click to enlarge

Derek Harrison photo illustration

This story was originally published by ProPublica. ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to get stories like this in your inbox.

Series: The Secret IRS Files

In the tax documents of 0.001%

I

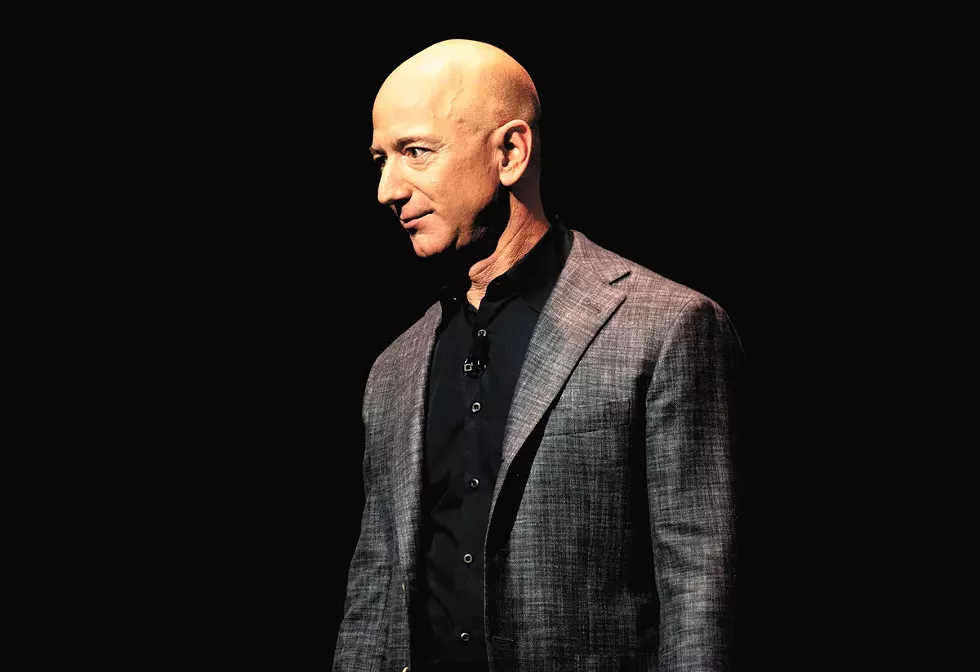

n 2007 Jeff Bezos, then multi-billionaire and now the richest man in the world, did not pay a cent in federal income taxes. In 2011 he succeeded again. In 2018, Tesla founder Elon Musk, the second richest person in the world, also paid no federal income taxes.

Michael Bloomberg has succeeded in this over the past few years. Billionaire investor Carl Icahn did it twice. George Soros paid no federal income tax for three consecutive years.

ProPublica has received a vast treasure trove of Internal Revenue Service data on the tax returns of thousands of the richest people in the country for over 15 years. The data provides unprecedented insight into the financial lives of America's titans, including Warren Buffett, Bill Gates, Rupert Murdoch, and Mark Zuckerberg. It not only shows their income and taxes, but also their investments, stock deals, gambling winnings and even the results of audits.

Taken together, it destroys the cornerstone of America's tax system: that everyone pays their fair share, and that the richest Americans pay the most. The IRS records show that the wealthiest can – quite legally – pay income taxes that are just a tiny fraction of the hundreds of millions, if not billions, whose wealth is growing every year.

Many Americans live from paycheck to paycheck, accumulate little fortune, and pay the federal government a percentage of their income that increases as they earn more. For the past several years, the average American household was making about $ 70,000 a year and paying 14% in federal taxes. The highest income tax rate, 37%, was introduced this year for couples with incomes over $ 628,300.

The confidential tax records received from ProPublica show that the ultra-rich are effectively circumventing this system.

America's billionaires are employing tax avoidance strategies that the common man cannot achieve. Their wealth comes from the skyrocketing value of their assets like stocks and property. These gains are not defined as taxable income under U.S. law unless and until the billionaires sell.

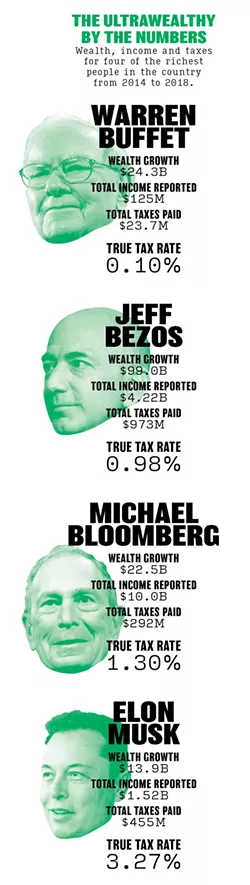

To capture the financial realities of the richest Americans, ProPublica conducted an unprecedented analysis. We compared how much taxes the 25 richest Americans pay each year versus how much their wealth grew over the same period, according to Forbes estimates.

We will call this their true tax rate.

The results are blatant. According to Forbes, the value of those 25 people grew by a total of $ 401 billion from 2014 to 2018. They paid a total of $ 13.6 billion in federal income taxes over those five years, the IRS data shows. That is a staggering sum, but corresponds to a true tax rate of only 3.4%.

![]()

Advertising:

The situation is very different for Americans from the middle class, for example workers in their early 40s who have amassed wealth typical of their age. From 2014 to 2018, their net worth rose an average of about $ 65,000 after tax, largely due to the appreciation of their homes. But because the vast majority of her income was made up of salaries, her tax bills for that five-year period were nearly $ 62,000.

No one among the 25 richest has avoided as many taxes as Buffett, the grandfather's hundred millionaire. Perhaps surprising, given his public stance as an advocate of higher taxes for the rich. According to Forbes, his wealth rose by $ 24.3 billion between 2014 and 2018. During those years, Buffett said he paid $ 23.7 million in taxes, the data shows.

That gives a real tax rate of 0.1% or less than 10 cents for every $ 100 he adds to his net worth.

In the coming months, ProPublica will use the IRS data we have received to examine in detail how the ultra-rich avoid taxes, exploit loopholes, and evade control by federal auditors.

Experts have long understood how little the rich are taxed in the US, and many laypeople have long suspected it.

But few details about individuals are ever made public. Tax information is one of the federal government's most closely guarded secrets. ProPublica has chosen to divulge individual tax information from some of the richest Americans because the public can only understand the realities of the country's tax system in detail.

In 2011, a year when his wealth was roughly constant at $ 18 billion, Bezos filed a tax return reporting that he had lost money.

tweet that

Consider Bezos & # 39; 2007, one of the years he didn't pay federal income taxes. Amazon's stock has more than doubled. Bezos' net worth rose $ 3.8 billion, according to Forbes, whose wealth estimates are widely quoted. How is it that a person who enjoys such a wealth explosion end up paying no income tax?

That year, Bezos, who was filing his taxes with his then-wife MacKenzie Scott, reported (for him) a miserable income of $ 46 million, mostly from interest and dividend payments on outside investments. He was able to offset every penny he earned with losses from side investments and various deductions such as interest expenses on debts and the vague collective category “other expenses”.

In 2011, a year when his wealth was roughly constant at $ 18 billion, Bezos filed a tax return reporting that he had lost money – his income that year was more than offset by investment losses. Also, because he was making so little under the tax law that he even claimed and received a $ 4,000 tax credit for his children.

His tax avoidance becomes even more noticeable when you look at 2006 to 2018, a period for which ProPublica has complete data. Bezos' net worth rose $ 127 billion, according to Forbes, but reported a total income of $ 6.5 billion. The $ 1.4 billion he paid in personal federal taxes is a massive number – but it equates to a true 1.1% tax rate on the increase in his wealth.

click to enlarge

Daniel Oberhaus / CC from 2.0 photo

Jeff Bezos' personal and corporate representatives declined to receive detailed questions about his taxes.

T

The IRS data revelations come at a crucial time. Wealth inequality has become one of the defining issues of our time. The President and Congress are considering the most ambitious tax hikes in decades for high-income people. But the American tax discussion has been dominated by the debate over incremental changes, such as whether the top tax rate should be 39.6% instead of 37%.

ProPublica data shows that while some wealthy Americans, such as hedge fund managers, would pay more taxes under the Biden government's current proposals, the vast majority of the top 25 would see little change.

The tax data was made available to ProPublica after we published a series of articles investigating the IRS. The articles revealed how years of budget cuts have hampered the agency's ability to enforce the law, and how the largest corporations and the rich have benefited from the weakness of the IRS. They also showed that people in poor regions are now more frequently checked than people in wealthy areas.

ProPublica does not disclose how it obtained the data provided to us in raw form without any conditions or conclusions. ProPublica reporters spent months processing and analyzing the material to turn it into a usable database.

We then verified the information by comparing items to dozens of already public tax details (in court documents, politicians' financial statements, and news bulletins) and reviewing them with individuals whose tax information is in the treasure trove. Comments from each individual whose tax information is described in this story have been requested. Those who responded, including Buffett, Bloomberg and Icahn, all said they had paid the taxes they owed.

A Soros spokesman said in a statement: "Between 2016 and 2018, George Soros lost money on his investments, so he owed no federal income taxes in those years. Mr. Soros has long advocated higher taxes for wealthy Americans. ”Bezos personal and corporate officials declined to receive detailed questions on the matter. ProPublica attempted to reach Scott through their divorce attorney, personal representative, and family members; she did not answer. Musk responded to an initial query with a single punctuation mark: "?" After we sent him detailed questions, he didn't respond.

One of the billionaires mentioned in this article objected, arguing that disclosing personal tax information was an invasion of privacy. We have concluded that the public interest in knowing this information outweighs that legitimate interest at this crucial moment.

The consequences of allowing the wealthiest to play the tax system have been profound. Apart from military spending, federal budgets have been constrained for decades. Roads and bridges have collapsed, social services have withered, and the solvency of Social Security and Medicare is constantly being challenged.

There is an even more fundamental question than what programs are funded or not: taxes are a kind of collective sacrifice. Nobody loves giving their hard-earned money to the government. But the system only works as long as it is felt to be fair.

Our analysis of the tax records of the 25 richest Americans quantifies how unfair the system has become.

At the end of 2018, the 25 were worth $ 1.1 trillion.

By comparison, it would take 14.3 million normal American wage earners combined to make the same wealth.

The personal federal tax bill for the top 25 in 2018: $ 1.9 billion.

The bill for the wage earners: $ 143 billion.

T

he idea of a regular income tax, let alone wealth, does not appear in the country's founding documents. In fact, Article 1 of the US Constitution specifically forbids "direct" taxes on citizens in most cases. This meant that for decades the US government was financed primarily through "indirect" taxes: duties and taxes on consumer goods such as tobacco and alcohol.

In 1861, with the cost of the Civil War looming, Congress introduced a national income tax. The rich helped force their repeal shortly after the war ended. (Their resentment was only made worse by the law requiring disclosure. The Mughals' annual income – $ 1.3 million for William Astor; $ 576,000 for Cornelius Vanderbilt – was reported on the New York Times pages listed in 1865.)

In the late 19th and early 20th centuries, wealth inequality was acute and the political climate changed. The federal government began to expand, creating agencies to protect food, workers, and more. It needed funding, but tariffs tightened ordinary Americans more than the rich. The Supreme Court had rejected an 1894 law introducing an income tax. The Congress therefore decided to change the constitution. The 16th Amendment was ratified in 1913 and gave the government the power to "collect and levy taxes on income from whatever source".

In the early years, income tax worked as Congress intended and fell directly on the wealthiest. In 1918, only 15 percent of American families owed taxes. According to historian W. Elliot Brownlee, the top 1% paid 80% of the revenue.

But one question remained: what counts as income and what doesn’t? In 1916, a woman named Myrtle Macomber received a dividend on her Standard Oil of California stock. Thanks to the new law, she owed taxes. However, the dividend did not come in cash. It came in the form of an additional share for every two shares already held. She paid the taxes and then brought a lawsuit: yes, she had gotten a little richer, but she hadn't gotten any money. Hence, she argued, she had not received any "income".

Four years later, the Supreme Court agreed. In Eisner v. Macomber, the Supreme Court ruled that income comes only from proceeds. A person had to sell an asset – a stock, a bond, or a building – and reap some money before it could be taxed.

Since then, the concept that income only comes from revenue – when profits are "realized" – has been the bedrock of the US tax system. Wages are taxed. Cash dividends are taxed. Profits from the sale of assets are taxed. But if a taxpayer has not sold anything, there is no income and therefore no tax.

Macomber's contemporary critics have been plentiful and forward-looking. Cordell Hull, the congressman known as the "father" of income tax, has attacked the decision, according to researcher Marjorie Kornhauser. Hull predicted that tax avoidance would become commonplace. The ruling opened a gaping loophole, Hull warned, that would allow industrialists to start a business and borrow against the stock to pay the cost of living. Everyone can live “on the value” of their company shares, “without selling them and of course without ever paying taxes,” he said.

Hull's prediction would not reach full bloom until decades later, fueled by a series of epoch-making economic, legal, and cultural changes that gained momentum in the 1970s. Antitrust authorities increasingly accepted mergers and stopped trying to break up huge corporations. Corporations, for their part, were obsessed with the value of their stocks and excluded almost everything. This has resulted in a number of corporate monoliths over the past 40 years – from Microsoft and Oracle in the 1980s and 1990s to Amazon, Google, Facebook, and Apple today – that often have concentrated ownership, high profit margins, and rich stock prices . The winner-take-all economy has created modern fortunes that in some ways resemble those of John D. Rockefeller, J.P. Morgan and Andrew Carnegie to shame.

click to enlarge

NASA photo

Elon Musk responded to an initial query from ProPublica with a single punctuation mark: "?" After receiving detailed questions, he did not answer.

I

Here and now, the ultra-rich are using a variety of techniques that are unavailable to less well-off people to circumvent the tax system.

Certainly there are illegal tax evaders among them, but it turns out that billionaires do not have to evade taxes exotic and illegally – they can routinely and legally avoid it.

Most Americans have to work to live. If they do, they'll get paid – and they'll be taxed. The federal government regards almost every dollar workers make as "income," and employers deduct taxes directly from their paychecks.

The bezoses of the world don't need a salary. Bezos' wages on Amazon have long been at the mid-range level of around $ 80,000 a year.

For years there has been such a thing as competition among elite founder-CEOs to go even deeper. Steve Jobs made a dollar when he returned to Apple in the 1990s. Facebook's Zuckerberg, Oracle's Larry Ellison, and Google's Larry Page have all done the same thing.

However, this is not the selfless gesture it appears to be: wages are taxed heavily. The 25 richest Americans reported wages of $ 158 million in 2018, according to IRS data. That's only 1.1% of what they reported as total reported income on their tax forms. The rest comes mostly from dividends and the sale of stocks, bonds, or other investments that are taxed lower than wages.

As Congressman Hull long ago envisioned, the ultra-rich usually hold onto the stocks of the companies they start up. Many 21st century titans are sitting on mountains of so-called unrealized profits, the total size of which fluctuates every day as stock prices rise and fall. Of the $ 4.25 trillion in fortunes US billionaires own, about $ 2.7 trillion is unrealized, according to Emmanuel Saez and Gabriel Zucman, economists at the University of California, Berkeley.

Buffett is known to have held his shares in Berkshire Hathaway, a company he founded, the conglomerate that owns Geico, Duracell and significant stakes in American Express and Coca-Cola. This largely enabled Buffett to avoid converting his wealth into income. From 2015 to 2018, he had an annual income of $ 11.6 million to $ 25 million. That may seem like a lot, but Buffett is roughly the sixth richest person in the world – he's worth $ 110 billion as of May 2021, according to Forbes estimate. According to IRS data, at least 14,000 U.S. taxpayers reported higher income than him in 2015.

There is also a second strategy that Buffett relies on that minimizes income and therefore taxes. Berkshire pays no dividend, the amount (in theory a portion of profits) many companies pay each quarter to those who own their stocks. Buffett has always argued that it is better to use that money to find investments for Berkshire that will further add to the value of the stocks he and other investors hold. If Berkshire had offered anywhere near the average dividend in recent years, Buffett would have received over $ 1 billion in dividend income each year and owed hundreds of millions in taxes each year.

Many Silicon Valley and infotech companies have mimicked Buffett's model, avoiding stock dividends, at least temporarily. In the 1980s and 1990s, companies like Microsoft and Oracle provided shareholders with rapid growth and profits, but did not pay dividends. Google, Facebook, Amazon, and Tesla don't pay dividends.

In a detailed written response, Buffett defended his practices, but did not go directly into the calculation of ProPublica's true tax rate. "I continue to believe that tax laws should be fundamentally changed," he wrote, adding that in his opinion "huge dynastic wealth is undesirable for our society".

The decision not to let Berkshire pay dividends was backed by the vast majority of its shareholders. "I cannot imagine a large corporation where shareholders are so united in their belief in reinvestment," he wrote. And he pointed out that Berkshire Hathaway pays significant corporate taxes, which represent 1.5% of total U.S. corporate taxes in 2019 and 2020.

Buffett reiterated that he has started giving away his enormous fortune and eventually plans to donate 99.5% of them to charity. "I believe the money will be of greater benefit to society when it is disbursed philanthropically than when it is used to slightly reduce an ever-growing US debt," he wrote.

S.

o How do mega-billionaires pay their mega-bills while settling on $ 1 salaries and hanging on their stocks? According to public documents and experts, the answer for some is to borrow money – lots of it.

For ordinary people, credit is often something out of necessity, for example for a car or a house. But for the ultra-rich it can be a way to access billions without generating income and thus income tax.

Tax mathematics offers a clear incentive for this. If you own a business and have a high salary, you pay 37% income tax on most of it. When you sell stocks, you pay 20% capital gains tax – and lose control of your business. But take out a loan and you pay single-digit interest and no taxes these days; Since loans must be repaid, the IRS does not consider them to be income. Banks usually ask for collateral, but the rich have plenty of it.

The vast majority of the ultra-rich loans do not appear in the tax records received from ProPublica as they are generally not disclosed to the IRS. Occasionally, however, the loans are disclosed in securities archives. For example, in 2014, Oracle announced that its CEO, Ellison, had a line of credit backed by approximately $ 10 billion of its stock.

Last year, Tesla reported that Musk had pledged around 92 million shares valued at around $ 57.7 billion as of May 29, 2021 as collateral for personal loans.

For ordinary people, credit is often something out of necessity, for example for a car or a house. But for the ultra-rich it can be a way to access billions without generating income and thus income tax.

tweet that

Except for a year in which he exercised more than $ 1 billion in stock options, Musk's tax bills in no way reflect the wealth available to him. In 2015, he paid $ 68,000 in federal income tax. It was $ 65,000 in 2017, and he paid no federal income tax in 2018. Between 2014 and 2018 it had a true tax rate of 3.27%.

The IRS records provide insight into other massive loans. In both 2016 and 2017, investor Carl Icahn, who ranks 40th richest Americans on the Forbes list, did not pay federal income taxes, despite reporting gross adjusted income totaling $ 544 million (that of the IRS as income minus items such as students Are defined). Loan interest or maintenance). Icahn had a $ 1.2 billion outstanding loan with Bank of America, among other loans, according to IRS data. It was technically a mortgage because it was backed at least in part by penthouses and other Manhattan real estate.

Borrowing gives Icahn several advantages: He receives huge tranches of cash to increase his investment returns. Then he can deduct the interest from his taxes. In an interview, Icahn stated that he reports the profits and losses of his business empire on his personal taxes.

Icahn acknowledged that he is a "big borrower". I borrow a lot of money. "When asked if he also took out loans to reduce his tax burden, Icahn said," No, not at all. My borrowing is up for grabs. I enjoy the competition. I enjoy winning. "

He said the adjusted gross income was a misleading figure for him. After deducting hundreds of millions for the interest on his loans, he recorded tax losses for both years, he said. "I didn't make any money because unfortunately my interest rates were higher for me than my total adjusted income."

When asked if it was fair that he had not paid income tax in certain years, Icahn said he was confused by the question. "There's a reason it's called income tax," he said. "The reason is if you're a poor person, a rich person, when you are Apple – if you have no income, you don't pay taxes." He added, "Do you think that a rich person should pay taxes no matter." what is happening? I don't think it's wrong. How can you ask me that question? "

click to enlarge

Gage Skidmore photo

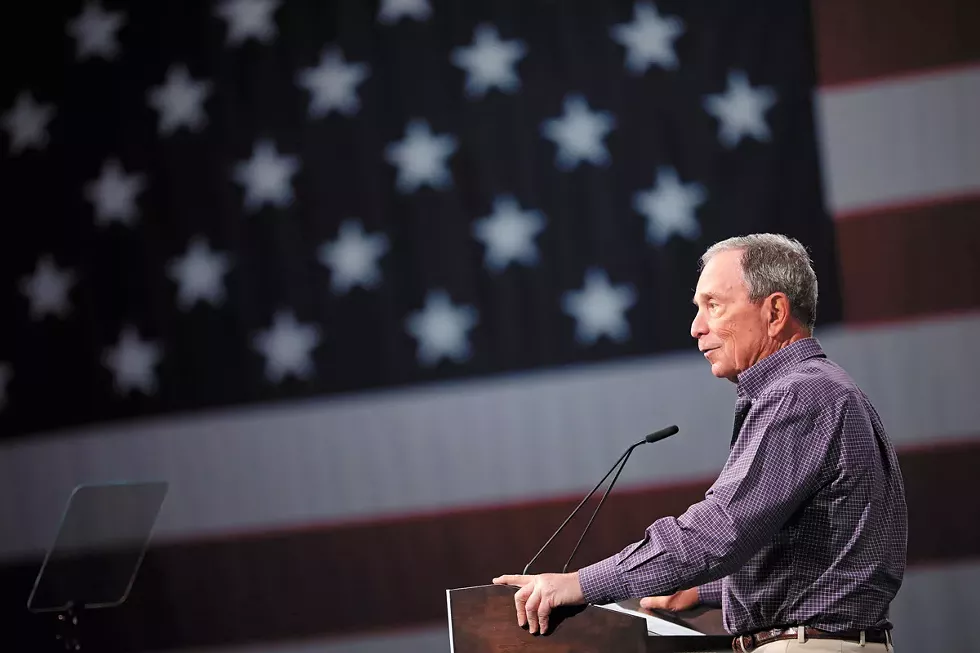

In a statement, a spokesman for Michael Bloomberg noted that Bloomberg had stood up as a candidate for a variety of tax increases for the wealthy.

S.

Keepics could challenge our analysis of how little the super-rich pay in taxes. For one thing, they could argue that business owners are affected by corporate taxes. They could also counteract the fact that some billionaires cannot avoid income – and thus taxes -. And after death, it is widely understood, there is one final no-escape clause: inheritance tax, which imposes a high tax rate on amounts over $ 11.7 million.

ProPublica found that none of these factors change the basic picture.

Take corporate taxes. When businesses pay them, economists say, those costs are passed on to the businesses' owners, workers, or even consumers. The models vary, but they usually assume that major shareholders will take the lion's share.

However, corporate taxes have plunged into a golden age of corporate tax avoidance over the past few decades. By sending profits overseas, companies like Google, Facebook, Microsoft, and Apple have often paid little or no US corporate tax.

For some of the richest people in the country, especially Bezos and Musk, adding corporate taxes would do little to change anything. Other companies like Berkshire Hathaway and Walmart pay more, which means corporate tax for the likes of Buffett and the Waltons could add significantly to their burden.

It is also true that some billionaires fail to avoid taxes by avoiding income. In 2018, nine of the 25 richest Americans reported incomes over $ 500 million and three over $ 1 billion.

In such cases, however, the data received from ProPublica shows that billionaires have a range of tax avoidance options to offset their profits through credits, deductions (which may include charitable donations), or losses to lower or even offset their tax bills. Some have sports teams that offer such lucrative write-offs that the owners often pay much lower tax rates than their millionaire players. Others have commercial buildings that are steadily increasing in value, but can still be used to offset income-compensating paper losses.

Michael Bloomberg, the 13th richest American on the Forbes list, often reports high earnings because the profits of the private company he controls go mainly to him.

In 2018, he reported an income of $ 1.9 billion. When it came to its taxes, Bloomberg managed to cut its bill by taking advantage of deductions made possible through tax cuts during the Trump administration, $ 968.3 million to charitable donations and loans to pay foreign taxes were. The end result was that he paid $ 70.7 million in income tax on that nearly $ 2 billion in income. That corresponds to a conventional income tax rate of only 3.7%. Between 2014 and 2018, Bloomberg had a true tax rate of 1.30%.

In a statement, a Bloomberg spokesman noted that Bloomberg had stood up as a candidate for a variety of tax increases for the wealthy. "Mike Bloomberg pays the statutory maximum tax rate on all federal, state, local and international taxable income," the spokesman wrote. Und er zitierte Bloombergs philanthropisches Spenden und bot die Berechnung an, dass „das, was Mike für wohltätige Zwecke spendet und Steuern zahlt, ungefähr 75 % seines Jahreseinkommens ausmacht“.

In der Erklärung heißt es auch: „Die Veröffentlichung der Steuererklärungen eines Privatmanns sollte ungeachtet der politischen Zugehörigkeit oder der Ansichten zur Steuerpolitik echte Datenschutzbedenken aufwerfen. In den Vereinigten Staaten sollte kein Privatmann die illegale Herabsetzung seiner Steuern befürchten. Wir beabsichtigen, alle uns zur Verfügung stehenden rechtlichen Mittel zu nutzen, um festzustellen, welche natürliche oder staatliche Stelle diese durchgesickert hat, und sicherzustellen, dass sie zur Verantwortung gezogen werden.“

Letztendlich soll die Erbschaftssteuer nach Jahrzehnten des Vermögensaufbaus als Letztsicherung dienen und den Behörden die Möglichkeit geben, endlich ein riesiges Vermögen zu erwerben, bevor es an eine neue Generation weitergegeben wird. Aber in Wirklichkeit ist die Vorbereitung auf den Tod eher die letzte Stufe der Steuervermeidung für die Ultrareichen.

Edward McCaffery, Professor für Steuerrecht an der University of Southern California, hat den gesamten Bogen unter dem Schlagwort „buy, Borrow, Die“ zusammengefasst.

Das Sterben als Steuervorteil erscheint paradox. Normalerweise, wenn jemand einen Vermögenswert verkauft, sogar eine Minute vor seinem Tod, schuldet er 20 % Kapitalertragsteuer. Aber mit dem Tod ändert sich das. Alle bis zu diesem Zeitpunkt erzielten Kapitalgewinne werden nicht besteuert. Dies ermöglicht es den Ultrareichen und ihren Erben, Steuern in Milliardenhöhe zu vermeiden. Die „Aufstockung der Basis“ wird von Experten aus dem gesamten politischen Spektrum weithin als Fehler im Kodex anerkannt.

Dann kommt die Erbschaftssteuer, die mit 40% zu den höchsten im Bundesgesetzbuch gehört. Diese Steuer soll der Regierung eine letzte Chance geben, an all den nicht realisierten Gewinnen und anderen Vermögenswerten zu kommen, die die reichsten Amerikaner im Laufe ihres Lebens anhäufen.

Aus aggregierten IRS-Daten, Steuerrecherchen und dem, was in die öffentliche Arena über die Nachlassplanung der Reichen eindringt, ist jedoch klar, dass sie es leicht vermeiden können, fast die Hälfte des Wertes ihres Nachlasses zu verkaufen. Viele der Reichsten schaffen Stiftungen für philanthropisches Spenden, die zu Lebzeiten große Steuerabzüge für wohltätige Zwecke bieten und die Erbschaftssteuer umgehen, wenn sie sterben.

Vermögensverwalter bieten ihren Kunden eine Reihe von undurchsichtigen und komplizierten Trusts, die es den wohlhabendsten Amerikanern ermöglichen, ihren Erben große Summen zu geben, ohne Erbschaftssteuern zu zahlen. Die von ProPublica erhaltenen IRS-Daten geben einen Einblick in die Nachlassplanung der Ultrareichen und zeigen Hunderte dieser Trusts.

Das Ergebnis ist, dass große Vermögen weitgehend intakt von einer Generation zur nächsten weitergegeben werden können. Von den 25 reichsten Menschen Amerikas sind heute etwa ein Viertel Erben: drei sind Waltons, zwei sind Sprößlinge des Mars-Süßigkeitsvermögens und einer ist der Sohn von Estée Lauder.

ich

n den letzten anderthalb Jahren sind Hunderttausende Amerikaner an COVID-19 gestorben, Millionen wurden arbeitslos. Aber eine der düstersten Zeiten in der amerikanischen Geschichte erwies sich für Milliardäre als eine der lukrativsten. Laut Forbes haben sie von Januar 2020 bis Ende April dieses Jahres 1,2 Billionen Dollar zu ihrem Vermögen hinzugefügt.

Dieser Glücksfall ist einer der vielen Faktoren, die das Land an einen Wendepunkt geführt haben, der auf ein halbes Jahrhundert wachsender Vermögensungleichheit und die Finanzkrise von 2008 zurückgeht, die viele Menschen nachhaltig geschädigt hat. Die amerikanische Geschichte ist reich an solchen Wendungen. Es gab berühmte Steuerwiderstände, wie die Boston Tea Party, denen weniger bekannte Bemühungen gegenüberstanden, die Reichen mehr bezahlen zu lassen.

Ein solcher Vorfall vor über einem halben Jahrhundert schien große Veränderungen herbeizuführen. Der scheidende Finanzminister von Präsident Lyndon Johnson, Joseph Barr, schockierte die Nation, als er enthüllte, dass 155 Amerikaner, die über 200.000 US-Dollar (etwa 1,6 Millionen US-Dollar heute) verdienten, keine Steuern gezahlt hatten. Diese Gruppe, sagte er dem Senat, umfasste 21 Millionäre.

„Wir stehen jetzt vor der Möglichkeit einer Revolte der Steuerzahler, wenn wir nicht bald große Reformen unserer Einkommensteuern vornehmen“, sagte Barr. Kongressabgeordnete erhielten in jenem Jahr mehr wütende Briefe über die Steuerhinterziehung als über den Vietnamkrieg.

Der Kongress verabschiedete zwar einige Reformen, aber der langfristige Trend war eine Revolte in die entgegengesetzte Richtung, die sich dann mit der Wahl von Ronald Reagan 1980 beschleunigte für politische Ämter haben die Ultrareichen die Steuerdebatte zu ihren Gunsten mitgestaltet.

Eine offensichtliche Ausnahme: Buffett, der mit seiner Milliardärs-Kohorte aus den Reihen brach, um höhere Steuern für die Reichen zu fordern. In einem berühmten Kommentar der New York Times aus dem Jahr 2011 schrieb Buffett: „Meine Freunde und ich wurden lange genug von einem milliardenfreundlichen Kongress verhätschelt. Es ist an der Zeit, dass unsere Regierung das gemeinsame Opfer ernst nimmt.“

Buffett did something in that article that few Americans do: He publicly revealed how much he had paid in personal federal taxes the previous year ($6.9 million). Separately, Forbes estimated his fortune had risen $3 billion that year. Using that information, an observer could have calculated his true tax rate; it was 0.2%. But then, as now, the discussion that ensued on taxes was centered on the traditional income tax rate.

In 2011, President Barack Obama proposed legislation, known as the Buffett Rule. It would have raised income tax rates on people reporting over a million dollars a year. It didn’t pass. Even if it had, however, the Buffett Rule wouldn’t have raised Buffett’s taxes significantly. If you can avoid income, you can avoid taxes.

Today, just a few years after Republicans passed a massive tax cut that disproportionately benefited the wealthy, the country may be facing another swing of the pendulum, back toward a popular demand to raise taxes on the wealthy. In the face of growing inequality and with spending ambitions that rival those of Franklin D. Roosevelt or Johnson, the Biden administration has proposed a slate of changes. These include raising the tax rates on people making over $400,000 and bumping the top income tax rate from 37% to 39.6%, with a top rate for long-term capital gains to match that. The administration also wants to up the corporate tax rate and to increase the IRS’ budget.

Some Democrats have gone further, floating ideas that challenge the tax structure as it’s existed for the last century. Oregon Sen. Ron Wyden, the chairman of the Senate Finance Committee, has proposed taxing unrealized capital gains, a shot through the heart of Macomber. Sens. Elizabeth Warren and Bernie Sanders have proposed wealth taxes.

Aggressive new laws would likely inspire new, sophisticated avoidance techniques. A few countries, including Switzerland and Spain, have wealth taxes on a small scale. Several, most recently France, have abandoned them as unworkable. Opponents contend that they are complicated to administer, as it is hard to value assets, particularly of private companies and property.

What it would take for a fundamental overhaul of the U.S. tax system is not clear. But the IRS data obtained by ProPublica illuminates that all of these conversations have been taking place in a vacuum. Neither political leaders nor the public have ever had an accurate picture of how comprehensively the wealthiest Americans avoid paying taxes.

Buffett and his fellow billionaires have known this secret for a long time. As Buffett put it in 2011: “There’s been class warfare going on for the last 20 years, and my class has won.” ♦