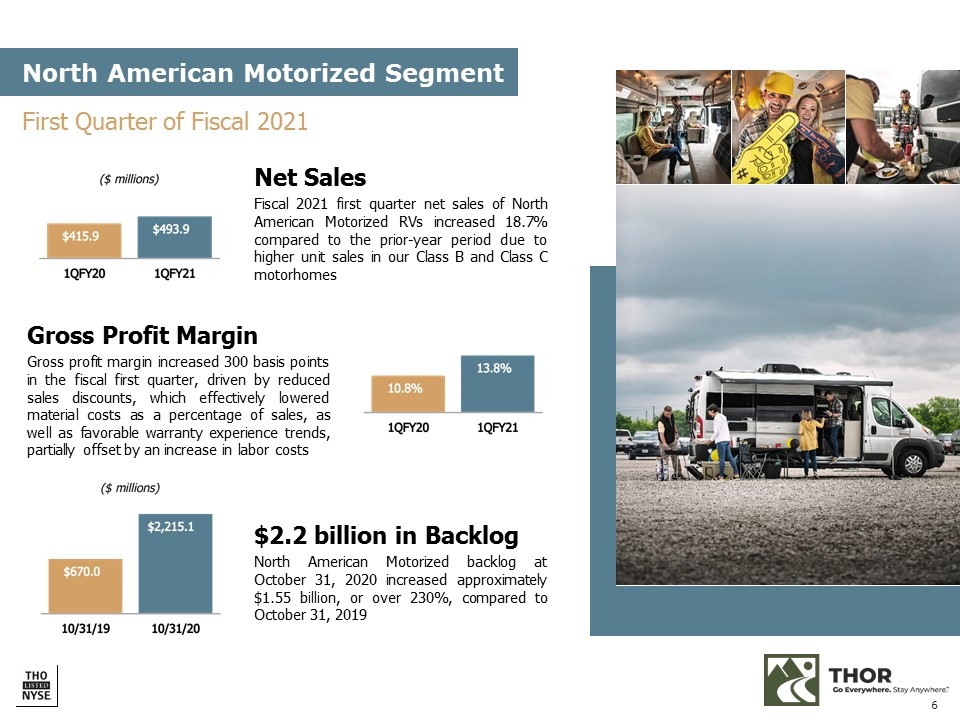

North American Motorized RVs

- North American motor home net sales were

$ 493.9 million for the first quarter of fiscal 2021 compared to $ 415.9 million for the same period last year. The increase in motorized net sales for the quarter was mainly driven by higher volumes in our Class B and C motorhomes. - North American Motorized RV's gross profit margin was 13.8% for the first quarter of fiscal 2021, compared to 10.8% for the same period last year. The improvement in gross profit margin in the first quarter mainly resulted from a decrease in sales discounts, which effectively reduced the cost of materials as a percentage of net sales, and favorable trends in warranty experience, partly offset by higher labor costs due to current competitive labor market conditions for RVs in North -Indiana.

- Income before taxes for RVs in North America increased to $ 41.6 million in the first quarter of fiscal 2021, compared to $ 21.8 million per year

before the driven increase in motorized net sales in North America. - North American motor home order backlog as of October 31, 2020 was $ 2.22 billion, an increase of $ 1.55 billion, or 230.6%, compared to $ 670.0 million as of October 31, 2019 .

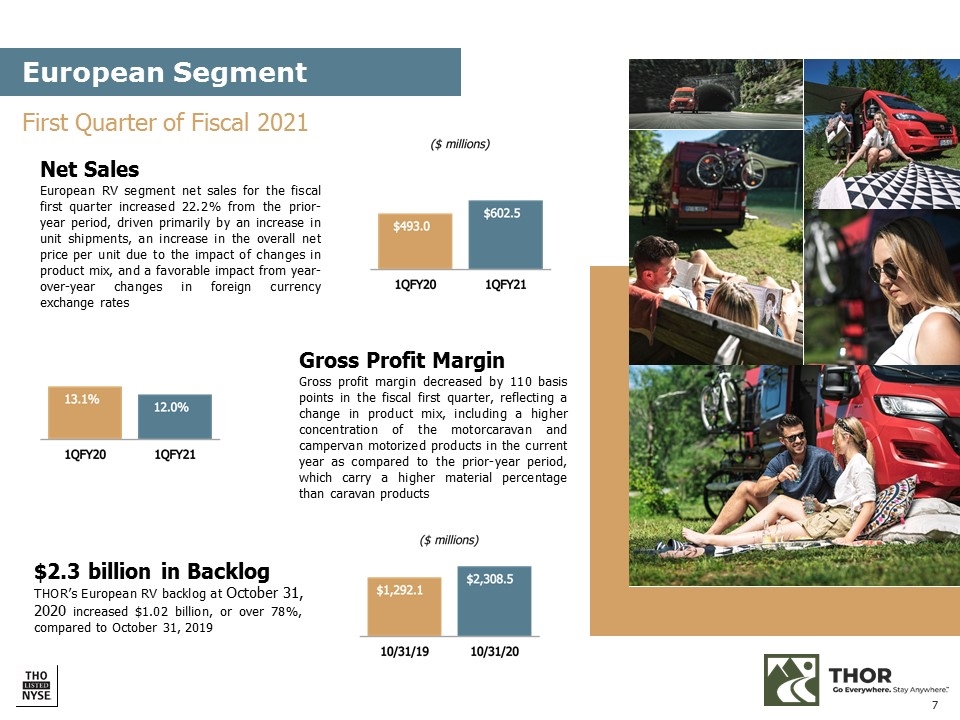

European RVs

- Net RV sales in Europe were $ 602.5 million for the first quarter of fiscal 2021 compared to $ 493.0 million for the same period last year. European net sales increased 22.2%, mainly driven by an increase in unit numbers, an increase in the total net price per unit due to the impact of changes in the product mix, and a favorable impact of changes in foreign currency over the previous year in exchange rates.

- The gross profit margin for RVs in Europe was 12.0% of net sales for the first quarter, compared to 13.1% for the same period last year. The gross profit margin was affected by a higher product mix

Concentration of sales of motorized mobile homes and mobile homes in the current year, which have a higher material cost share than caravan products. - European RV pre-tax loss was $ 5.5 million for the first quarter of fiscal 2021, compared to a pre-tax net loss of $ 23.0 million for the first quarter of fiscal 2020. The decrease in pre-tax loss was driven by an increase in Europe recreational vehicle net sales and a decrease in SG&A expenses.

- European RV backlog was $ 2.31 billion as of October 31, 2020, an increase of $ 1.02 billion, or 78.7%, from $ 1.29 billion as of October 31, 2019.

"Each of our business areas achieved a better operating result in the first quarter compared to the first quarter of the previous year. Our improved financial performance shows that we

The ability to successfully grow production volumes in response to increasing demand while managing our expenses to achieve improved margins and net revenues in an unusually complex operating environment, "said Colleen Zuhl, senior vice president and chief financial officer, THOR.

"Historically, our cash flow has tended to be seasonal as we build inventory in our first and second fiscal quarters to prepare for the typical demand cycle for our products. This is also the case this year as the added complexity of moving additional chassis and inventory We assume that the total working capital will remain high in view of the strong market demand, but we expect our work-in-process to normalize to an appropriate level over the course of the financial year as the supply chain stabilizes and

We send finished work-in-process units. We continue to have strong liquidity with cash and cash equivalents of $ 337.4 million as of October 31, 2020 and currently approximately $ 720 million available for borrowing under our ABL. Our cash usage priorities continue to align with our historical priorities: we will invest in our business, increase our dividend over time, further reduce our acquisition-related debt obligations, and support opportunistic strategic investments, including acquisitions, to add long-term shareholder value " , Zuhl concluded.

outlook

"Our financial results for the first quarter were very good despite the ongoing challenges we faced due to the pandemic. Our teams did an excellent job in what remains an uncertain operating environment. We are seeing the current chain restrictions." his

They are temporary in nature and anticipate continued growth in fiscal 2021, supported by our backlog of $ 8.92 billion as of October 31, "said Bob Martin, President and CEO of THOR Industries.

"We believe the long-term growth potential for the RV industry remains very positive. While the effects of COVID-19 have brought new buyers to our industry, both THOR and the industry in general attracted new buyers and saw strong demand independently from the pandemic. People have shown they value the long-term value proposition of RVs – affordability, vacationing in a controlled environment, freedom and outdoor fun. We also believe that consumers' desire to be in control of their destinies and be safer , socially distant vacation activities have been, and will continue to be, a key factor in the recent demand for RVs

a factor for the foreseeable future.

"On December 1, 2020, RVIA updated its most likely forecast and now expects calendar 2021 shipments to increase 18.7% from the most likely estimate for 2020 calendar shipments. We support their forecast and believe there is upside potential Forecast is based on current industry conditions, "concluded Martin.

Materials for Posting Additional Earnings

THOR has provided a comprehensive question and answer document as well as a PowerPoint presentation on the quarterly results and other topics. To view these materials, go to http://ir.thorindustries.com.

About THOR Industries, Inc.

THOR is the sole owner of operating subsidiaries that together represent the world's largest manufacturer of recreational vehicles. More information about the company and its

You can find products at www.thorindustries.com.

Forward-Looking Statements

This press release contains certain statements that are "forward-looking" statements within the meaning of the US Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. as amended. These forward-looking statements are based on management's current expectations and beliefs with respect to future and expected developments and their effects on THOR and inherently involve uncertainties and risks. These forward-looking statements are not guarantees of future performance. We cannot assure you that actual results will not differ materially from our expectations. Factors that can produce materially different results include, but are not limited to, the extent and impact of the

Continuing the COVID-19 pandemic, as well as responding to the containment of the spread of the virus by various government agencies or other actors that may negatively affect retail customer demand, our independent distributors, our supply chain, manufacturing, or any other aspect of our business and that could adversely affect our consolidated results of operations, financial condition, cash flows and liquidity; the ability to quickly ramp up or down production in response to rapid changes in demand while managing costs and market share; the effects of fluctuations in raw material and raw material prices and / or supply bottlenecks for raw materials, raw materials or chassis; the impact of tariffs on material or other input costs; The amount and scope of the warranty claims; Legislative, regulatory and tax law and / or political developments, including how they may affect ours

Dealers and their retail customers or our suppliers; the cost of complying with government regulations; Legal and compliance issues, including those that may arise in connection with recent transactions; lower consumer confidence and discretionary consumer spending; Fluctuations in interest rates and their potential impact on the general economy and, in particular, our traders and consumers; the effects of exchange rate fluctuations; restrictive lending practices that could adversely affect our independent dealers and / or retail customers; Management changes; the success of new and existing products and services; the ability to use existing production facilities efficiently; Changes in consumer preferences; the risks associated with acquisitions, including: the pace and successful completion of an acquisition, its integration and its financial implications, the

Degree of achievement of expected operational synergies from acquisitions, the potential for unknown or undervalued liabilities related to acquisitions, the potential loss of existing customers from acquisitions and our ability to retain key personnel of the acquired companies; Lack of manpower for production and rising labor costs to attract production workers in times of high demand; the loss or reduction of sales to major dealers; Disruption of the delivery of units to dealers; rising freight and transportation costs; Asset impairment losses; Cost structure changes; Competition; the impact of potential losses from repurchase or funded receivables contracts; the potential impact of the strength of the US dollar on international demand for US dollar products; general economic, market-related and political conditions in the various countries

in which our products are manufactured and / or sold; the impact of changing emissions and other regulatory standards in the various countries in which our products are manufactured and / or sold; Changes to our investment and capital allocation strategies or other aspects of our strategic plan; Changes in market liquidity conditions, credit ratings, and other factors that could affect our access to future finance and the cost of debt.

These and other risks and uncertainties are discussed in more detail in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2020 and in Item 1A of our Annual Report on Form 10-K for the fiscal year ended July 31, 2020.

We disclaim any obligation or obligation to post updates or revisions to any forward-looking statements in this press release or any changes to our expectations after the date of this document or changes to

Events, conditions or circumstances on which a statement is based, except as required by law.

THOR INDUSTRIES, INC. | ||||||||||

CONDENSED CONSOLIDATED INCOME STATEMENTS | ||||||||||

FOR THE THREE MONTHS OF OCTOBER 31, 2020 and 2019 | ||||||||||

($ 000 excluding share and per share data) (unaudited) | ||||||||||

Three months ended on October 31st | ||||||||||

2020 | % Network | 2019 | % Network | |||||||

Net sales | $ | 2,537,360 | $ | 2,158,785 | ||||||

Gross income | $ | 378.852 | 14.9% | $ | 308.811 | 14.3% | ||||

Selling and general administration | 181,763 | 7.2% | 188.464 | 8.7% | ||||||

Amortization of intangible assets | 27,427 | 1.1% | 24.293 | 1.1% | ||||||

Net interest expense | 23,958 | 0.9% | 27,050 | 1.3% | ||||||

Other income (expenses), net | 615 | -% | (370) | -% | ||||||

Profit before tax | 146.319 | 5.8% | 68,634 | 3.2% | ||||||

Income tax | 30,680 | 1.2% | 16,789 | 0.8% | ||||||

Net income | 115,639 | 4.6% | 51,845 | 2.4% | ||||||

Less: net income from non-controlling interests | 1,882 | 0.1% | 780 | -% | ||||||

THOR Industries, Inc. Net Income | $ | 113,757 | 4.5% | $ | 51,065 | 2.4% | ||||

Earnings per ordinary share | ||||||||||

basic | $ | 2.06 | $ | 0.93 | ||||||

Diluted | $ | 2.05 | $ | 0.92 | ||||||

Weighted average Ordinary Shares Outstanding – Basis | 55,238,164 | 55,095,074 | ||||||||

Weighted average Ordinary Shares Outstanding – Diluted | 55,554,682 | 55,224,655 | ||||||||

(1) Percentages may not be added due to rounding differences | ||||||||||

SUMMARY OF CONDENSED CONSOLIDATED BALANCE SHEETS ($ 000) (unaudited) | ||||||||||||||||||

October 31, 2020 | July 31, 2020 | October 31, 2020 | July 31, 2020 | |||||||||||||||

Cash and equivalents | $ | 340.210 | $ | 541,363 | Short term liabilities | $ | 1,596,690 | $ | 1,515,281 | |||||||||

Claims, net | 817,653 | 814.227 | Long-term liabilities | 1,585,019 | 1,652,831 | |||||||||||||

Inventories, net | 1,038,250 | 716.305 | Other long-term liabilities | 258.692 | 257.779 | |||||||||||||

Prepaid expenses and other | 44.203 | 30,382 | Equity | 2,420,521 | 2,345,569 | |||||||||||||

Total current assets | 2,240,316 | 2,102,277 | ||||||||||||||||

Property, plant and equipment, net | 1,091,941 | 1,107,649 | ||||||||||||||||

Goodwill | 1,481,283 | 1,476,541 | ||||||||||||||||

Amortizable intangible assets, net | 885.454 | 914.724 | ||||||||||||||||

Deferred income taxes and other, net | 161,928 | 170.269 | ||||||||||||||||

total | $ | 5,860,922 | $ | 5,771,460 | $ | 5,860,922 | $ | 5,771,460 | ||||||||||

Contact

Investor Relations:

Mark Trinske, Vice President for Investor Relations

[email protected]

(574) 970-7912

FIRST QUARTER OF FISCAL 2021 FINANCIAL RESULTS Appendix 99.2

Forward-Looking Statements This presentation contains certain statements that are “forward-looking” statements within the meaning of the US Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange, which are Act of 1934, as amended Version. These forward-looking statements are based on management's current expectations and beliefs with respect to future and expected developments and their effects on THOR and inherently involve uncertainties and risks. These forward-looking statements are not guarantees of future performance. We cannot assure you that actual results will not differ materially from our expectations. Factors that could produce materially different outcomes include, but are not limited to, the extent and impact of the continuation of the COVID-19 pandemic, as well as the response to the containment of the spread of the virus by various government agencies or other actors that have a negative impact may affect the demand from retail customers, our independent dealers, our supply chain, our manufacturing, or any other aspect of our business that could adversely affect our consolidated results of operations, financial condition, cash flows and liquidity; the ability to quickly ramp up or down production in response to rapid changes in demand while managing costs and market share; the effects of fluctuations in raw material and raw material prices and / or supply bottlenecks for raw materials, raw materials or chassis; the impact of tariffs on material or other input costs; The amount and scope of the warranty claims; Legislative, regulatory and tax law and / or political developments, including their possible effects on our dealers and their retail customers or on our suppliers; the cost of complying with government regulations; Legal and compliance issues, including those that may arise in connection with recent transactions; lower consumer confidence and discretionary consumer spending; Fluctuations in interest rates and their potential impact on the general economy and, in particular, our traders and consumers; the effects of exchange rate fluctuations; restrictive lending practices that could adversely affect our independent dealers and / or retail customers; Management changes; the success of new and existing products and services; the ability to use existing production facilities efficiently; Changes in consumer preferences; the risks associated with acquisitions, including: the pace and success of an acquisition, its integration and financial impact, achievement of expected operational synergies from acquisitions, potential for unknown or undervalued liabilities in connection with acquisitions, potential loss of existing customers from acquisitions and our ability To keep key personnel of the acquired companies; Lack of manpower for production and rising labor costs to attract production workers in times of high demand; the loss or reduction of sales to major dealers; Disruption of the delivery of units to dealers; rising freight and transportation costs; Asset impairment losses; Cost structure changes; Competition; the impact of potential losses from repurchase or funded receivables contracts; the potential impact of the strength of the US dollar on international demand for US dollar products; general economic, market and political conditions in the various countries in which our products are manufactured and / or sold; the impact of changing emissions and other regulatory standards in the various countries in which our products are manufactured and / or sold; Changes to our investment and capital allocation strategies or other aspects of our strategic plan; Changes in market liquidity conditions, credit ratings and other factors that could affect our access to future finance and the cost of debt. These and other risks and uncertainties are discussed in more detail in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2020 and in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2020 disclaim any obligation or any obligation to post updates or revisions to any forward-looking statements in this presentation or changes in our expectations after the date of this document or changes in events, conditions or circumstances on which statements are based, except as required by law.

Quarterly Highlights European 23.7% 0.60 billion USD NA Motorized 19.5% 0.49 billion USD NA Towables 54.9% 1.39 billion USD Other 1.9% 0.05 billion USD 14.9 % Gross Margin $ 2.05 Diluted EPS $ 59.7M Paid on debt related to the acquisition of its European operations in fiscal first quarter North American independent dealer inventory of THOR products at historically low RV backlog $ 8.92 billion + 194.5% net sales $ 2.54 billion first fiscal quarter 2021

Net Sales Net sales increased 17.5% to $ 2.54 billion in the first quarter of fiscal 2021. This is due to the increased number of units in the business areas. Gross Profit Margin Gross profit increased 22.7% to $ 378.9 million in the first quarter of fiscal 2021. Gross profit margin improved to 14.9% in the first quarter of fiscal 2021 compared to 14.3% in the year-ago period, mainly due to the impact of higher net sales, which resulted in a decrease in the percentage of manufacturing overheads and favorable trends in warranty experiences, Partly offset by increased labor costs Financial results First quarter of fiscal 2021

Net Sales Net sales of North American RVs increased 15.9% in the first quarter of fiscal 2021 compared to the same period last year. This is due to the increased demand for caravans and fifth wheels. Gross Profit Margin Gross Profit Margin increased 50 basis points for the fiscal year The first quarter was driven by lower sales discounts that effectively reduced the cost of materials as a percentage of sales, as well as favorable trends in warranty experience, partly driven by an increase in backlog of 4, $ 4 billion as of October 31, 2020 was offset approximately 312% from October 31, 2019 As of October 31, 2020, dealer inventory levels were well below optimal inventory levels, which increased dealer orders and backlog in the first quarter of the North American towing segment Fiscal year 2021

Fiscal 2021 Net Sales Net sales of motorhomes in North America increased 18.7% compared to the same period last year. This is due to higher sales volumes in our class B and C motorhomes. Gross Profit Margin Gross profit margin increased 300 basis points in the first quarter of the quarter was driven by lower sales discounts, which effectively reduced the cost of materials as a percentage of sales, and favorable trends in warranty experience, partly driven by a 2.2 billion increase in labor costs . USD were offset. North American Motorized's backlog as of October 31, 2020 increased approximately $ 1.55 billion, or more than 230%, compared to the first quarter of fiscal 2021 for the North American Motorized segment on October 31, 2019

Net sales Sales in the European RV segment rose 22.2% in the first quarter of the fiscal year compared to the same period last year. This is mainly due to an increase in unit numbers, an increase in the total net price per unit due to the effects of changes in the product mix. and a beneficial effect due to year-on-year exchange rate changes 1st Quarter of Fiscal Year 2021 Gross Profit Margin The gross profit margin decreased 110 basis points in the first quarter of the fiscal year, due to a change in the product mix including a higher concentration of motor home and RV products Motorhomes this year versus the same period last year, which have a higher material content than caravan products, have an order backlog of $ 2.3 billion. THOR's backlog for European RVs as of October 31, 2020 increased $ 1.02 billion, or over 78%. compared to the European segment as of October 31, 2019

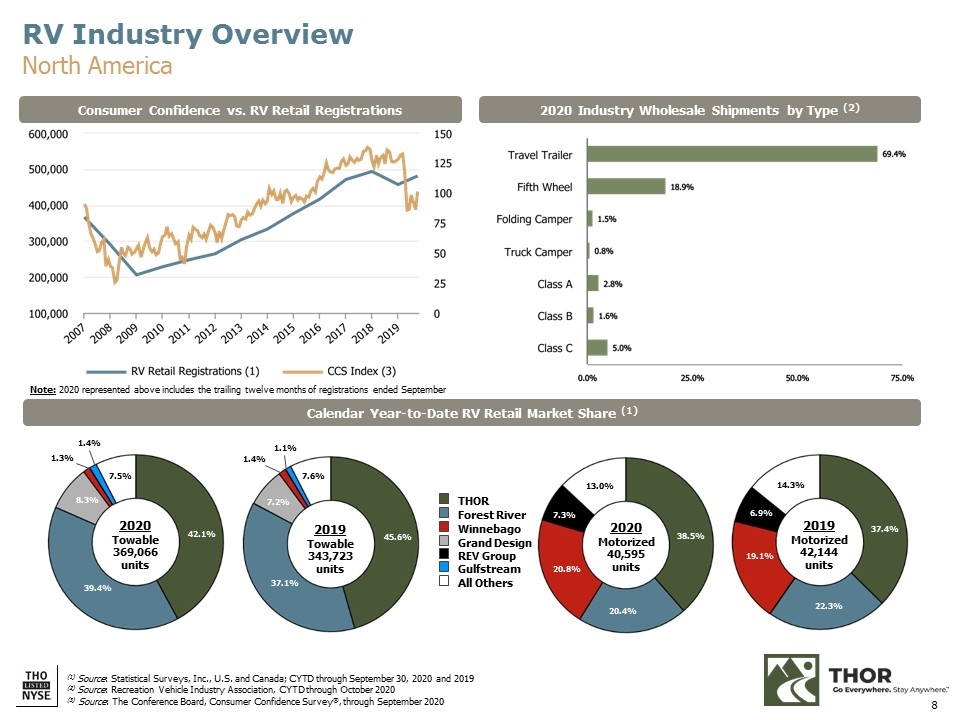

(1) Source: Statistical Surveys, Inc., USA and Canada; CYTD bis 30. September 2020 und 2019 (2) Quelle: Verband der Freizeitfahrzeugindustrie, CYTD bis Oktober 2020 (3) Quelle: Conference Board, Consumer Confidence Survey®, bis September 2020 2020 Großhandelslieferungen nach Typ (2) Verbrauchervertrauen Kalender für RV-Einzelhandelsregistrierungen Kalender seit Jahresbeginn RV-Einzelhandelsmarktanteil (1) RV-Branchenüberblick Nordamerika THOR Forest River Winnebago Grand Design REV-Gruppe Gulfstream Alle anderen 2020 Schleppbar 369.066 Einheiten 2020 Motorisiert 40.595 Einheiten 2019 Motorisiert 42.144 Einheiten 2019 Schleppbar 343.723 Einheiten 38,5% 42,1% 37,4% 45,6% 39,4% 20,4% 8,3% 1,3% 7,5% 1,4% 20,8% 7,3% 13,0% 7,6% 7,2% 37,1% 1,1% 1,4% 14,3% 22,3% 19,1% 6,9% Hinweis: 2020 oben dargestellt enthält Die letzten zwölf Monate der Registrierung endeten im September

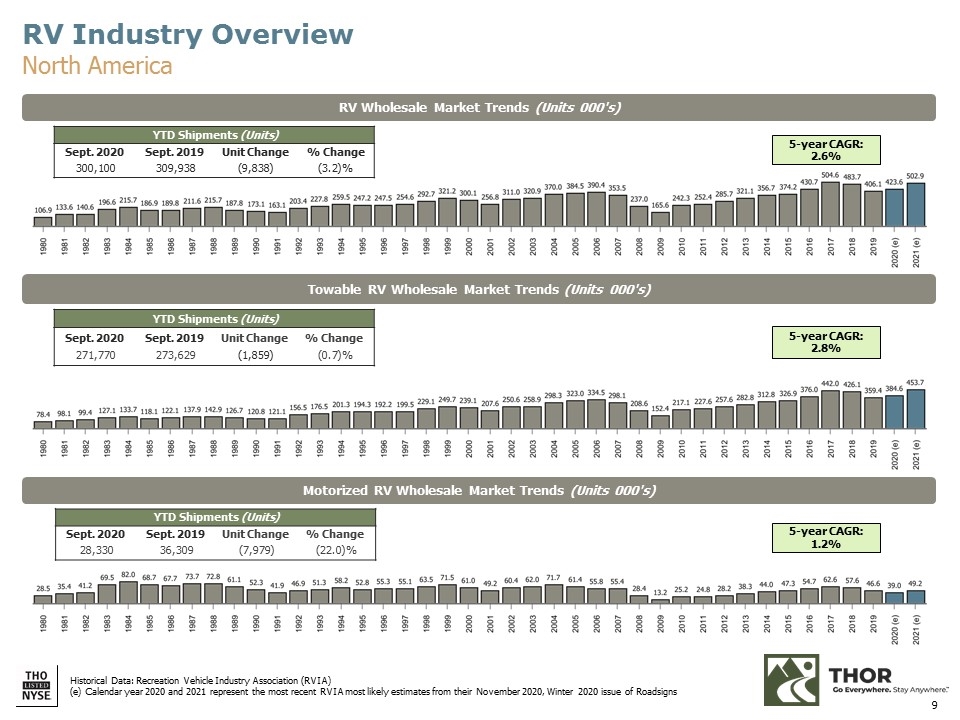

RV-Großhandelsmarkttrends (Einheiten 000) Schleppbare RV-Großhandelsmarkttrends (Einheiten 000) YTD-Sendungen (Einheiten) Sept. 2020 Sept. 2019 Einheitenänderung% Veränderung 300.100 309.938 (9.838) (3,2)% YTD-Sendungen (Einheiten) Sept. 2020 Sept. Änderung der Einheiten 2019% Veränderung 271.770 273.629 (1.859) (0,7)% Markttrends für motorisierte Wohnmobil-Großhandel (Einheiten 000) YTD-Lieferungen (Einheiten) Sept. 2020 Sept. 2019 Einheit Veränderung% Veränderung 28.330 36.309 (7.979) (22,0)% Historische Daten : Verband der Freizeitfahrzeugindustrie (RVIA) (e) Die Kalenderjahre 2020 und 2021 stellen die jüngsten RVIA-Schätzungen aus der 5-Jahres-CAGR von Roadsigns vom November 2020, Winter 2020, dar: 2,6% 5-Jahres-CAGR: 2,8% 5- Jahr CAGR: 1,2% RV Industry Overview North America

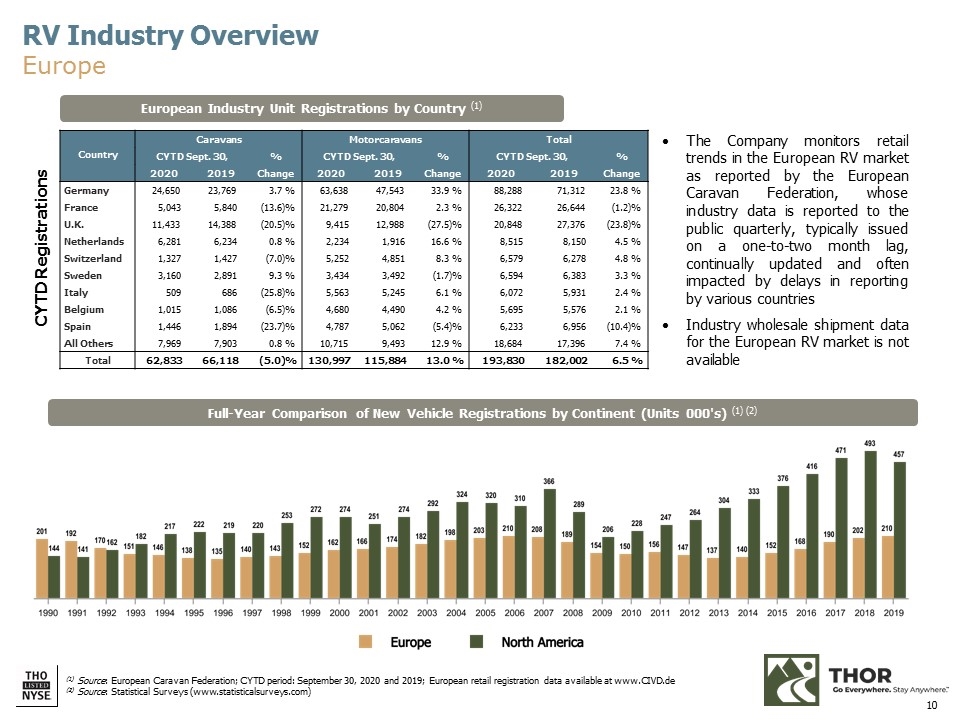

(1) Quelle: European Caravan Federation; CYTD-Zeitraum: 30. September 2020 und 2019; Registrierungsdaten für den europäischen Einzelhandel verfügbar unter www.CIVD.de (2) Quelle: Statistische Erhebungen (www.statisticalsurveys.com) Land Caravans Motorcaravans Total CYTD 30. September,% CYTD 30. September,% CYTD 30. September,% 2020 2019 Änderung 2020 2019 Änderung 2020 2019 Änderung Deutschland 24.650 23.769 3,7% 63.638 47.543 33,9% 88.288 71.312 23,8% Frankreich 5.043 5.840 (13,6)% 21.279 20.804 2,3% 26.322 26.644 (1,2)% UK 11.433 14.388 (20,5)% 9.415 12.988 (27,5)% 20.848 27.376 (23,8)% Niederlande 6.281 6.234 0,8% 2.234 1.916 16,6% 8.515 8.150 4,5% Schweiz 1.327 1.427 (7,0)% 5.252 4.851 8,3% 6.579 6.278 4,8% Schweden 3.160 2.891 9,3% 3.434 3.492 (1,7)% 6.594 6.383 50 686 (25,8)% 5.563 5.245 6,1% 6.072 5.931 2,4% Belgien 1.015 1.086 (6,5)% 4.680 4.490 4,2% 5.695 5.576 2,1% Spanien 1.446 1.894 (23,7)% 4.787 5.062 (5,4)% 6.233 6.956 (10,4)% Alle anderen 7.969 7.903 0,8% 10.715 9.493 12,9% 18.684 17.396 7,4% Gesamt 62.833 66.118 (5,0)% 130.997 115.884 13,0% 193.830 182.002 6,5% Registrierungen der europäischen Industrieeinheiten nach Ländern (1) Das Unternehmen überwacht die Einzelhandelsentwicklung in Der europäische Wohnmobilmarkt, wie von der European Caravan Federation gemeldet, deren Branchendaten vierteljährlich an die Öffentlichkeit gemeldet werden, wird in der Regel mit einer Verzögerung von ein bis zwei Monaten veröffentlicht, ständig aktualisiert und häufig durch Verzögerungen bei der Berichterstattung durch verschiedene Länder beeinflusst für den europäischen Wohnmobilmarkt nicht verfügbar CYTD-Zulassungen Ganzjahresvergleich der Neufahrzeugzulassungen nach Kontinent (Einheiten 000) (1) (2) Überblick über die Wohnmobilindustrie Europa

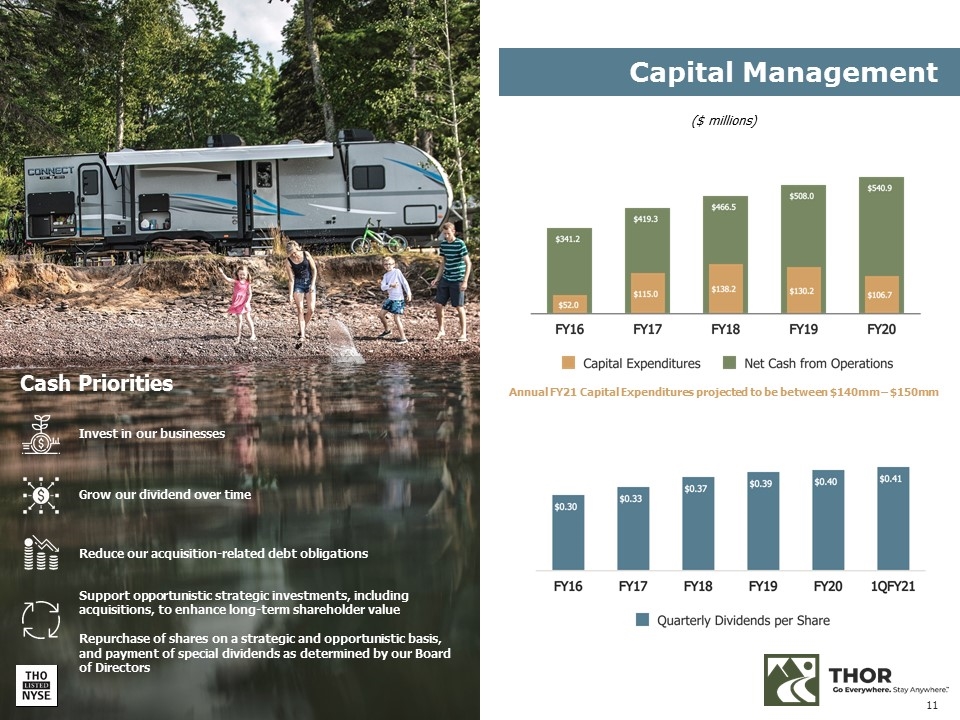

Kapitalmanagement (in Mio. USD) Cash-Prioritäten Unterstützen Sie opportunistische strategische Investitionen, einschließlich Akquisitionen, um den langfristigen Shareholder Value zu steigern. Rückkauf von Aktien auf strategischer und opportunistischer Basis und Zahlung von Sonderdividenden, wie von unserem Verwaltungsrat festgelegt Schuldenverpflichtungen Steigern Sie unsere Dividende im Laufe der Zeit Investieren Sie in unser Geschäft Jährliche GJ21-Investitionen, die voraussichtlich zwischen 140 und 150 mm liegen werden

INVESTORENBEZIEHUNGEN KONTAKT: Mark Trinske Vizepräsident für Investor Relations [email protected] (574) 970-7912

Anlage 99.3

ERSTES QUARTAL VON FISCAL 2021

INVESTORENFRAGEN & ANTWORTEN

Veröffentlicht am 8. Dezember 2020

Forward-Looking Statements

Es wird auf die zukunftsgerichteten Aussagen am Ende dieses Dokuments verwiesen.

Executive-Übersicht

• • | Der Nettoumsatz im ersten Quartal betrug 2,54 Milliarden US-Dollar, eine Steigerung von 17,5%. Die Ergebnisse des ersten Quartals beinhalten einen Nettoumsatz von 1,89 Milliarden US-Dollar für Wohnmobile in Nordamerika und einen Nettoumsatz von 602,5 Millionen US-Dollar für europäische Wohnmobile. |

• • | Die konsolidierte Bruttogewinnmarge betrug im ersten Quartal 14,9%, eine Verbesserung um 60 Basispunkte gegenüber dem Vorjahreszeitraum. |

• • | Net income attributable to THOR for the first quarter increased 122.8% to $113.8 million, or $2.05 per diluted share. |

• • | Consolidated RV backlog as of October 31, 2020 was $8.92 billion, an increase of 194.5% over October 31, 2019. |

Quick Reference to Contents

Current Market Conditions and Outlook Assumptions | 2 | ||

Fragen und Antworten | 4th | ||

Segment Data | |||

Summary of Key Quarterly Segment Data – North American Towable RVs | 9 | ||

Summary of Key Quarterly Segment Data – North American Motorized RVs | 10 | ||

Summary of Key Quarterly Segment Data – European RVs | 11 | ||

Forward-Looking Statements | 12 | ||

Current Market Conditions and Outlook Assumptions

Absent a significant long-term economic impact to the United States or Europe as a direct or indirect result of COVID-19 or other events, our long-term outlook for the RV industry is one of optimism based on:

▪ | Positive near-term and long-term RV industry fundamentals in both North America and Europe. Confident outlook is supported by favorable demographics, favorable perception of RVing as promoting a healthy lifestyle and adequate availability of dealer and consumer credit at historically low rates in both North America and Europe. |

▪ | Independent dealer outlook in North America and Europe. Independent dealer optimism remains high in North America and Europe for both the near term and the long term. Even prior to the onset of COVID-19, demand was being driven by favorable demographic and lifestyle growth trends. We believe these trends have been strengthened since the onset of COVID-19. Many dealers, particularly larger dealers in North America, continue to invest heavily in their businesses with new or expanded locations, added service facilities and other amenities to serve RV consumers. |

▪ | Market conditions in North America. Currently, dealer inventories are at historically low levels in North America given the recent strong retail demand for RVs due to the perceived safety of RV travel during the COVID-19 pandemic, a strong desire to socially distance and the reduction in commercial air travel and cruises. We believe consumers are likely to continue to prefer vacations that RVs are uniquely positioned to provide, where they can continue practicing social distancing while also allowing them to explore or unwind, often close to home and on short notice. Minimal-contact vacation options like road trips and camping are ideal for people who want to keep their risk factors low. |

Demand in the market remains very high, such that our recent deliveries to dealers are being sold at retail very quickly and are not yet adding to dealer lot inventory levels. As a result, our order backlog at the end of our fiscal first quarter was at a new all-time high value of $8.92 billion. The growth in backlog, combined with the low level of current dealer inventory, speaks to the longer-term nature of the current demand cycle. We expect this cycle of robust retail sales, followed by a restocking cycle, will last at least through the end of our fiscal year 2021.

On December 1st, RVIA issued its updated forecast for calendar years 2020 and 2021 wholesale unit shipments. RVIA estimates total North American shipments in calendar year 2021 will likely be 502,900 units, an increase of approximately 19% over the most-likely estimate of unit shipments for calendar year 2020. Towable RV shipments are anticipated to reach 453,700 units in calendar year 2021, an increase of approximately 18% over anticipated calendar year 2020 shipments. Motorhome shipments are projected to finish at 49,200 units in calendar year 2021, an increase of approximately 26% over anticipated calendar year 2020 shipments.

▪ | Market conditions in Europe. The European outlook for future growth in retail sales depends upon the various economic conditions in the respective countries we sell into. Germany is the largest RV market in Europe and is performing well, and, as in North America, dealer inventories in Germany are below normal stocking levels. Our long-term outlook for future growth in European retail sales remains positive as more and more people discover RVs as a way to support their lifestyle in search of independence and individuality, as well as using the RV as a multi-purpose vehicle to escape urban life and explore outdoor activities and nature. |

2

We are seeing many of the themes that we are experiencing in North America also play out in Europe, although the magnitude varies country by country. Total retail registrations in Europe for the third calendar quarter of 2020 increased 56% compared to the same time period in 2019, drawing dealer inventories down to below normal stocking levels. Germany, our largest European market, saw an increase in retail registrations of 80% in the third calendar quarter of 2020 compared to the prior year period. Registrations in Germany, calendar year-to-date through September, are up 24% in 2020 versus 2019. The UK, which is the third largest European market and among the hardest hit countries during the pandemic, also saw third calendar quarter retail unit sales increase 34% year-over-year. UK calendar year-to-date registrations through September, however, are still down 24%.

Due to the COVID-19 pandemic and ongoing efforts to limit its spread, we have cancelled our participation in all trade fairs and major events planned for the remainder of calendar 2020, and are evaluating the level of our trade fair participation for fiscal year 2021. In place of the trade fairs, we have and will continue to strengthen and expand our digital activities in order to reach high potential target groups, generate leads and steer customers directly to dealerships. With over 1,000 active independent dealers in Germany and throughout Europe, we have one of the strongest and most professionally structured dealer and service networks, and we are optimistic about long-term future growth.

▪ | Supply chain constraints. Given the high RV retail demand, historically low dealer inventory levels and a global supply chain ramping up to meet the higher demand, while also continuing to manage the impacts of COVID-19 to their own production schedules, we, and the industry, are experiencing various constraints and disruptions within the supply chain in both North America and, to a lesser extent, Europe. This situation is fluid, with specific shortages changing frequently. Managing through peaks and valleys of demand and supply chain constraints are part of the history of our business, and our teams are very experienced in managing through these challenges. Today we are working closely with our supply chain partners to manage production and delivery of the components we need and, where necessary, seeking alternative supply solutions. We are committed to quickly resolving any temporary supply chain issues but also recognize that in the short term we may experience impacts to our production schedules. As we work through these constraints, we have also identified long-term opportunities to work with our supply chain partners to increase efficiencies through initiatives such as stock-keeping unit (SKU) reductions, as well as the ability to expand our supplier base as we help new suppliers recognize the growth potential the RV industry has to offer. |

▪ | COVID-19 operational impacts. THOR has always prioritized employee health and safety and will continue to maintain COVID-19 safety protocols that are in place at every one of our facilities worldwide for as long as necessary. THOR has invested in equipment that disinfects our plants and offices on a regular basis and in personal safety equipment – not only for our employees, but for first responders in many of the communities where are facilities are located. The Company is also supporting and working closely with various health agencies to stay abreast of current developments and support safety protocols and messaging to our employees and the communities where our team members live and work. |

During the quarter, our operations were impacted by COVID-19 primarily by the related supply chain constraints noted above, which led to certain production interruptions.

The extent to which the COVID-19 pandemic may impact our business in future periods remains uncertain and unpredictable. Recently, the rate of COVID-19 infections has again begun to increase in the U.S., Europe and other markets in which we operate and sell our products. Negative impacts to our results of operations, liquidity and financial position, may occur in future periods as a direct or indirect result of the pandemic.

3

▪ | Post-COVID-19 outlook. Recently a number of COVID-19 vaccines were announced that show promise and may be available for use in the coming months. Currently, the timing and impact of these developments remain uncertain. Even when an approved vaccine does reach the market, the Company believes that the RV industry will continue to attract new and repeat consumers in part because the macroeconomic factors underlying the strong demand for RVs that were evident prior to the onset of COVID-19 have remained consistent. People have also shown that they appreciate the long-term value proposition RVs offer – affordability, a vacation in a controlled environment, freedom, quality time with family and friends and outdoor fun. |

We also believe that the desires of consumers to "control their own destinies" and to have safer, socially distanced vacation activities have been factors in driving recent RV demand and will continue to be factors long after a vaccine is made available. In addition, historically, new RV owners that enjoy the RV lifestyle tend to trade in and trade up for a new RV every 3 to 5 years, and children that grow up RVing tend to continue the lifestyle once they have families of their own, so attracting and maintaining this first-time buyer now creates further opportunities for growth for years to come.

Fragen und Antworten

1. | Can you comment on THOR’s North American market share in calendar year 2020? How should we think about THOR's North American market share going forward? |

one. | We carefully monitor and manage our market share, taking several factors into consideration, including the following: |

• • | THOR's wholesale shipment share is improving. Both of our North American segments have gained wholesale shipment share quarter-over-quarter since the pandemic commenced. Our Motorized segment wholesale shipment share increased to 43.4% in the first quarter of fiscal 2021 compared to 38.7% in the fourth quarter of fiscal 2020, and our Towable wholesale segment shipment share increased to 43.6% in the first quarter of fiscal 2021 compared to 43.2% in the fourth quarter of fiscal 2020. |

Given that current demand exceeds supply in the market and many state motor vehicle departments are behind in registering new RVs, we believe recent retail share indicators are not as meaningful as usual. Wholesale shipment share (as a percent of total wholesale shipments) is currently a more accurate proxy for market share growth.

• • | THOR is expanding production capacity to capture further wholesale shipment share gains. Since restarting production, we have retrofitted existing, and added new, production lines to increase capacity within our plant footprint. We will continue to bring additional capacity online in our second and third quarters of fiscal 2021, with modest capital investments, and expect to see continued shipment share gains as we further accelerate production throughput. |

We believe prudent production management is critical in our cyclical industry. Overproducing leads to excess finished goods inventory and increased discounting and promotions which may temporarily increase share, but would also negatively impact the manufacturers' gross margin.

4th

• • | Looking ahead, THOR expects continued wholesale shipment share growth in fiscal 2021. RVIA calendar year 2021 forecast projects an 18.7% increase in wholesale shipments over projected calendar year 2020 wholesale shipments. We agree with their forecast and are fortunate to have the leading portfolio of brands, great strategic relationships with our supplier and dealer base and a record order backlog of approximately $9 billion. |

Through increased production capacity and throughput, superior product offerings, and continued operational excellence, we believe, absent a significant economic impact as a result of COVID-19 or other events, that THOR should meet or exceed RVIA’s forecasted growth and continue to increase its wholesale shipment share.

2. | Can you provide color on recent retail trends? |

one. | In North America, current demand is strong across each of our product categories, but we continue to see outsized demand for entry-level products within our Towable segment and smaller units within our Motorized segment, indicative of first-time buyer trends. We are also seeing demand growth across Europe, with Germany outperforming other European countries. Within Germany, we are seeing strong demand for our motorized campervan products. |

3. | Do you think the increase in new units being sold in North America will lead to an overabundance of used units in the North American market space in the near future? How do used units impact wholesale sales? |

one. | We have consistently viewed a healthy used RV market in North America as an essential ingredient for creating a healthy new RV market. Typically, much of a dealer's used RV inventory is a result of a trade-in for a new unit. In addition, used unit sales are often made to new entrants to the RV lifestyle which will generate future sales of new units if they enjoy the lifestyle. |

All of our independent North American dealers manage their product portfolios based on current market demand and their own internal metrics. Right now, used inventory is either nonexistent or very limited. Looking ahead, we believe any change in used inventory levels in the market space would not materially impact our sales, as we are now operating with an all-time record backlog and dealers are in need of inventory.

4th | THOR's consolidated gross profit margin increased 60 basis points in the first quarter on a year-over-year basis. What drove this improvement? How should we think about gross margins going forward? |

one. | The improvement in consolidated gross profit margin was primarily driven by our North American segments. Total North American gross profit margin increased 110 basis points, from 14.2% in the first quarter of fiscal 2020 to 15.3% in the first quarter of fiscal 2021. North American Towable RV and North American Motorized RV gross profit margins were positively impacted by 1) a reduction in sales discounts, 2) favorable warranty experience trends and 3) lower overhead costs as a percentage of sales as a result of higher production levels and overhead spending controls. These positive impacts were partially offset by higher labor costs due to the current competitive RV labor market conditions in Northern Indiana. |

European recreational vehicle gross profit margin decreased from 13.1% in the first quarter of fiscal 2020 to 12.0% in the first quarter of fiscal 2021, impacted primarily by product mix, with a higher concentration of the motorcaravan and campervan motorized product sales in the current fiscal year. Motorcaravans and campervans carry a higher chassis and material percentage than caravan products and dilute gross profit margins, similar to the margin profile difference that exists between the North American Motorized and North American Towable segments.

5

Regarding future gross margins, we continue to operate in a complex and rapidly evolving environment due to COVID-19 and a high-volume production environment given the strong demand backdrop. As a result, absent significant direct or indirect impacts from COVID-19, including further supply constraints, we expect to see a continuation of 1) cost pressures as labor markets remain tight and competitive across the supply chain, 2) lower year-over-year discounting and promotional sales environment and 3) favorable operating leverage given the high production levels.

As a reminder, our business does not lend itself to meaningful sequential analysis because of varying seasonal demand and production. Due to seasonality within the RV industry and the current COVID-19 pandemic, among other factors, annualizing the results of operations for the three months ended October 31, 2020 would not necessarily be indicative of the results expected for the full fiscal year.

5. | Are you able to recapture higher input costs through selling price increases? |

one. | To the extent we face higher input costs, we have a number of levers available to offset the higher costs. Our flexible production model allows us to quickly respond in terms of decontenting, improving production efficiencies or implementing material sourcing strategies, before raising the selling prices of our units. Other options we can utilize include sourcing lower-cost substitute components, obtaining alternative supply sources or instituting temporary pricing surcharges. |

6th | On a consolidated basis, THOR’s Selling, General and Administrative ("SG&A") expenses improved compared to the prior-year period. What were some of the key factors that led to this improvement during the quarter? How should we think about SG&A expenses going forward? |

one. | Selling, general and administrative expenses for the first quarter of fiscal 2021 decreased by $6.7 million, or 3.6%, compared to the prior-year period. This reduction was primarily due to reduced sales-related travel, advertising and promotional costs in the current year period, largely a result of the cancellation of the major RV shows in North America and in Europe along with travel restrictions due to the COVID-19 pandemic. These savings were partially offset by the impact of higher net sales and income before income taxes across our business segments in both North America and Europe, which caused related commissions, incentive and other compensation to increase. Looking forward, the magnitude of savings realized in the first fiscal quarter from sales-related travel, advertising and promotional costs will not carry forward into the remaining quarters of fiscal year 2021 as the majority of our RV show expenses, especially in Europe, are incurred in the first fiscal quarter. |

We will continue to evaluate the level of SG&A expenses going forward (e.g. travel) in addition to how we allocate dollars (e.g. marketing and promotional costs shifting to digital) as we continually look to optimize our SG&A spend, leverage best practices across our global organization and adjust to current industry and market conditions.

6th

7th | What was THOR's adjusted EBITDA for the first quarter for both fiscal 2021 and 2020? |

one. | Although we do not generally disclose non-GAAP numbers, we recognize that many of the users of our financial statements find a measure of EBITDA adjusted for non-cash or non-routine items to be useful. Below are some items within our financial statements that might be helpful in considering this question: |

Three months ended | ||

Income Before Income Taxes (1) | $ | 146.3 million |

Depreciation & Amortization (2) | 54.2 million | |

Net Interest Expense (1) | 24.0 million | |

Stock-Based Compensation Expense (3) | 5.8 million | |

Change in LIFO Reserve (4) | 1.0 million | |

Three months ended | ||

Income Before Income Taxes (1) | $ | 68.6 million |

Depreciation & Amortization (2) | 50.2 million | |

Net Interest Expense (1) | 27.1 million | |

Stock-Based Compensation Expense (3) | 5.0 million | |

(1) From the Income Statement | (2) From the Business Segments footnote | |||

(3) From the Statement of Cash Flows | (4) From the Inventories footnote |

8th. | What are your cash priorities? |

one. | Our priorities remain consistent with our historical priorities, which are (1) funding our growth, (2) reducing our debt obligations, (3) growing our dividend over time and (4) supporting opportunistic strategic investments, including acquisitions. The Company's Board of Directors may also consider strategic and opportunistic repurchases of shares and special dividends. |

Each quarter of fiscal 2020, we made payments on our debt related to the acquisition of our European operations. During the first quarter of fiscal 2021, we paid approximately $59.7 million on debt related to the acquisition of our European operations. Life-to-date, we have paid approximately $678 million on debt related to the acquisition of our European operations in February of 2019.

9. | What level of capital expenditures do you anticipate in fiscal 2021? |

one. | Capital expenditures for the first quarter of fiscal 2021 amounted to $24.7 million. We anticipate capital expenditures during the remainder of fiscal 2021 to range between $115 million and $125 million. Approximately half of those expenditures are expected to be incurred in North America and half in Europe. Investments in capital expenditures for fiscal 2021 will primarily be for the completion of certain building projects and replacing and upgrading machinery, equipment and other assets throughout our facilities to be used in the ordinary course of business. |

7th

10. | What was THOR's effective tax rate in the first quarter of fiscal 2021? What do you expect THOR's fiscal 2021 effective income tax rate will be? |

one. | The Company's effective income tax rate for the first quarter of fiscal 2021 was 21.0% compared with 24.5% for the first quarter of fiscal 2020. The primary driver of the decrease in the effective tax rate between comparable periods was additional income tax expense in the three months ended October 31, 2019 from the vesting of share-based compensation awards. The Company estimates its effective income tax rate for fiscal 2021 will be between 19% and 22% before consideration of any discrete tax items. The actual effective income tax rate will be dependent upon the mix of foreign and domestic pretax earnings and subject to the impact of foreign currency exchange rates. |

11. | What recent progress has THOR made on its Environmental, Social and Governance ("ESG") initiatives? |

one. | THOR has been making significant strides in our ESG initiatives. Early in our first fiscal quarter of 2021, we engaged Chandria Harris to serve as THOR's Chief People and Inclusion Consultant responsible for overseeing the inclusion strategies for THOR. In early November, we named William J. Kelley, Jr., to our Board of Directors. With his more than 30 years of executive-level experience, he personifies the significant value we place upon corporate governance and risk oversight expertise as well as board refreshment and diversity. Finally, during the quarter we issued our fiscal year 2020 sustainability report. This second annual report formalizes our comprehensive global approach to sustainability. The report is available for download from THOR's website. We believe these efforts to improve our inclusion strategies, diversify our Board of Directors and advance our ESG efforts will have very positive long-term impacts on our business, our shareholders and the broader communities we serve. |

12. | In summary, what is THOR's outlook for fiscal 2021? |

one. | On December 1, 2020, the RVIA updated their most-likely forecast and now expects an increase of 18.7% in calendar 2021 shipments over their most-likely estimate for calendar 2020 shipments. We support their forecast and believe there is potential for upside to this forecast based on current industry conditions. |

While we are optimistic about the outlook for our fiscal year 2021, we are cognizant of the uncertain operating environment due to the COVID-19 pandemic and that the extent to which the pandemic may impact our business in future periods remains uncertain and unpredictable.

8th

Summary of Key Quarterly Segment Data – North American Towable RVs

NET SALES: | Three months ended | Three months ended | % Change | |||||||

North American Towables | ||||||||||

Travel Trailers and Other | $ | 837,900 | $ | 709,665 | 18.1 | %. | ||||

Fifth Wheels | 554,144 | 491,223 | 12.8 | %. | ||||||

Total North American Towables | $ | 1,392,044 | $ | 1,200,888 | 15.9 | %. | ||||

# OF UNITS: | Three months ended | Three months ended | % Change | |||||||

North American Towables | ||||||||||

Travel Trailers and Other | 39,077 | 32,520 | 20.2 | %. | ||||||

Fifth Wheels | 11,264 | 10,345 | 8.9 | %. | ||||||

Total North American Towables | 50,341 | 42,865 | 17.4 | %. | ||||||

ORDER BACKLOG | From | From | % Change | |||||||

North American Towables | $ | 4,397,713 | $ | 1,067,023 | 312.1 | %. | ||||

TOWABLE RV MARKET SHARE SUMMARY (1) | CYTD September 30, | |||||||||

2020 | 2019 | |||||||||

U.S. Market | 41.6 | %. | 45.0 | %. | ||||||

Canadian Market | 47.4 | %. | 50.1 | %. | ||||||

Combined North American Market | 42.1 | %. | 45.6 | %. | ||||||

(1) Source: Statistical Surveys, Inc. CYTD September 30, 2020 vs. CYTD September 30, 2019

Note: Data reported by Stat Surveys is based on official state and provincial records. This information is subject to adjustment, is continuously updated, and is often impacted by delays in reporting by various states or provinces. The COVID-19 pandemic has resulted in further delays in the submission of information reported by the various states or provinces beginning with calendar 2020 results, and may also be impacting the completeness of such information.

9

Summary of Key Quarterly Segment Data – North American Motorized RVs

NET SALES: | Three months ended | Three months ended | % Change | |||||||

North American Motorized | ||||||||||

Class A | $ | 158,555 | $ | 161,732 | (2.0) | %. | ||||

Class C | 275,399 | 229,837 | 19.8 | %. | ||||||

Class B | 59,901 | 24,320 | 146.3 | %. | ||||||

Total North American Motorized | $ | 493,855 | $ | 415,889 | 18.7 | %. | ||||

# OF UNITS: | Three months ended | Three months ended | % Change | |||||||

North American Motorized | ||||||||||

Class A | 1,168 | 1,250 | (6.6) | %. | ||||||

Class C | 3,464 | 3,041 | 13.9 | %. | ||||||

Class B | 535 | 199 | 168.8 | %. | ||||||

Total North American Motorized | 5,167 | 4,490 | 15.1 | %. | ||||||

ORDER BACKLOG | From | From | % Change | |||||||

North American Motorized | $ | 2,215,069 | $ | 669,978 | 230.6 | %. | ||||

MOTORIZED RV MARKET SHARE SUMMARY (1) | CYTD September 30, | |||||||||

2020 | 2019 | |||||||||

U.S. Market | 38.2 | %. | 37.3 | %. | ||||||

Canadian Market | 44.3 | %. | 39.2 | %. | ||||||

Combined North American Market | 38.5 | %. | 37.4 | %. | ||||||

(1) Source: Statistical Surveys, Inc. CYTD September 30, 2020 vs. CYTD September 30, 2019

Note: Data reported by Stat Surveys is based on official state and provincial records. This information is subject to adjustment, is continuously updated and is often impacted by delays in reporting by various states or provinces. The COVID-19 pandemic has resulted in further delays in the submission of information reported by the various states or provinces beginning with calendar 2020 results, and may also be impacting the completeness of such information.

10

Summary of Key Quarterly Segment Data – European RVs

NET SALES: | Three months ended | Three months ended | % Change | |||||||

europäisch | ||||||||||

Motorcaravan | $ | 318,343 | $ | 281,733 | 13.0 | %. | ||||

Campervan | 143,400 | 77,597 | 84.8 | %. | ||||||

Caravan | 55,195 | 61,032 | (9.6) | %. | ||||||

Other | 85,550 | 72,645 | 17.8 | %. | ||||||

Total European | $ | 602,488 | $ | 493,007 | 22.2 | %. | ||||

# OF UNITS: | Three months ended | Three months ended | % Change | |||||||

europäisch | ||||||||||

Motorcaravan | 5,383 | 5,510 | (2.3) | %. | ||||||

Campervan | 4,277 | 2,631 | 62.6 | %. | ||||||

Caravan | 2,566 | 3,146 | (18.4) | %. | ||||||

Total European | 12,226 | 11,287 | 8.3 | %. | ||||||

ORDER BACKLOG | From | From | % Change | |||||||

europäisch | $ | 2,308,472 | $ | 1,292,063 | 78.7 | %. | ||||

EUROPEAN RV MARKET SHARE SUMMARY (1) | CYTD September 30, | |||||||||

2020 | 2019 (3) | |||||||||

Motorcaravan and Campervan (2) | 26.2 | %. | 25.7 | %. | ||||||

Caravan | 20.6 | %. | 21.1 | %. | ||||||

(1) Source: European Caravan Federation ("ECF"), CYTD September 30, 2020 vs. CYTD September 30, 2019. Data from the ECF is subject to adjustment, continuously updated and is often impacted by delays in reporting by various countries (some countries, including the United Kingdom, do not report OEM-specific data and are thus excluded from the market share calculation).

(2) The ECF reports motorcaravans and campervans together.

(3) For comparison purposes, the totals reflected above include the pre-acquisition results of Erwin Hymer Group for January 2019.

Note: Industry wholesale shipment data for the European RV market is not available.

11

Forward-Looking Statements

This release includes certain statements that are “forward-looking” statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks. These forward-looking statements are not a guarantee of future performance. We cannot assure you that actual results will not differ materially from our expectations. Factors which could cause materially different results include, among others: the extent and impact from the continuation of the COVID-19 pandemic, along with the responses to contain the spread of the virus by various governmental entities or other actors, which may have negative effects on retail customer demand, our independent dealers, our supply chain, our production or other aspects of our business and which may have a negative impact on our consolidated results of operations, financial position, cash flows and liquidity; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share; the effect of raw material and commodity price fluctuations, and/or raw material, commodity or chassis supply constraints; the impact of tariffs on material or other input costs; the level and magnitude of warranty claims incurred; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers; the costs of compliance with governmental regulation; legal and compliance issues including those that may arise in conjunction with recently completed transactions; lower consumer confidence and the level of discretionary consumer spending; interest rate fluctuations and their potential impact on the general economy and specifically on our dealers and consumers; the impact of exchange rate fluctuations; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers; management changes; the success of new and existing products and services; the ability to efficiently utilize existing production facilities; changes in consumer preferences; the risks associated with acquisitions, including: the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production and increasing labor costs to attract production personnel in times of high demand; the loss or reduction of sales to key dealers; disruption of the delivery of units to dealers; increasing costs for freight and transportation; asset impairment charges; cost structure changes; competition; the impact of potential losses under repurchase or financed receivable agreements; the potential impact of the strength of the U.S. dollar on international demand for products priced in U.S. dollars; general economic, market and political conditions in the various countries in which our products are produced and/or sold; the impact of changing emissions and other regulatory standards in the various jurisdictions in which our products are produced and/or sold; changes to our investment and capital allocation strategies or other facets of our strategic plan; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt.

These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2020 and in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2020.

We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this release or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law.

12