Receive instant notifications when there is news about your stocks. Request your one-week free trial of StreetInsider Premium here.

UNITED STATES

SECURITIES AND BILLS COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT FROM

REGISTERED

MANAGEMENT INVESTMENT COMPANIES

File number of the Investment Company Act:

811-02958

| T. Rowe Price International Funds, Inc. |

| (Exactly Name of registrant as indicated in the charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of the main offices) |

| David Austrians |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Surname and address of the agent for the service) |

Registrant phone number, including area code: (410) 345-2000

Fiscal year end date: December 31st

Date of the reporting period: June 30, 2021

Item 1. Reports to the shareholders

(a) Report under Rule 30e-1.

Global industrial fund | June 30, 2021 |

| role playing game | Investor class |

| TRGAX | i class |

| T. ROWE PRICE GLOBAL INDUSTRIALS FUND |

HIGHLIGHTS

| ■ | The Global Industrials Fund had positive results for the six months ended June 30, 2021, but lagged its benchmark slightly. |

| ■ | The Fund's positioning in the electrical equipment segment of the industrial sector detracted from relative performance, while the portfolio's road and rail holdings added in value. |

| ■ | Our largest purchases during the period were in companies that we believe will be able to benefit from rising demand for commercial aviation, parcel delivery and factory automation. |

| ■ | We believe that the beginning of a new business cycle offers a favorable environment for industrial companies. |

Sign in to your account at troweprice.com for more informations.

* Certain mutual fund accounts that have an annual service fee can also save money by moving to electronic delivery.

CIO market commentary

Dear Shareholder

Global equity markets posted strong returns in the first half of 2021, while rising returns weighed on returns in some bond sectors. Investor sentiment was fueled by the reopening of developed market economies, unprecedented fiscal and monetary stimulus, and expectations that the economy would benefit from an alleviation of the demand congestion.

All major global and regional equity benchmarks posted positive results over the period. Developed market stocks generally outperformed emerging markets, while US small cap stocks outperformed large caps and value outperformed growth. The large cap S&P 500 index returned 15% and ended the period on a record high. The worst performing energy sector in 2020 led the way over the six month period on a sharp rise in oil prices. Financials were also strong as banks benefited from an increase in long-term interest rates while the real estate sector was helped by a lift in many of the pandemic restrictions. Utilities underperformed with slight increases.

Fiscal and monetary support remained an important factor in creating a positive environment for the markets. President Joe Biden signed the American Rescue Plan Act for $ 1.9 trillion in March, and the Federal Reserve kept its short-term lending rates near zero. However, given the strong economic growth, central bank policymakers revised their outlook in a slightly less cautious direction towards the end of the period, suggesting that rate hikes could begin in 2023, which was earlier than previously expected.

The economic recovery was reflected in a large number of indicators. According to the latest estimate, U.S. gross domestic product grew at an annualized rate of 6.4% in the first quarter of 2021, after growing 4.3% in the fourth quarter of 2020. Weekly jobless claims hit new pandemic-era lows throughout the period back, although the monthly outside farm payroll report sometimes disappointed as employers struggled to fill positions. Meanwhile, according to FactSet, total earnings for companies in the S&P 500 rose nearly 53% year over year in the first quarter – the best since late 2009.

However, concerns about inflation led to a certain degree of volatility in the stock market, which was less favorable, and caused yields on longer-term government bonds to rise sharply in the first quarter. (Bond prices and yields are moving in opposite directions.) For example, while inflation metrics were above the Fed's long-term inflation target of 2% towards the end of our period, consumer prices in core markets saw their largest annual increase (3.8%) since May 1992 – Investors appeared to accept the Fed's determination that rising price pressures were due to temporary factors related to the reopening of the global economy.

Longer-term government bond yields trended lower as inflation expectations eased later in the period, but still ended significantly higher than late 2020. Rising yields have been a headwind for many bond investors; However, high yield bonds, which are less sensitive to changes in interest rates, performed solidly, and investment grade corporate bonds also performed well on solid corporate fundamentals.

Looking ahead, assuming the economy continues to recover from the pandemic, the key question for investors is whether returns on financial assets will be just as robust. Valuations are up in almost all asset classes and there are clear signs of speculation in some areas. However, a changed global economic landscape brings with it both potential opportunities and risks. Post-pandemic trends have the potential to produce both winners and losers, giving active portfolio managers more leeway to generate excess returns. It's not an easy environment to invest in, but our investment teams remain rooted in company fundamentals and long-term oriented. You will continue to use strong fundamental analysis to find the best investments for your portfolio.

Thank you for your continued trust in T. Rowe Price.

Sincere,

Robert Sharps

Group Chief Investment Officer

Management's explanations on fund performance

INVESTMENT OBJECTIVE

The fund seeks long-term capital growth.

FUND COMMENTARY

How has the fund performed over the past six months?

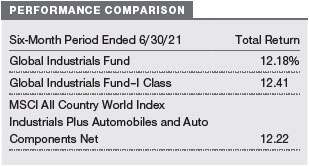

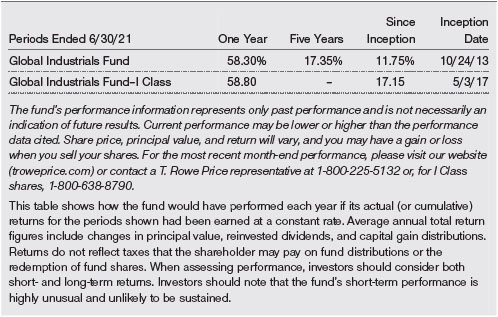

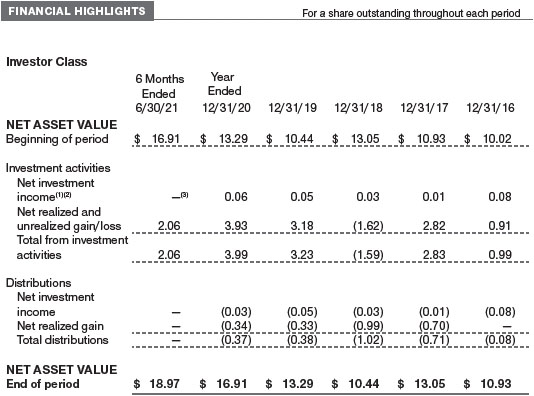

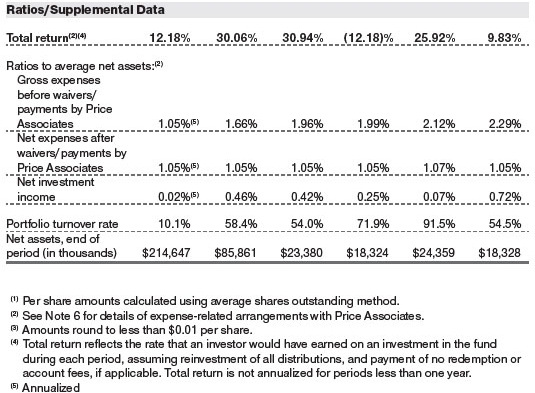

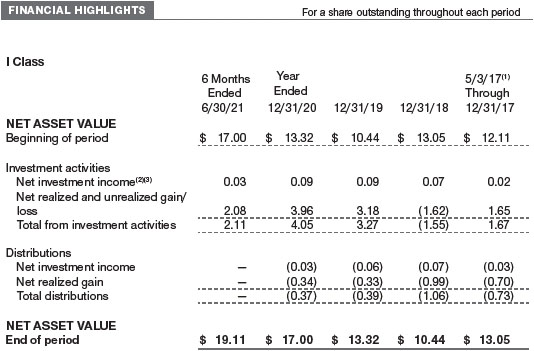

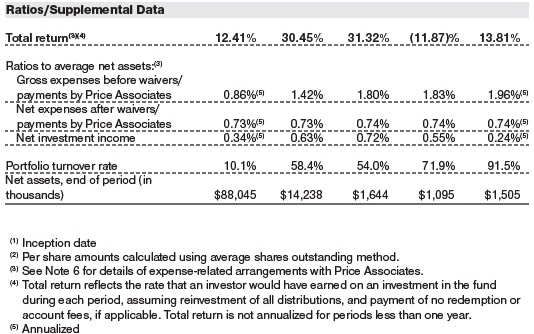

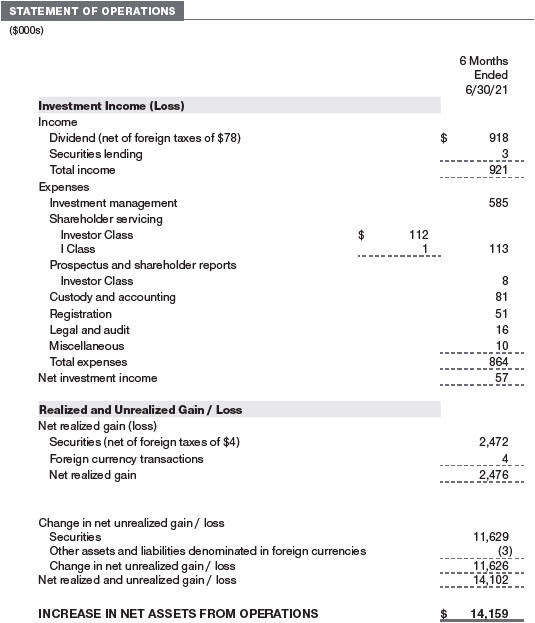

The T. Rowe Price Global Industrials Fund returned 12.18% for the six months ended June 30, 2021, slightly below the benchmark MSCI All Country World Index Industrials Plus Automobiles and Auto Components Net, which was 12.22 % paid off. (The results for Class I Shares varied slightly, reflecting their different fee structure. Past performance cannot guarantee future results.)

What factors influenced the fund's performance?

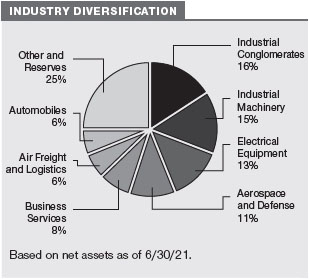

Industrials posted solid gains in the first half of 2021, with strong early year results making up most of the gains. The introduction of coronavirus vaccines, strong economic growth and steepening the yield curve provided a favorable environment for the sector. However, signs of a peak in growth and the spread of COVID-19 variants led to subdued gains in the second quarter. Within the portfolio, stock selection in electrical appliances, construction & agricultural machinery, and durable household goods weighed on relative performance, while stock selection in road & rail, business services, and aerospace & defense were beneficial.

In the electrical equipment segment, our position in Alstom, a global provider of railway equipment and services, detracted from performance in the electrical equipment segment. The company recently bought Bombardier's rail division and discovered some incremental challenges in the program that will weigh on short-term operating margins. Our position in circuit protection and sensor manufacturer Littelfuse also underperformed. The company reported solid results over the period, but its stock was largely unchanged after posting strong gains in the second half of 2020.

Among our positions in the construction and agricultural machinery category, shares in construction and mining equipment maker Komatsu delivered disappointing results. The company faced headwinds from peak raw material prices and other macro factors.

In the consumer goods segment, the Chinese air conditioning manufacturer Gree Electric Appliances Inc. from Zhuhai underperformed. We believe the company has significant potential, but it struggled in transitioning from a state-owned company to a traditional corporate structure. During the period, investors reacted negatively to the company's introduction of a new equity incentive program.

On the plus side, Kansas City Southern was our largest contributor in the road and rail category. Railroad shares rose nearly 40% over the period after receiving a $ 33.6 billion tender offer from the Canadian National Railroad. After the strong price gains, we reduced our position. Diversified transportation company JB Hunt Transport Services also performed well. JB Hunt achieved a better than expected result despite the bad weather in February that weighed on volume in the Intermodal category.

Ashtead, a London-based equipment rental company operating in the United States through its subsidiary Sunbelt, was our largest contributor in the Business Services segment. The company continued to gain market share and management raised earnings forecasts. Avery Dennison, which makes labels and other materials for the industrial and healthcare sectors, also posted solid gains. The company experienced strong growth in all of its business areas. We closed our position in the stock as valuations became less attractive.

In the aerospace and defense sectors, Textron and Airbus led the way. Textron reported better than expected results and raised earnings guidance as demand for its business jets was strong. Aircraft manufacturer Airbus also performed well, given a solid earnings report and a more positive outlook from management.

Our general underweight in the automotive segment and a lack of exposure to Tesla, the biggest name in the subsector, also contributed to portfolio performance. Tesla shares lost ground over the period on weaker core earnings.

How is the fund set up?

In managing the fund, we mainly focus on investing in stocks where our research process gives us a differentiated proposition from the broader market and where we can identify a path for a company to outperform. We also look at factors such as management quality; technological skills; and environmental, social and governance (ESG) considerations. Since our last report, we've made our largest purchases in companies that we believe will be able to capitalize on growing demand for commercial aviation, package delivery, and factory automation.

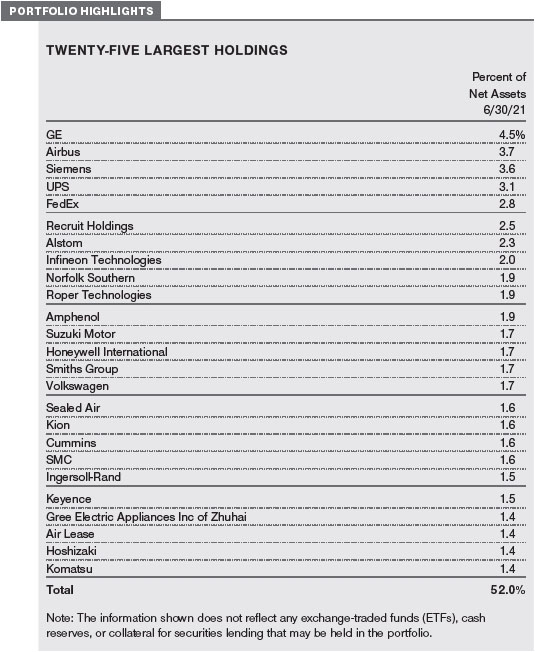

GE, our largest purchase in the last six months and the fund's largest holding, is an industrial conglomerate facing increasing demand for air travel through its aviation division. We believe the company could do well in a variety of macro scenarios, and easing concerns about its pension and insurance liabilities could help.

During the period we also added Airbus, the second largest position in the portfolio. We believe the market is underestimating the aircraft manufacturer's market share gains over the past 18 months and the potential for higher profit margins due to cost reductions and other factors. Our positive attitude towards aviation is also reflected in our positioning at Air Lease, which rents commercial aircraft to airlines, and the business jet manufacturer Textron. While the market has been more focused on the backlog in air travel caused by the pandemic, we believe the aviation sector is well positioned for several years of outperformance.

In the parcel delivery business, we opened a position in FedEx and increased our position in UPS. We expect these companies will continue to benefit from the growth in e-commerce.

We have also increased our position at Siemens as we expect the company to benefit from increasing factory automation. Additionally, Siemens' productivity and cost reduction efforts could result in better than expected returns.

We believe that the automotive sector is facing a difficult environment and we have increased our underweight position in this sector. Auto components maker Magna International was our biggest sale of the period after solid gains, and we trimmed our position in automaker Daimler.

North America remained the Fund's largest geographic allocation, accounting for 48% of the portfolio's holdings at the end of the period. Europe was our largest overweight relative to the benchmark at 30% as we believe the region offers high quality industrial companies at relatively cheap valuations along with indirect exposure to emerging markets. We also have a significant allocation in Japan (15%).

What is the outlook for portfolio management?

Looking ahead to the second half of 2021, we assume that the environment for industrials will be favorable. The pandemic has ended a business cycle, and when a new cycle begins, global economies should be supported by fiscal stimulus and expansionary monetary policies.

While overall valuations are less attractive after the strong price gains many stocks have seen over the past year, we continue to find investment opportunities in the industrial sector that we believe will outperform over the long term. Many commercial aerospace and transportation companies will benefit from positive long-term trends, and at the regional level, we believe Europe has a number of world-class companies to offer. Shifts in macroeconomic trends also offer opportunities. For example, we recently invested in several companies that we believe could benefit from slowing commodity inflation.

We will continue to use our fundamental research skills to identify companies that can continue to grow their earnings and to identify stocks with limited upside potential.

Views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change due to market, economic, or other conditions. These views are not predictions of future events and are not guarantees of future results.

RISKS OF INTERNATIONAL INVESTMENT

Funds that invest overseas generally carry a higher risk than funds that invest exclusively in US assets. Funds that invest in a single country or limited geographic area tend to be riskier than more diversified funds. Risks can result from different stages of economic and political development; different regulatory environments, trading days and accounting standards; and higher transaction costs from non-US markets. Non-US investments are also subject to currency risk or depreciation of a foreign currency against the US dollar, which reduces the dollar value of securities denominated in that currency.

The fund is "not diversified"; H. it can invest a larger part of its assets in fewer issuers than is permitted for a “diversified” fund. As a result, a poor performance by a single issuer could have a more negative impact on fund performance than if the fund were invested in a larger number of issuers. Due to the fund's concentration on companies in the industrial sector, its share price will be more volatile than that of more diversified funds.

BENCHMARK INFORMATION

Note: MSCI makes no representations or warranties, express or implied, and accepts no liability whatsoever with respect to the MSCI data contained herein. The MSCI data may not be redistributed or used as a basis for any other index or security or financial product. This report is not approved, reviewed, or produced by MSCI.

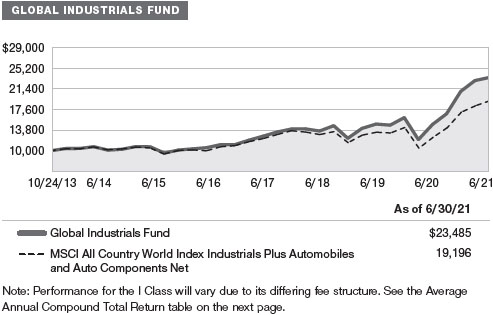

GROWTH OF $ 10,000

This graph shows the value of a hypothetical investment of $ 10,000 in the fund over the past 10 financial years or since inception (for funds with no 10 year records). The result is compared with benchmarks, which contain a broad market index and can also contain a peer group average or index. Market indices do not include expenses that are deducted from fund income, mutual fund averages and indices.

AVERAGE ANNUAL COMPOUND TOTAL RESULT

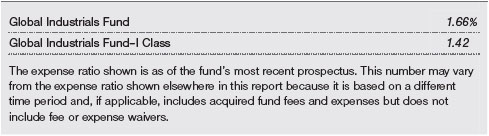

COST RATE

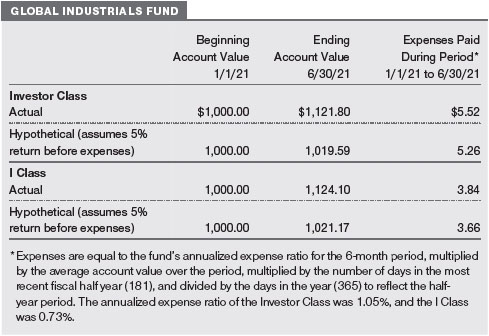

EXAMPLE OF FUND EXPENSES

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales fees, and (2) ongoing costs, including management fees, distribution and service fees (12b-1) and other fund expenses. The following example is provided to help you understand your ongoing costs (in dollars) of investing in the fund and how to compare that cost to the ongoing costs of investing in other mutual funds. The example is based on an investment of $ 1,000 that was invested at the beginning of the last six months and held for the entire period.

Please note that the fund has two share classes: the original share class (investor class) does not charge a sales and service fee (12b-1), and the class I shares are also available for institutional clients and do not charge 12b-1 or management fees Fee payment. Each share class is shown separately in the table.

Actual expenses

The first line of the following table (Actual) provides information about the actual account values and expenses based on the actual income of the fund. You can use the information on this line, along with your balance, to estimate the amount of expenses you have paid over the period. Simply divide your account value by $ 1,000 (e.g. account at that time.

Hypothetical example for comparison purposes

The information in the second line of the table (Hypothetical) is based on hypothetical account values and expenses, which result from the actual expense ratio of the fund and an assumed return of 5% per year before costs (not the actual return of the fund). You can compare the ongoing charges of investing in the Fund to other funds by contrasting this hypothetical 5% example and the hypothetical 5% examples that appear in the other funds' shareholder reports. The hypothetical account values and expenses should not be used to estimate the actual final account balance or the expenses you have paid for the period.

Note: T. Rowe Price charges an annual account service fee of $ 20, generally for accounts less than $ 10,000. The fee is waived for any investor whose accounts with a T. Rowe Price mutual fund have a total value of $ 50,000 or more; Accounts that choose to send bank statements, transaction confirmations, prospectuses and shareholder reports electronically; or accounts of an investor who is a client of T. Rowe Price Personal Services or Enhanced Personal Services (participation in these programs generally requires T. Rowe Price assets of at least $ 250,000). This fee is not included in the attached table. If there is any fee, keep this in mind when assessing the ongoing charges of investing in the fund and comparing the charges of this fund with other funds.

You should also be aware that the expenses listed in the table only highlight your ongoing charges and do not reflect any transaction costs such as redemption fees or sales fees. Therefore, the second line of the table is only useful for comparing ongoing charges and does not help you determine the total relative costs of owning different funds. However, to the extent that a fund has transaction costs, the total cost of owning that fund is higher.

Unchecked

The accompanying notes are an integral part of these annual financial statements.

Unchecked

The accompanying notes are an integral part of these annual financial statements.

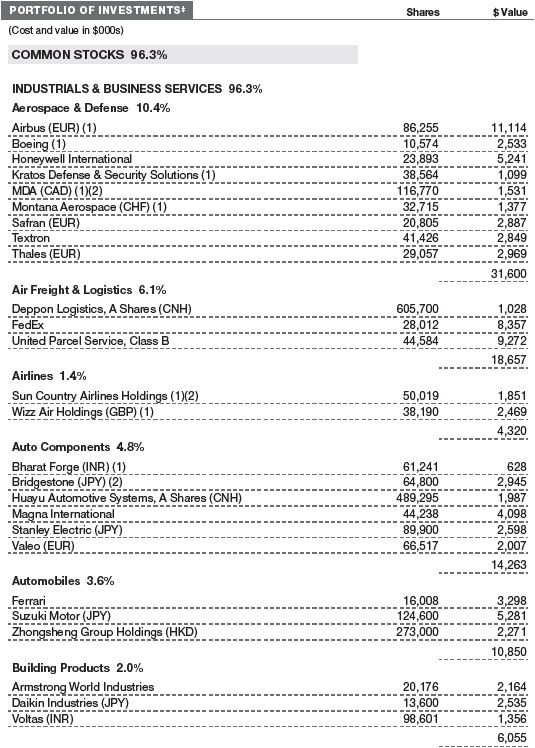

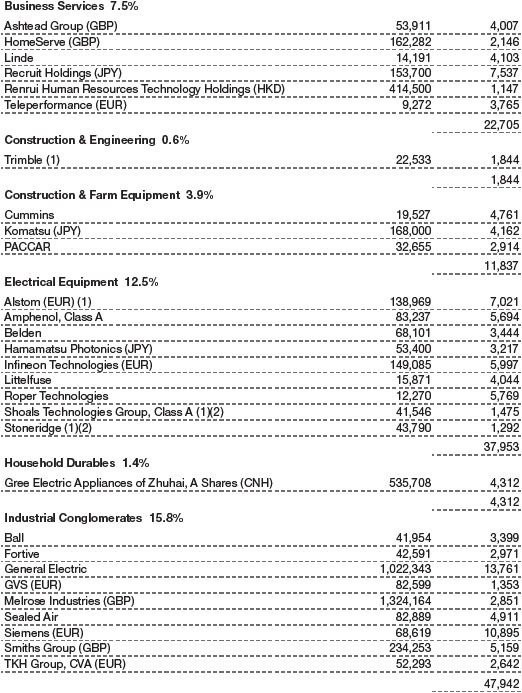

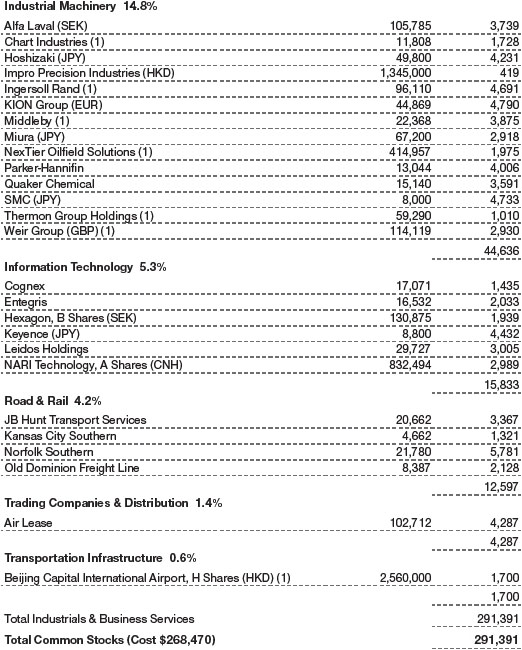

June 30, 2021 (unaudited)

The accompanying notes are an integral part of these annual financial statements.

June 30, 2021 (unaudited)

The accompanying notes are an integral part of these annual financial statements.

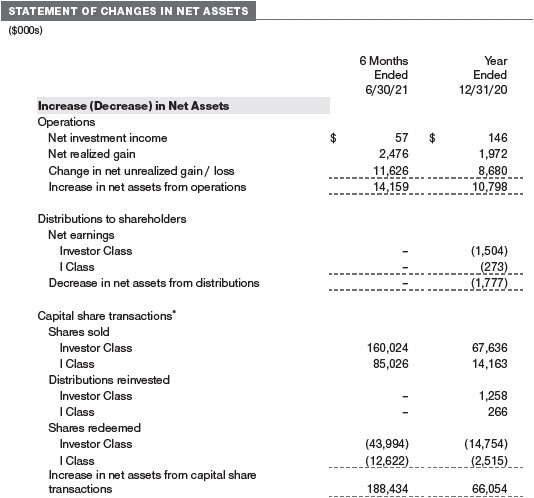

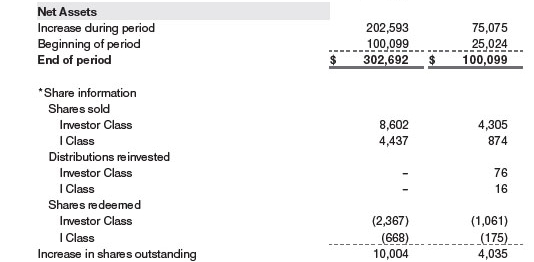

Unchecked

The accompanying notes are an integral part of these annual financial statements.

Unchecked

The accompanying notes are an integral part of these annual financial statements.

Unchecked

| NOTES TO THE FINANCIAL STATEMENTS |

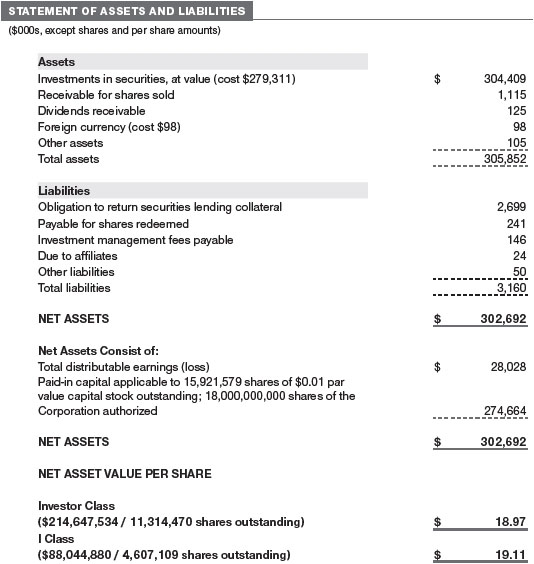

T. Rowe Price International Funds, Inc. (the Company) is registered under the Investment Company Act of 1940. Global Industrials Fund (the Fund) is a non-diversified, open-ended management investment company established by the Company. The fund seeks long-term capital growth. The fund has two share classes: the Global Industrials Fund (investor class) and the Global Industrials Fund – I-class (I-class). Class I Shares require a minimum investment of $ 1 million, although the minimum is waived for retirement plans, financial intermediaries and certain other accounts generally. Each class has exclusive voting rights in matters relating solely to that class; separate voting rights in matters affecting both classes; and otherwise the same rights and duties as the other class.

NOTE 1 – IMPORTANT ACCOUNTING POLICIES

Basis of preparation The fund is an investment company and follows the accounting and reporting guidelines of the Financial Accounting Standards Board (FASB). Codification of accounting standards Subject 946 (ASC 946). The accompanying financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (GAAP) including, but not limited to ASC 946. GAAP requires the use of management estimates. Management believes that estimates and valuations are reasonable; however, actual results could differ from these estimates and the valuations reflected in the accompanying financial statements could differ from final realized values at the time of sale or maturity.

Investment Transactions, Investment Income and Distributions Investment transactions are accounted for on the trading day. Income and expenses are recorded in the appropriate period. Realized gains and losses are reported on the basis of the identified acquisition costs. Income tax interest and penalties, if any, are recognized as income tax expense. Dividends from mutual fund investments are reported as dividend income; Capital gains distributions are reported as realized gain / loss. Dividend income and capital gains distributions are recorded on the ex-dividend date. Any dividends in kind are recorded at the market value of the asset received. Distributions to shareholders are recorded on the ex-dividend date. Income distributions, if any, are declared and paid annually by each class. In addition, the fund can declare and pay out a capital gain distribution annually.

Currency conversion Assets, including investments and liabilities, denominated in foreign currencies are converted into US dollars on a daily basis at the current exchange rate, taking the mean value of the bid and offer rates against these currencies US dollars as provided by an outside pricing service. Purchases and sales of securities, income and expenses are converted into US dollars at the exchange rate prevailing on the day of such transaction. The impact of changes in exchange rates on realized and unrealized gains and losses on securities is not split off from the share attributable to changes in market prices.

Class accounting Shareholder administration costs, the prospectus and the share reports for each class will be charged directly to the class concerned. Both classes of shared expenses, investment income and realized and unrealized gains and losses are allocated to the classes on the basis of the relative daily net assets of each class.

Capital transactions The interest of every investor in the net assets of the fund is represented by fund units. The Fund's Net Asset Value (NAV) per Share is calculated as the New York Stock Exchange (NYSE) closes, normally at 4:00 pm. ET, the NYSE is open for business every day. However, the net asset value per share may be calculated at any time other than the normal NYSE close if trading on the NYSE is restricted, if the NYSE closes earlier or is approved by the SEC. Purchases and redemptions of Fund Shares will be processed upon receipt of the transaction order by T. Rowe Price Associates, Inc. or its agents at the next calculated NAV per Share.

damage payment In the normal course of business, the Fund may make compensation in connection with its officers and directors, service providers and / or investments by private companies. The fund's maximum exposure under these agreements is unknown; However, the risk of material loss is currently assessed to be low.

NOTE 2 – EVALUATION

Fair value The Fund's financial instruments are valued at NYSE closing time and are carried at fair value, which, under GAAP, is the price that would be received for the sale of an asset or paid for the transfer of a liability in an orderly transaction between market participants on the valuation date. The T. Rowe Price Valuation Committee is an internal committee that has been assigned specific duties by the Fund's board of directors (the Board of Directors) to ensure that financial instruments are fair value in accordance with GAAP and 1940. are valued law. Under the supervision of the Board of Directors, the Valuation Committee develops and monitors pricing policies and procedures and approves all fair value determinations. In particular, the Valuation Committee shall establish policies and procedures that will be used in the valuation of financial instruments, including those that cannot be valued according to normal procedures or using price providers; defines pricing techniques, sources and persons authorized to carry out pricing measures at fair value; evaluates the services and performance of the price providers; monitors the pricing process to ensure guidelines are met and procedures are followed; and provides guidance on internal controls and valuation-related matters. The Evaluation Committee reports regularly to the Board of Directors on evaluation matters.

Various valuation techniques and input factors are used to determine the fair value of financial instruments. GAAP defines the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – Quoted prices (unadjusted) on active markets for identical financial instruments that the fund can access on the balance sheet date

Level 2 – parameters other than Level 1 quoted prices that are either directly or indirectly observable (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities and credit spreads)

Stufe 3 – nicht beobachtbare Inputfaktoren (einschließlich der fondseigenen Annahmen bei der Bestimmung des beizulegenden Zeitwerts)

Beobachtbare Inputfaktoren werden anhand von Marktdaten, wie öffentlich zugänglichen Informationen über tatsächliche Ereignisse oder Transaktionen, entwickelt und spiegeln die Annahmen wider, die Marktteilnehmer zur Preisbildung des Finanzinstruments verwenden würden. Nicht beobachtbare Inputfaktoren sind solche, für die keine Marktdaten verfügbar sind und die unter Verwendung der besten verfügbaren Informationen über die Annahmen entwickelt wurden, die Marktteilnehmer zur Bewertung des Finanzinstruments verwenden würden. GAAP erfordert Bewertungstechniken, um die Verwendung relevanter beobachtbarer Parameter zu maximieren und die Verwendung nicht beobachtbarer Parameter zu minimieren. Wenn mehrere Inputfaktoren zur Ableitung des beizulegenden Zeitwerts verwendet werden, wird das Finanzinstrument der Stufe innerhalb der Fair-Value-Hierarchie basierend auf dem niedrigsten Inputfaktor zugeordnet, der für den beizulegenden Zeitwert des Finanzinstruments wesentlich ist. Input-Ebenen sind nicht unbedingt ein Hinweis auf das Risiko oder die Liquidität, die mit Finanzinstrumenten auf dieser Ebene verbunden sind, sondern eher das Maß an Ermessen, das bei der Bestimmung dieser Werte verwendet wird.

Bewertungstechniken Beteiligungspapiere, einschließlich Exchange Traded Funds, die an einer Wertpapierbörse oder im Freiverkehr (OTC) notiert oder regelmäßig gehandelt werden, werden zum letzten notierten Verkaufspreis oder für bestimmte Märkte zum offiziellen Schlusskurs zu diesem Zeitpunkt bewertet die bewertungen erfolgen. Wertpapiere des OTC Bulletin Board werden zum Mittelwert der Schluss- und Briefkurse bewertet. Ein Wertpapier, das an mehr als einer Börse notiert oder gehandelt wird, wird zu der Notierung an der Börse bewertet, die als Primärmarkt für dieses Wertpapier bestimmt ist. Börsennotierte Wertpapiere, die an einem bestimmten Tag nicht gehandelt werden, werden zum Mittelwert aus dem Schlusskurs von Geld- und Briefkursen für inländische Wertpapiere und dem letzten notierten Verkaufs- oder Schlusskurs für internationale Wertpapiere bewertet.

Die zuletzt notierten Kurse von Nicht-US-Aktienpapieren können angepasst werden, um den beizulegenden Zeitwert dieser Wertpapiere zum Börsenschluss der NYSE widerzuspiegeln, wenn der Fonds feststellt, dass Entwicklungen zwischen dem Börsenschluss eines ausländischen Marktes und dem Börsenschluss der NYSE Auswirkungen auf die Wert einiger oder aller Wertpapiere des Portfolios. An jedem Geschäftstag verwendet der Fonds Informationen von externen Preisermittlungsdiensten, um zu bewerten und gegebenenfalls zu entscheiden, ob die notierten Preise angepasst werden müssen, um den beizulegenden Zeitwert widerzuspiegeln Märkte und die Wertentwicklung von Instrumenten, die an US-Märkten gehandelt werden, die ausländische Wertpapiere und Körbe ausländischer Wertpapiere darstellen. Der Fonds nutzt externe Preisermittlungsdienste, um ihm notierte Preise und Informationen zur Bewertung oder Anpassung dieser Preise zur Verfügung zu stellen. Der Fonds kann nicht vorhersagen, wie oft er notierte Preise verwendet und wie oft er eine Anpassung dieser Preise an den beizulegenden Zeitwert für erforderlich hält.

Anlagen in Investmentfonds werden zum Schluss-NIW pro Anteil des Investmentfonds am Bewertungstag bewertet. Vermögenswerte und Verbindlichkeiten, die keine Finanzinstrumente sind, einschließlich kurzfristiger Forderungen und Verbindlichkeiten, werden zu Anschaffungskosten oder dem geschätzten erzielbaren Wert, wenn dieser niedriger ist, der ungefähr dem beizulegenden Zeitwert entspricht, angesetzt.

Anlagen, für die Marktnotierungen oder marktbasierte Bewertungen nicht ohne weiteres verfügbar sind oder als unzuverlässig erachtet werden, werden zum beizulegenden Zeitwert bewertet, wie er vom Bewertungsausschuss nach Treu und Glauben in Übereinstimmung mit den Grundsätzen und Verfahren der beizulegenden Zeitbewertung bestimmt wird. Ziel jeder Ermittlung des beizulegenden Zeitwerts ist es, einen Preis zu ermitteln, der bei einem laufenden Verkauf vernünftigerweise erwartet werden kann. Vom Bewertungsausschuss bewertete Finanzinstrumente sind in erster Linie Privatplatzierungen, gesperrte Wertpapiere, Optionsscheine, Rechte und andere Wertpapiere, die nicht öffentlich gehandelt werden. Die zur Bestimmung des beizulegenden Zeitwerts verwendeten Faktoren variieren je nach Art der Anlage und können markt- oder anlagespezifische Erwägungen beinhalten. Der Bewertungsausschuss wird in der Regel den tatsächlichen Preisen bei Transaktionen zu marktüblichen Bedingungen das größte Gewicht beimessen, sofern sie geordnete Transaktionen zwischen Marktteilnehmern darstellen, Transaktionsinformationen zuverlässig erhalten werden können und die Preise als repräsentativ für den beizulegenden Zeitwert angesehen werden. Der Bewertungsausschuss kann jedoch auch andere Bewertungsmethoden wie marktbasierte Bewertungsmultiplikatoren berücksichtigen; a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the investment. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants.

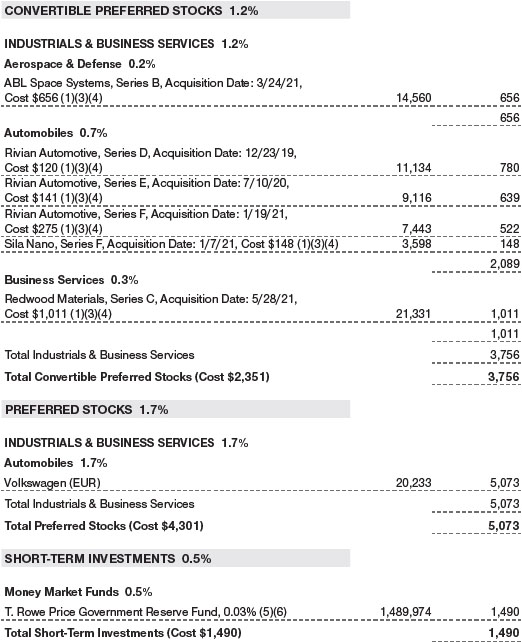

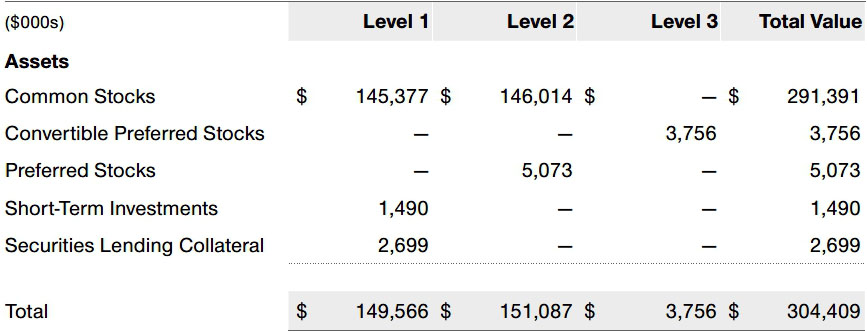

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on June 30, 2021 (for further detail by category, please refer to the accompanying Portfolio of Investments):

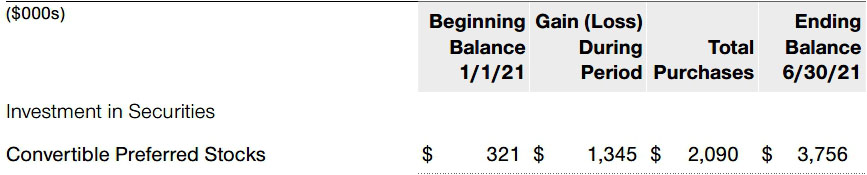

Following is a reconciliation of the fund’s Level 3 holdings for the six months ended June 30, 2021. Gain (loss) reflects both realized and change in unrealized gain/loss on Level 3 holdings during the period, if any, and is included on the accompanying Statement of Operations. The change in unrealized gain/loss on Level 3 instruments held at June 30, 2021, totaled $1,345,000 for the six months ended June 30, 2021.

NOTE 3 – OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund invests in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

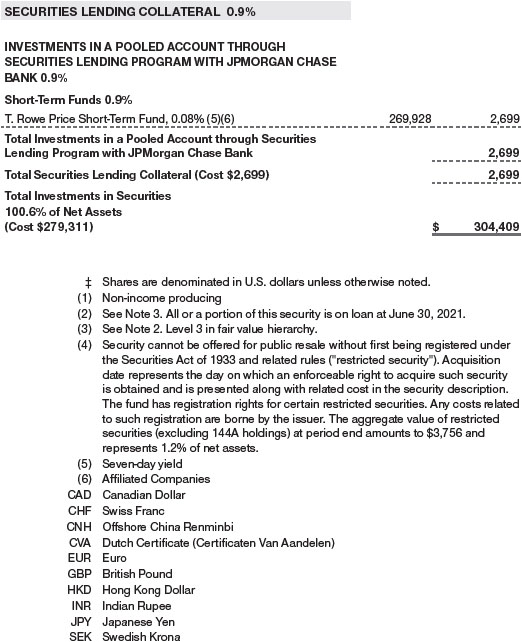

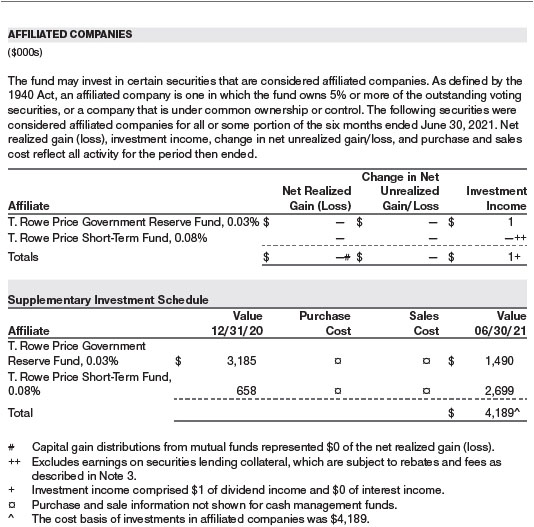

Securities Lending The fund may lend its securities to approved borrowers to earn additional income. Its securities lending activities are administered by a lending agent in accordance with a securities lending agreement. Security loans generally do not have stated maturity dates, and the fund may recall a security at any time. The fund receives collateral in the form of cash or U.S. government securities. Collateral is maintained over the life of the loan in an amount not less than the value of loaned securities; any additional collateral required due to changes in security values is delivered to the fund the next business day. Cash collateral is invested in accordance with investment guidelines approved by fund management. Additionally, the lending agent indemnifies the fund against losses resulting from borrower default. Although risk is mitigated by the collateral and indemnification, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities, collateral investments decline in value, and the lending agent fails to perform. Securities lending revenue consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower, compensation to the lending agent, and other administrative costs. In accordance with GAAP, investments made with cash collateral are reflected in the accompanying financial statements, but collateral received in the form of securities is not. At June 30, 2021, the value of loaned securities was $2,619,000; the value of cash collateral and related investments was $2,699,000.

Others Purchases and sales of portfolio securities other than short-term securities aggregated $206,456,000 and $17,396,000, respectively, for the six months ended June 30, 2021.

NOTE 4 – FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

At June 30, 2021, the cost of investments for federal income tax purposes was $279,781,000. Net unrealized gain aggregated $24,627,000 at period-end, of which $28,806,000 related to appreciated investments and $4,179,000 related to depreciated investments.

NOTE 5 – FOREIGN TAXES

The fund is subject to foreign income taxes imposed by certain countries in which it invests. Additionally, capital gains realized upon disposition of securities issued in or by certain foreign countries are subject to capital gains tax imposed by those countries. All taxes are computed in accordance with the applicable foreign tax law, and, to the extent permitted, capital losses are used to offset capital gains. Taxes attributable to income are accrued by the fund as a reduction of income. Current and deferred tax expense attributable to capital gains is reflected as a component of realized or change in unrealized gain/loss on securities in the accompanying financial statements. To the extent that the fund has country specific capital loss carryforwards, such carryforwards are applied against net unrealized gains when determining the deferred tax liability. Any deferred tax liability incurred by the fund is included in either Other liabilities or Deferred tax liability on the accompanying Statement of Assets and Liabilities.

NOTE 6 – RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.40% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.260% for assets in excess of $845 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. The fee is computed daily and paid monthly. At June 30, 2021, the effective annual group fee rate was 0.28%.

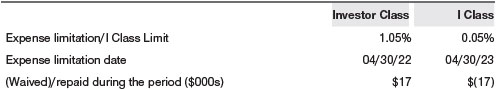

The Investor Class is subject to a contractual expense limitation through the expense limitation date indicated in the table below. During the limitation period, Price Associates is required to waive its management fee or pay any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; and other non-recurring expenses permitted by the investment management agreement) that would otherwise cause the class’s ratio of annualized total expenses to average net assets (net expense ratio) to exceed its expense limitation. The class is required to repay Price Associates for expenses previously waived/paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s net expense ratio (after the repayment is taken into account) to exceed the lesser of: (1) the expense limitation in place at the time such amounts were waived; or (2) the class’s current expense limitation. However, no repayment will be made more than three years after the date of a payment or waiver.

The I Class is also subject to an operating expense limitation (I Class Limit) pursuant to which Price Associates is contractually required to pay all operating expenses of the I Class, excluding management fees; interest; expenses related to borrowings, taxes, and brokerage; and other non-recurring expenses permitted by the investment management agreement, to the extent such operating expenses, on an annualized basis, exceed the I Class Limit. This agreement will continue through the expense limitation date indicated in the table below, and may be renewed, revised, or revoked only with approval of the fund’s Board. The I Class is required to repay Price Associates for expenses previously paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s operating expenses (after the repayment is taken into account) to exceed the lesser of: (1) the I Class Limit in place at the time such amounts were paid; or (2) the current I Class Limit. However, no repayment will be made more than three years after the date of a payment or waiver.

Pursuant to these agreements, expenses were waived/paid by and/or repaid to Price Associates during the six months ended June 30, 2021 as indicated in the table below. Including these amounts, expenses previously waived/paid by Price Associates in the amount of $244,000 remain subject to repayment by the fund at June 30, 2021. Any repayment of expenses previously waived/paid by Price Associates during the period would be included in the net investment income and expense ratios presented on the accompanying Financial Highlights.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates, each an affiliate of the fund (collectively, Price). Price Associates provides certain accounting and administrative services to the fund. T. Rowe Price Services, Inc. provides shareholder and administrative services in its capacity as the fund’s transfer and dividend-disbursing agent. T. Rowe Price Retirement Plan Services, Inc. provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class. For the six months ended June 30, 2021, expenses incurred pursuant to these service agreements were $35,000 for Price Associates; $36,000 for T. Rowe Price Services, Inc.; and less than $1,000 for T. Rowe Price Retirement Plan Services, Inc. All amounts due to and due from Price, exclusive of investment management fees payable, are presented net on the accompanying Statement of Assets and Liabilities.

The fund may invest its cash reserves in certain open-end management investment companies managed by Price Associates and considered affiliates of the fund: the T. Rowe Price Government Reserve Fund or the T. Rowe Price Treasury Reserve Fund, organized as money market funds, or the T. Rowe Price Short-Term Fund, a short-term bond fund (collectively, the Price Reserve Funds). The Price Reserve Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. Cash collateral from securities lending is invested in the T. Rowe Price Short-Term Fund. The Price Reserve Funds pay no investment management fees.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the six months ended June 30, 2021, the fund had no purchases or sales cross trades with other funds or accounts advised by Price Associates.

Effective January 1, 2020, Price Associates has voluntarily agreed to reimburse the fund from its own resources on a monthly basis for the cost of investment research embedded in the cost of the fund’s securities trades. This agreement may be rescinded at any time. For the six months ended June 30, 2021, this reimbursement amounted to $4,000, which is included in Net realized gain (loss) on Securities in the Statement of Operations.

NOTE 7 – OTHER MATTERS

Unpredictable events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases, and similar public health threats may significantly affect the economy and the markets and issuers in which a fund invests. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others, and exacerbate other pre-existing political, social, and economic risks. During 2020, a novel strain of coronavirus (COVID-19) resulted in disruptions to global business activity and caused significant volatility and declines in global financial markets.

These types of events, such as the global pandemic caused by COVID-19, may also cause widespread fear and uncertainty, and result in, among other things: enhanced health screenings, quarantines, cancellations, and travel restrictions, including border closings; disruptions to business operations and supply chains and customer activity; exchange trading suspensions and closures, and overall reduced liquidity of securities, derivatives, and commodities trading markets; reductions in consumer demand and economic output; and significant challenges in healthcare service preparation and delivery. The fund could be negatively impacted if the value of a portfolio holding were harmed by such political or economic conditions or events. In addition, the operations of the fund, its investment advisers, and the fund’s service providers may be significantly impacted, or even temporarily halted, as a result of any impairment to their information technology and other operation systems, extensive employee illnesses or unavailability, government quarantine measures, and restrictions on travel or meetings and other factors related to public emergencies.

Governmental and quasi-governmental authorities and regulators have in the past responded to major economic disruptions with a variety of significant fiscal and monetary policy changes, including but not limited to, direct capital infusions into companies, new monetary programs, and dramatically lower interest rates. An unexpected or quick reversal of these policies, or the ineffectiveness of these policies, could negatively impact overall investor sentiment and further increase volatility in securities markets.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS

A description of the policies and procedures used by T. Rowe Price funds to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www.troweprice.com/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s reports on Form N-PORT are available electronically on the SEC’s website (sec.gov). In addition, most T. Rowe Price funds disclose their first and third fiscal quarter-end holdings on troweprice.com.

APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT

Each year, the fund’s Board of Directors (Board) considers the continuation of the investment management agreement (Advisory Contract) between the fund and its investment advisor, T. Rowe Price Associates, Inc. (Advisor). In that regard, at a meeting held on March 8–9, 2021 (Meeting), the Board, including all of the fund’s independent directors, approved the continuation of the fund’s Advisory Contract. At the Meeting, the Board considered the factors and reached the conclusions described below relating to the selection of the Advisor and the approval of the Advisory Contract. The independent directors were assisted in their evaluation of the Advisory Contract by independent legal counsel from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, the Advisor was guided by a detailed set of requests for information submitted by independent legal counsel on behalf of the independent directors. In considering and approving the Advisory Contract, the Board considered the information it believed was relevant, including, but not limited to, the information discussed below. The Board considered not only the specific information presented in connection with the Meeting but also the knowledge gained over time through interaction with the Advisor about various topics. The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the T. Rowe Price funds’ advisory contracts, including performance and the services and support provided to the funds and their shareholders.

Services Provided by the Advisor

The Board considered the nature, quality, and extent of the services provided to the fund by the Advisor. These services included, but were not limited to, directing the fund’s investments in accordance with its investment program and the overall management of the fund’s portfolio, as well as a variety of related activities such as financial, investment operations, and administrative services; compliance; maintaining the fund’s records and registrations; and shareholder communications. The Board also reviewed the background and experience of the Advisor’s senior management team and investment personnel involved in the management of the fund, as well as the Advisor’s compliance record. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Advisor.

Investment Performance of the Fund

The Board took into account discussions with the Advisor and reports that it receives throughout the year relating to fund performance. In connection with the Meeting, the Board reviewed the fund’s net annualized total returns for the one-, two-, three-, four-, and five-year periods as of September 30, 2020, and compared these returns with the performance of a peer group of funds with similar investment programs and a wide variety of other previously agreed-upon comparable performance measures and market data, including those supplied by Broadridge, which is an independent provider of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Advisor under the Advisory Contract and other direct and indirect benefits that the Advisor (and its affiliates) may have realized from its relationship with the fund. In considering soft-dollar arrangements pursuant to which research may be received from broker-dealers that execute the fund’s portfolio transactions, the Board noted that the Advisor bears the cost of research services for all client accounts that it advises, including the T. Rowe Price funds. The Board received information on the estimated costs incurred and profits realized by the Advisor from managing the T. Rowe Price funds. While the Board did not review information regarding profits realized from managing the fund in particular because the fund had either not achieved sufficient portfolio asset size or not recognized sufficient revenues to produce meaningful profit margin percentages, the Board concluded that the Advisor’s profits were reasonable in light of the services provided to the T. Rowe Price funds.

The Board also considered whether the fund benefits under the fee levels set forth in the Advisory Contract from any economies of scale realized by the Advisor. Under the Advisory Contract, the fund pays a fee to the Advisor for investment management services composed of two components—a group fee rate based on the combined average net assets of most of the T. Rowe Price funds (including the fund) that declines at certain asset levels and an individual fund fee rate based on the fund’s average daily net assets—and the fund pays its own expenses of operations (subject to a contractual expense limitation). The Board concluded that the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees and Expenses

The Board was provided with information regarding industry trends in management fees and expenses. Among other things, the Board reviewed data for peer groups that were compiled by Broadridge, which compared: (i) contractual management fees, total expenses, actual management fees, and nonmanagement expenses of the Investor Class of the fund with a group of competitor funds selected by Broadridge (Expense Group) and (ii) total expenses, actual management fees, and nonmanagement expenses of the Investor Class of the fund with a broader set of funds within the Lipper investment classification (Expense Universe). The Board considered the fund’s contractual management fee rate, actual management fee rate (which reflects the management fees actually received from the fund by the Advisor after any applicable waivers, reductions, or reimbursements), operating expenses, and total expenses (which reflect the net total expense ratio of the fund after any waivers, reductions, or reimbursements) in comparison with the information for the Broadridge peer groups. Broadridge generally constructed the peer groups by seeking the most comparable funds based on similar investment classifications and objectives, expense structure, asset size, and operating components and attributes and ranked funds into quintiles, with the first quintile representing the funds with the lowest relative expenses and the fifth quintile representing the funds with the highest relative expenses, although there were not sufficient funds in the Expense Group to meaningfully rank within quintiles. The information provided to the Board indicated that the fund’s contractual management fee ranked third out of four funds (Expense Group), the fund’s actual management fee rate ranked first out of four funds (Expense Group) and in the first quintile (Expense Universe), and the fund’s total expenses ranked second and third out of four funds (Expense Group) and in the third and fourth quintiles (Expense Universe).

The Board also reviewed the fee schedules for other investment portfolios with similar mandates that are advised or subadvised by the Advisor and its affiliates, including separately managed accounts for institutional and individual investors; subadvised funds; and other sponsored investment portfolios, including collective investment trusts and pooled vehicles organized and offered to investors outside the United States. Management provided the Board with information about the Advisor’s responsibilities and services provided to subadvisory and other institutional account clients, including information about how the requirements and economics of the institutional business are fundamentally different from those of the proprietary mutual fund business. The Board considered information showing that the Advisor’s mutual fund business is generally more complex from a business and compliance perspective than its institutional account business and considered various relevant factors, such as the broader scope of operations and oversight, more extensive shareholder communication infrastructure, greater asset flows, heightened business risks, and differences in applicable laws and regulations associated with the Advisor’s proprietary mutual fund business. In assessing the reasonableness of the fund’s management fee rate, the Board considered the differences in the nature of the services required for the Advisor to manage its mutual fund business versus managing a discrete pool of assets as a subadvisor to another institution’s mutual fund or for an institutional account and that the Advisor generally performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price funds than it does for institutional account clients, including subadvised funds.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract

As noted, the Board approved the continuation of the Advisory Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund and its shareholders for the Board to approve the continuation of the Advisory Contract (including the fees to be charged for services thereunder).

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

There has been no change to the procedures by which shareholders may recommend nominees to the

registrant’s board of directors.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change

in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR

is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934 and the Investment Company Act of 1940, the

registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

T. Rowe Price International Funds, Inc.

| By | /s/ David Oestreicher | |||||

| David Oestreicher | ||||||

| Principal Executive Officer | ||||||

| Date | August 17, 2021 | |||||

Pursuant to the requirements of the

Securities Exchange Act of 1934 and the Investment Company Act of 1940, this

report has been signed below by the following persons on behalf of the

registrant and in the capacities and on the dates indicated.

| By | /s/ David Oestreicher | |||||

| David Oestreicher | ||||||

| Principal Executive Officer | ||||||

| Date | August 17, 2021 | |||||

| By | /s/ Alan S. Dupski | |||||

| Alan S. Dupski | ||||||

| Principal Financial Officer | ||||||

| Date | August 17, 2021 | |||||

Item 13. (a)(2)

CERTIFICATIONS

I, David Oestreicher, certify that:

| 1. | I have reviewed this report on Form N-CSR of T. Rowe Price Global Industrials Fund; | |||

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; | |||

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if the financial statements are required to include a statement of cash flows) of the registrant as of, and for, the periods presented in this report; | |||

| 4. | The registrant's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in rule 30a-3(c) under the Investment Company Act of 1940) and internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the registrant and have: | |||

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; | |||

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; | |||

| (c) | Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing date of this report based on such evaluation; and | |||

| (d) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and | |||

| 5. | The registrant's other certifying officer(s) and I have disclosed to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): | |||

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize, and report financial information; and | |||

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. | |||

| Date: August 17, 2021 | /s/ David Oestreicher |

| David Oestreicher | |

| Principal Executive Officer |

CERTIFICATIONS

I, Alan S. Dupski, certify that:

| 1. | I have reviewed this report on Form N-CSR of T. Rowe Price Global Industrials Fund; | |||

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; | |||

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if the financial statements are required to include a statement of cash flows) of the registrant as of, and for, the periods presented in this report; | |||

| 4. | The registrant's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in rule 30a-3(c) under the Investment Company Act of 1940) and internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the registrant and have: | |||

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; | |||

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; | |||

| (c) | Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing date of this report based on such evaluation; and | |||

| (d) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and | |||

| 5. | The registrant's other certifying officer(s) and I have disclosed to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): | |||

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize, and report financial information; and | |||

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. | |||

| Date: August 17, 2021 | /s/ Alan S. Dupski |

| Alan S. Dupski | |

| Principal Financial Officer |

Item 13. (b)

| CERTIFICATION UNDER SECTION 906 OF SARBANES-OXLEY ACT OF 2002 | ||

| Name of Issuer: T. Rowe Price Global Industrials Fund | ||

| In connection with the Report on Form N-CSR for the above named Issuer, the undersigned hereby certifies, to the best of his knowledge, that: | ||

| 1. | The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; | |

| 2. | The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Issuer. | |

| Date: August 17, 2021 | /s/ David Oestreicher |

| David Oestreicher | |

| Principal Executive Officer | |

| Date: August 17, 2021 | /s/ Alan S. Dupski |

| Alan S. Dupski | |

| Principal Financial Officer | |