As businesses finalize their 2020 tax returns and complete regulatory compliance, it's never too early to start planning for 2021 tax. Taxpayers can provide incentives to evaluate and change accounting practices in a number of ways. Most of the changes provide taxpayers with audit protection, so the IRS could not contest improper practices from prior years or impose interest and penalties for incorrect treatment of an item.

Taxpayers can also benefit from adjustments for the current year that would reduce taxable income, and accounting methods provide a means of tax planning around optimal methods for recording income and expenses.

One notable point to consider for tax planning 2021 – the likelihood that tax rates will rise. Since accounting policies only determine the point in time when income or expenses are recognized in taxable income, they are considered to be temporary or temporary. There are numerous accounting methods and planning elements that can postpone the recording of income or expenses to another tax year. However, with recognition just postponing from year to year, many taxpayers may not want the administrative burden of keeping separate accounting and tax working papers for a given item unless the timing brings a significant benefit.

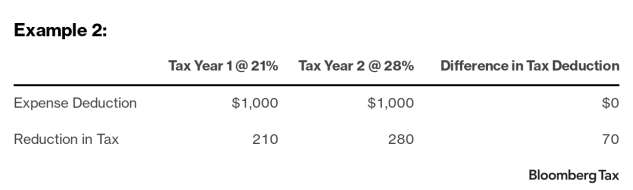

However, if tax rates change, there is a chance that quasi-permanent tax savings will recognize an expense in a year with a higher tax rate or income in a year with a lower tax rate. Take a look at the following examples, which show that a $ 1,000 deduction for prepaid expense is not the same when tax rates change:

As noted in the examples above, a $ 1,000 expedited deduction to expedite a deductible expense in the first year doesn't necessarily provide a tax benefit by recognizing the deduction in the first tax year – an expedited deduction that the book would not recognize until year 2 if, for example If the tax rates remain the same, a taxpayer may want to expedite the withholding process so that it can be recognized in an earlier tax year.

However, if tax rates change, a taxpayer may want to postpone an expense to a later tax year in order to capture a pecuniary tax benefit. In example 2 above, the taxpayer's tax benefit is an additional $ 70 tax saving – by simply recording the expense in a different tax year. That $ 70 difference is a permanent tax benefit that the taxpayer would otherwise not have recognized.

Common accounting methods for analysis

Taxpayers should consider reviewing all accounting practices as part of their tax planning for the 2021 tax year. Below is a list of common methods and notable points to consider for 2021:

- Prepaid Expenses – Under the 12 month rule, taxpayers may be allowed to expedite the deduction of certain prepaid expenses such as insurance, commercial licenses, and business (not social or lobbying) fees. Certain prepaid expenses are ineligible, including software, materials and supplies, professional services, insurance, and rentals.

- Revenue Recognition – Taxpayers are required to review and approve permitted revenue recognition methods for when advance payments are recognized and deferred under the new rules codified in Section 451 of the Taxes Act as part of the Tax Cuts and Jobs Act (TCJA).

- Research and Testing Expenses – This is a notable change for tax years starting after December 31, 2021 that will affect many taxpayers who incur R&D expenses. Section 174 no longer allows direct expenses or an immediate tax deduction for R&D expenses.

- Taxpayers are now required to capitalize and write off R&D expenditure over a period of five years (15 years for foreign research) from the middle of the tax year in which this expenditure is incurred.

- Taxpayers should be proactive in reviewing the tax treatment of R&D expenses in order to understand current accounting policies and how they may need to change the tax treatment of R&D expenses from the current method as a result of the tax law changes that will take effect for the next tax year.

- A change in accounting policy may be necessary for most taxpayers who have historically recognized R&D expenses as an expense to change their accounting policy for treating Section 174 expenses.

- State Deferred Taxes – Taxpayers have two options for when to deduct real estate, personal property, and state income or franchise taxes. They can be deducted from the payment in the tax year or they can be deducted from the taxpayer's financial statements.

- Fixed Assets / Capitalization – Taxpayers have a number of items that they can review for depreciation and amortization, including:

- Implementation of cost separation for new buildings or acquired properties;

- Review of property, plant and equipment books for correct tax duration;

- Review of a qualifying improvement property for a 15 year depreciation which has now been fixed;

- Assess the required or optional alternative treatment of the depreciation system;

- Ensuring proper tax depreciation of goodwill or other acquired intangible assets; and

- other tangible and intangible assets.

- Inventory / Section 263A Unified Capitalization (UNICAP) – Ensure proper tax compliance and inventory identification and assessment methods.

- Assess the required and allowed methods for UNICAP, especially the simplified methods – simplified production method, simplified resale method, and modified simplified production method.

- Accrued Bonus / Accrued Vacation – Payroll liabilities that are deductible according to the 2.5 month economic performance rule; however, the other two tests for the feasibility of the deduction are often overlooked, namely that the effort is fixed and determinable.

- Evaluate the vacation transfer policy. The following should all be assessed to determine whether taxpayers can expedite the accrued bonus:

- Will everything be paid out within 2.5 months of the end of the year?

- Is the full accumulated bonus amount guaranteed to be paid out?

- Does it require the approval of the board of directors and is this approval given by the board of directors before or after the end of the year?

- Does management have the option to change bonus amounts after the end of the year?

- Does an employee need to be busy on the day of the payout to receive their assigned bonus; and if so, will the amount be returned to the company or will it still be paid out and shared among the current employees?

- All of this needs to be assessed to determine whether the taxpayer can expedite this deduction. In addition, bonus and vacation provisions are not deductible for shareholders of S companies, even if the provisions are fixed and determinable and are paid out within 2.5 months of the end of the year.

- Incurred But Not Reported (IBNR) – Self-financed medical expenses for self-insured taxpayers, including any amounts not covered by insurance, such as: B. "Deductible" amounts under an insurance policy related to employee medical expenses. The taxpayer can deduct the cost of medical services when the service is provided, which may be in one tax year prior to payment.

- Small Business Taxpayer Accounting Practices – The TCJA expanded the definition of a small business taxpayer; for 2021, these are taxpayers with average gross receipts less than $ 26 million over the past three years (and no tax exemption). Taxpayers can qualify for the following simplified accounting methods:

- Total cash method;

- Exemption from the obligation to take stock according to § 471;

- Exemption from the requirement to capitalize costs under Section 263A;

- Exception to long-term contract requirements under Section 460.

Taxpayers who have switched to one of these simplified accounting methods after the extended TCJA approval, or who have always used these simplified accounting methods, should check whether they are still eligible for these methods and, if not, they must switch to an acceptable method.

- Bad debts – Taxpayers should ensure that they are not improperly following their accounting method of deducting bad debts under a reserve method.

- Non-Accrual Experience (NAE) – An exception to the bad debt method above applies to specially defined service-based areas in health, legal, engineering, architecture, accounting, actuarial, performing arts, and consulting. Taxpayers in these areas do not have to accumulate income that can be traced back to the provision of services that they do not expect to collect according to established NAE methods.

- Deferred Rent / Tenant Enhancements – Taxpayers should consider appropriately deducting rental expenses for tax purposes that may not follow the book method of deferred rent. In addition, taxpayers should review leases to determine whether the tenant or landlord owns the leasehold improvements, whether the tenant needs to record income for receiving tenant allowances, and who records the depreciation on those improvements.

The above list is not an all-inclusive list of accounting methods and is only a selection of some of the more common methods that taxpayers may or may not treat. Now is a good time for taxpayers to evaluate current practices and the potential impact of likely tax rate increases.

This column does not necessarily represent the opinion of the Bureau of National Affairs Inc. or its owners.

Information about the author

Ryan Vaughan leads Mazars' Chicago Tax Practice and Global Tax Credits and Incentives Practice, which provides expert tax services to companies in a variety of industries including manufacturing and distribution, energy, technology, real estate, retail, financial services, and healthcare.

Andrew Kosoy is a leader in the Tax Credits & Incentives practice and has provided federal income tax planning, business advisory and advisory services for over 13 years, specializing in projects and studies related to tax credit for research and development, tax accounting methods, income and expense recognition, fixed assets and depreciation , Inventory accounting and deduction of meals and entertainment.

Bloomberg Tax Insights articles are written by seasoned practitioners, academics and policy experts who discuss developments and current issues in the tax arena. To make a contribution, please contact us at [email protected].