To print this article, all you need is to be registered or login on Mondaq.com.

General Overview on HPP Law: The Government of

Indonesia issued Law No. 7 of 2021 on Harmonization of Taxation

Regulation (Harmonisasi Peraturan Perpajakan or

“HPP Law“), which amended several

material issues in the Indonesian Taxation Law. HPP Law was

promulgated on 29 October 2021 and most of the provisions will

become effective in the fiscal year 2022.

Similar to Job Creation Law, HPP law mainly provides amendments

to some provisions under the preceding tax laws

(i.e., Law No. 11 of 1995 on Excise, as amended by

Law No. 39 of 2007, Law No. 6 of 1983 on General Provisions and

Procedures on Taxation, as lastly amended by Law No. 16 of 2009),

as well as introduces new taxes such as the new Carbon Tax.

These provisions and the effective dates of such amendments

and/or new provisions are as follows:

- amendment to the General Provisions and Tax Procedures,

effective as of 29 October 2021; - amendment to the Income Tax Law, effective on the start of

fiscal year 2022 (i.e., 1 January 2022); - amendment to the Value Added Tax Law, effective as of 1 April

2022; - Taxpayer Voluntary Disclosure Program for the period between 1

January and 30 June 2022; - Carbon Tax, effective as of 1 April 2022; and

- Excise Law, effective as of 29 October 2022.

Aim of the HPP Law: Based on Article 1 (2) of

HPP Law, its issuance is aiming at:

- promoting sustainable economic growth and supporting

acceleration of the economic recovery; - optimizing the state revenue;

- providing fairer tax system and legal certainty;

- stipulating administrative reform and tax base expansion;

and - improving voluntary compliance of taxpayers.

Although the law is made to promote sustainable economic growth

and recovery from the pandemic induced effect, the Indonesian

general public and businesses’ most concern of the direct

economic effect of HPP Law, including the proposed raise of VAT

from 10% to 11%. Many experts and practitioners view that the law

was issued to provide the government with a “source of

funding” to cut the deficit in the state budget during

Covid-19 pandemic. This appears to be a non-traditional and unique

approach, especially compared to other countries’ approaches on

taxation during this time.

Although the spirit of HPP Law looks good on the surface, the

long-term effect on businesses and the public alike might be

concerning.

Scope of Analysis: In this article, we provide

a summary of the key points of the amendments and new provisions of

HPP Law. Given that the law provides many substantial changes to

taxation laws, we address these key points in two separate

articles. In this volume, we only address the amendments to (i)

Income Tax Law and (ii) VAT Law.

A. Amendment to the Income Tax Law

HPP Law amended some provisions of Law No. 7 of 1983 on Income

Tax, which was lastly amended by Law No. 11 of 2020 on Job Creation

(“Income Tax Law“)

The key amendments include that on the income tax rates, which

are determined progressively based on the income band

(“Income Band“).

Pursuant to Art. 3 (7) of HPP Law, the minimum and maximum

thresholds of income band, subject to the progressive income tax

rates, are increased to IDR60 million as the minimum threshold, and

IDR50 billion as the maximum threshold (“Income

Band“). Such changes are reflected in the new tax

rates:

Please note that the Income Band refers to the total annual

income as reported in the Taxpayer’s Annual Tax Return.

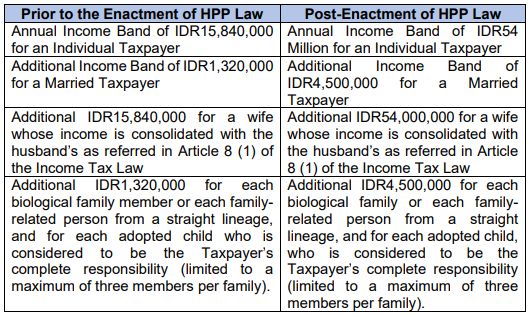

HPP law also introduces the following provisions on the

exclusion of certain amounts in the calculation of the progressive

Income Band:

Furthermore, HPP Law stipulates that the business income of an

Individual Taxpayer with a gross turnover of up to IDR500 million

in a single tax year is categorized under the Micro, Small, Medium

Enterprises (MSME) tax rate, and will not be subject to the income

tax.

Lastly, the Corporate Income Tax Rate for Corporate Taxpayer

will remain at 22% in 2022, as the initially planned 20% rate is

cancelled.

B. Amendment to VAT Law

Pursuant to Article 17 (2) of HPP Law, the provisions amending

the VAT Law shall become effective as of 1 April 2022. The changes

in VAT Law are as follows:

- Expansion of Tax Base by Removing Most of the Negative

List on VAT Exemption: Article 4 (1) of the HPP Law

provides certain goods and services that are no longer

exempted from VAT with the following details:- Goods and/or services that are removed from VAT

exemption: taxable goods from mining and drilling results

taken directly from the sources, which exclude coal, gold bars

other than those for the government’s forex reserve,

non-advertising broadcasting services, postal services, public

phone services, and money transfer by postal services. - Goods and/or services, which remain exempted from VAT

but subject to other requirements:

- Subject to Regional Tax: F&B served in

hotels or restaurants, hotel parking, catering, and

arts-and-entertainment services; - Public services provided by the government that cannot be

provided by other parties.

- Subject to Regional Tax: F&B served in

- VAT-able strategic goods and/or services exempted from

VAT: basic necessities, medical services, financial

services, insurance services, education services, non-profit social

services, public transportation of all modes of transportation, and

manpower services.

Possible Impact: Removal of these goods and

services from VAT exemption can be both beneficial or less

beneficial for various stakeholders.From the consumers’ point of view, this could be burdensome,

especially in terms of fulfilling their basic needs. From the

perspective of the government that has witnessed a progress of

business development in MSME sectors, specifically F&B, the

pandemic has also caused so much negative impact on the

economy. - Goods and/or services that are removed from VAT

- The Changes in VAT Rate: The most worrisome

change in the VAT Law under HPP Law is the change of VAT rate that

would be gradually increased from 10% to 12%.The rate increase from 10% to 11% will be effective as of 1

April 2022, and that the increase from 11% to 12%

will be effective no later than 1 January 2025.

C. NLP Closing Remarks on HPP Law

Amendments on taxation provisions under HPP Law are quite

controversial and will definitely have substantial impacts on the

daily life and businesses in Indonesia. In the eyes of the

Indonesian tax authority and the Ministry of Finance, such changes

are not always unbeneficial as they support the middle to

lower-middle classes with the haves paying more taxes.

It remains to be seen how the enforcement of the law will impact

on the public and state income. Many people still have a great

concern over the inflation caused by this tax reform that will

likely increase prices and living costs in Indonesia.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.