In terms of taxation in Thailand, income derived from an employment in Thailand is considered as a taxable income under `Source of Income‘ rules. Any foreign employee who receives income from the employment in Thailand is required to pay personal income tax in Thailand by filing an annual personal income tax return to the Thai Revenue Department (TRD) within the end of March of the following year. In the meantime, the employer is also required to withhold certain amount of tax from the wages payable to the employee and file monthly withholding tax return to the TRD and remit the tax so withheld.

For your information, apart from the requirements under the source of income rules, Thailand also adopts `Tax Resident’ rules for personal income tax purposes i.e. a person staying in Thailand from 180 days in a particular year will have to pay Thai tax on their foreign source income if in that year they bring the foreign source income which is derived in the same year into Thailand. However, at present `Nationality‘ rules are still absent.

From our experiences, we noticed that mistakes affecting legal and tax repeatedly arise from miscalculation of taxable income of the employee which leads to additional tax payment and criminal penalties for both employer and employee. In addition, legal compliance could be tricky when it comes to bringing a foreigner to work in Thailand. Both employer and employee may find themselves in a big trouble where a fine payment and imprisonment are awaiting ahead.

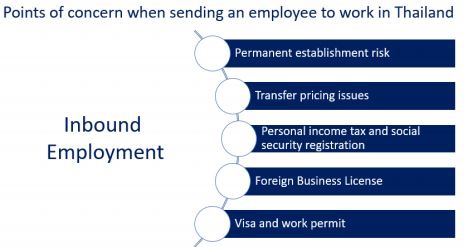

This article covers issues related to the employment of foreign employees and a dual employment contract (secondment) where an offshore parent company assigns its employee to work under an employment of its Thai subsidiary while still retaining the offshore employment status. Indeed, the TRD tends to scrutinise heavily on such employment arrangement to ensure the proper tax compliance. On the legal side, the authorities do not compromise as well when it comes to violation of Alien Working Law.

Mistake No. 1 Fixing corporate currency exchange rate

Wages can be agreed to be paid to the employees in any currencies, but it is required to be converted into Thai Baht for Thai tax computation. The conversion must be done using the exchange rate at the transaction date based on the rate provided by the Bank of Thailand or the average rate quoted by commercial banks in Thailand.

From our experiences, we found that many multinational companies fix annual currency rates for transactions among the group. Such fixed rates of currency (e.g. US Dollar) is also used in payroll for the employees of the group companies who are seconded to work outside their countries. By not using the proper exchange rates, it is likely to create tax exposures for both Thai employer and foreign employee. As a result, additional tax payable may be required with late payment surcharges, or the foreign employee may need to apply for a tax refund for the tax overpaid, as the case maybe.

In addition, under Thai tax law, compensation and benefits related to the employment in Thailand are NOT only salary and bonus but also other fringe benefits and allowances. For example, housing benefit, education fee for children, golf membership fee, and others. These benefits may also be agreed on a package under the “Secondment Corporate Policy” with internal fixed rate of corporate exchange rate.

To prevent the tax exposures from miscalculation, the employer may avoid fixing the exchange rate in the Thai employment contract as it tends to be different from the actual exchange rate at the transaction date and such difference could lead to the employer’s miscalculation of the wages and thus the overpaid or underpaid withholding tax.

In the case where the employer insists to adopt the fixed currency exchaneg rate according to the group policy, we would suggest the payroll team aware the rules on the exchange rate conversion which they may need to adjust the total withholding tax at the year end to ensure that the Thai company remits the correct amount of payroll withholding tax to the TRD.

Mistake No. 2 Offshore wage payment to avoid Thai tax

Payment of wages to the foreign employee may sometimes be made to both local and offshore bank accounts (particularly in a secondment arrangement since the secondment tends to be a short-term employment where the employee normally retains their bank account in the home country). Some people believe that as long as the income is not paid in Thailand, it is not subject to Thai tax. However, we strongly note that if the income paid for the work performed in Thailand and for benefit of the employer in Thailand, the total amount is required to be declared and included in the employee’s personal income tax return regardless whether it is paid in or outside Thailand. Failure to include the wages paid to the offshore bank account in the payroll will lead to an underpaid withholding tax where both employer and employee are mutually liable to the TRD. In addition, the employee will also have additional tax and surcharge liability when they file their annual personal income tax return.

Putting aside the issues with payroll withholding tax and personal income tax, we also found that sometimes an offshore parent company will be responsible for the seconded employees’ remunerations and recharge the cost to the Thai employing company in the form of management service fee or cost allocation.

In many cases in the past, reimbursement paid to offshore affiliate companies were challenged by the TRD as `Non-Deductible Expense‘ and `Non-Creditable Input VAT‘ (reverse charged VAT) for the Thai employing company. In one of the really bad examples, we encountered that the offshore company issued a commercial invoice to charge the Thai subsidiary the unreasonably high sum with tax risky description in such invoice e.g. `TP Charge‘ or `Cost Allocation‘, to cover Thai wage paid to the secondee. It is questionable in terms of transfer pricing whether the management service fee or the cost being allocated is reasonable and can be justified under the arm’s length price following to `Transfer Pricing‘ rules and regulation.

Mistake No. 3 Miscomputation of foreign employee’s personal income tax

Under an assignment agreement, it could be agreed that the employing company will bear personal income tax in the host country for the employee, especially for those in the management level as to help the employee not to suffer a great tax liability from the assignment. Such amount of tax paid on behalf of the foreign employee, however, must also be considered as part of the employment income and be included in the employee’s personal income tax computation. As a result, the Thai tax liabilities will be higher than the case where the employee is liable for his or her own tax.

In the case where it is agreed that the employer will pay the tax on behalf of the employee, the employer shall ensure that this obligation is clearly stated in the employment contract. This is to constitute a reasonable ground for the employer to treat such amount of tax paid on behalf of the foreign employee as a “Deductible Expense” for corporate income tax purposes.

Instead of bearing the personal income tax for the foreign employee, consideration may be given to the International Business Centre (IBC) scheme which was introduced in 2019 to replace the ROH (Regional Operating Headquarter) and IHQ (International Headquarter). Under the IBC scheme, the Thai government provides special tax privileges for foreign employee working in the IBC company at a flat rate of 15% instead of 5-35% progressive rates. This lower cost of foreign employee will benefit the Thai company not only in budget aspect but also for the company’s competitiveness in terms of HR Management.

Mistake No. 4 Possible risk of permanent establishment in Thailand

In some cases, we found that an employee is sent to Thailand and obtains a Work Permit under the employment with a certain Thai company. Under this arrangement, the Thai company remits payroll withholding tax and social security contributions in respect of the foreign employee. However, the foreign employee does not really work for the Thai employing company, but truly for the offshore employer’s business in Thailand. It is even worse if the salary is not actually paid to the employee but is only reported under payroll withholding tax return at the minimum wage as to support the renewal of the foreign employee’s work permit.

What will be adverse legal and tax consequences on this situation?

From a legal perspective, when the employee is sent to Thailand to perform the work for the offshore company, the offshore company will be regarded as carrying on business in Thailand which is prohibited under `Foreign Business Law‘ unless being permitted to do so by obtaining a Foreign Business License. Although the employee has a work permit with the Thai company, it does not legalise the business activities conducted on behalf of the company that sends him or her.

In terms of tax, in a secondment arrangement where a foreign employee from an offshore company is assigned to work in Thailand under a local employment, a Permanent Establishment (PE) or taxable presence risks of the offshore employer may arise if the company perform the work for the benefit of the employer in the home country. In such case, it will not be regarded as a local employment under the secondment arrangement, but as an offshore entity sending an employee to work in Thailand.

If this is the case, when a PE arises in Thailand, it will be treated as a taxable entity or a part of the offshore company to file a corporate income tax return in Thailand. The income attributable to the PE in Thailand shall be subject to Thai tax (the applicable tax rate is 20%). In this regard, tax ID number will be required to be applied for and obtained. In addition, the PE will need to have its accounts audited in Thailand.

To cope with that risk, the group companies shall ensure that the secondment arrangement is constituted in a way that the seconded employee will no longer be performing any work for the offshore company during their course of employment in Thailand.

Mistake No. 5 Single work permit but work for multiple companies in Thailand

Normally, a foreign employee working in Thailand is required to obtain a work permit while Non-Immigrant Visa, type B (Non-B Visa) is needed prior to entry to Thailand to work. The employer in Thailand will issue an `Invitation Letter’ for the foreign employee to work in Thailand under an employment with the company. This invitation letter will be used to apply for the Non-B visa from the Royal Thai Embassy or Thai Consulate in other countries and this visa will be extended to cover the period the employee is permitted to work in Thailand after a work permit is granted.

Usually, the foreign employee will work for only one employer. Under their work permit, the descriptions of employer in Thailand will include a place of work which is generally the office location of the Thai company. However, we found that certain Thai employing companies assign their foreign employees to work at project sites rather than the place they are permitted to work at in the work permit. In addition, the foreign employees may also work for associated companies in Thailand which is clearly out of the scope of work under the work permit. If this is the case, it is recommended that job descriptions in the work permit cover all the activities to be carried out by the foreign employee beforehand and the employee request for prior approval from the Thai Labour Authority. If the work is performed without approval from the authority, both foreign employee and the Thai employer are liable to the Alien Employment Law.

In terms of corporate income tax, if the foreign employee is assigned to work for many subsidiary companies in Thailand without a clear separation of works in the work permit and no clear cost being allocated and charged to such subsidiaries, it could lead to Transfer Pricing Investigation, resulting in the disallowed deductible expense of the employer under the work permit. On the other hand, such expenses could also be deemed as a taxable income of other companies who is not the employer under the work permit. We also note that the income attributable to the work that the employee performs shall be recognised as taxable income of the company that actually benefit from the work.

Kindly note that working for 2 or more employers is permissible in Thailand. However, the clear allocation of works under separated work permits should be made, together with proper allocation of remuneration under the employment contracts among the relevant employers.

Mistake No. 6 Fringe benefits and allowances for foreign employees

Certain benefits and allowances which the employer pays to the foreign employee under the employment contract or company’s policy need to be treated as the employee’s taxable income as well.

This mistake is usually made when it is understood that the benefits or allowance are not part of `salary’ or some cases the benefits are not in the form of money payment, and therefore it should not be taxed.

In this regard, the Supreme Court’s decision in many cases has ruled that allowance or other benefits which is paid or given to the employee in the same amount or manner (e.g. housing allowance, travelling allowance, and pension fund) shall also be included as the employee’s taxable income. The employer then shall ensure that it include such benefits or allowances in monthly withholding computation in order to avoid underpaid withholding tax.

We found that the package of fringe benefits and allowances provided to the foreign employee especially management level and key position will normally cover the `Executive Company Car‘. In the past, the TRD viewed that the company car shall be a part of `additional taxable income’ for personal income tax computation. However, the Supreme Court in its decision in 2011 ruled that the company car exclusively used for business purposes is similar to other office utilities e.g. air-conditioner, office desk, facsimile machine, available for work convenience, and thus is NOT a part of taxable income.

We further note that the benefits or allowances paid to employees cannot be regarded as tax deductible expenses for the corporate income tax unless they are provided under a written contract or policy.

The company policy should be approved by the Board of Director’s Meeting (BOD) to approve the provision of benefits and allowances including the amount or payment basis. The policy may be a part of HR Policy or Foreign Employment Policy for general treatment and not specific to just a certain employee.

Please note that a `Profit Sharing Programs‘ included in an employee benefits package may trigger `Non-Deductible Expense‘ with bad tax consequences. Profit sharing include employee bonus based on the company profit i.e. gross profit, net profit, or any profits. In the past, the Supreme Court of Thailand ruled in favour of the TRD that `Director Bonus‘ computed from the dividend distributed to the shareholder is regarded as `non-deductible expense’ for corporate tax computation. The Court viewed that dividend is a part of `Net Profit’ after corporate tax paid, and then, such bonus is not allowed for corporate tax purposes.

ONE Law’s Comments

Despite being subject to the same treatment under Thai labour laws (Labour Protection Act and Labour Relations Act) and Thai Revenue Code, hiring of a foreign employee may require special attention from an employer in order to ensure proper legal and tax compliance where an unusual employment arrangement is in question. Legal and tax mistakes discussed in this article could be regarded as a guideline for the employer to start looking back to the practice of their organisation and adjust where necessary in order to avoid an overpaid or underpaid tax which may cost the employer surcharge and penalty, or lead to possible tax audit conducted by tax authority.